While uncertainty about the decision to be taken by the SEC continues, the price of Bitcoin (BTC) experienced a drop of approximately 10% on Wednesday, January 3, following a panic sale triggered by speculative comments suggesting that ongoing ETF applications could be rejected. An analysis of the market sentiment index also sheds light on the strong expectations among crypto investors following the sales on Wednesday. So, do investors really expect the SEC to reject Bitcoin ETFs in January 2024, or are these rumors largely unfounded?

Bitcoin Price Drops by 10 Percent

The instant Bitcoin (BTC) sales that occurred on Wednesday were associated with a bearish statement published by the Digital Asset management firm Matrixport. The speculative statement suggested that the SEC could reject the ongoing ETF applications.

While the SEC’s decision is expected to be announced on January 10, this rumor triggered panic among BTC investors. Within minutes, BTC LONG positions worth $165 million were liquidated, and the market value saw a 10% drop on January 3.

Bitcoin Indexes Remain High

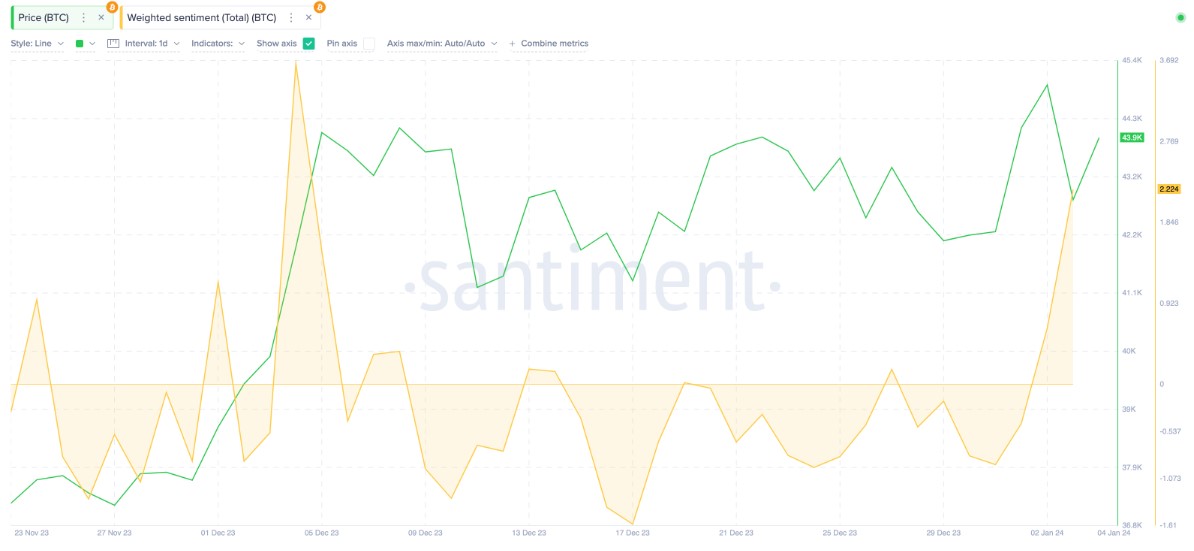

However, a critical on-chain metric indicates that the majority of investors have already moved past the rumors and are looking ahead. Santiment’s weighted sentiment chart is an on-chain metric that compares the number of positive comments about a particular asset to the negatives.

The latest chart shows that BTC weighted sentiment (yellow trend line) has risen to positive values in the last 24 hours.

Bitcoin weighted sentiment was at -0.91 on December 31. Following the emergence of news related to the SEC decision, positive values began to be seen, and as of the writing time on January 4, it had risen to 2.22.

The 2.22 value in the BTC Weighted Sentiment Index can be interpreted as the number of positive comments about BTC being twice as high as the negatives over the past 24 hours.

News related to the Spot Bitcoin ETF decision is at the center of discussions surrounding BTC. Most market observers express a clear view that a possible rejection is unlikely.

Due to the dominant positive sentiment specific to Bitcoin, the price of Bitcoin (BTC) triggered a 7% increase from the recent low of $40,750 and paved the way for surpassing the $44,000 level again. As of the writing time, BTC was trading at $44,400.