The price of Bitcoin (BTC)  $104,435 declined after President Biden authorized the use of long-range missiles in Ukraine. While there were hopes for an end to the Russia-Ukraine war when Trump was in office, it appears Biden is actively pursuing actions against Moscow. What insights do market experts offer regarding this situation?

$104,435 declined after President Biden authorized the use of long-range missiles in Ukraine. While there were hopes for an end to the Russia-Ukraine war when Trump was in office, it appears Biden is actively pursuing actions against Moscow. What insights do market experts offer regarding this situation?

Bitcoin (BTC) Peak Targets

BTC may experience corrections even while racing towards all-time high levels. If the price continually increased without interruption, profiting from cryptocurrencies would be overly simple. However, after two years since November 2022, Bitcoin is not hovering around $15,500 but at approximately $90,000. Did everyone manage to seize this opportunity as the price surged?

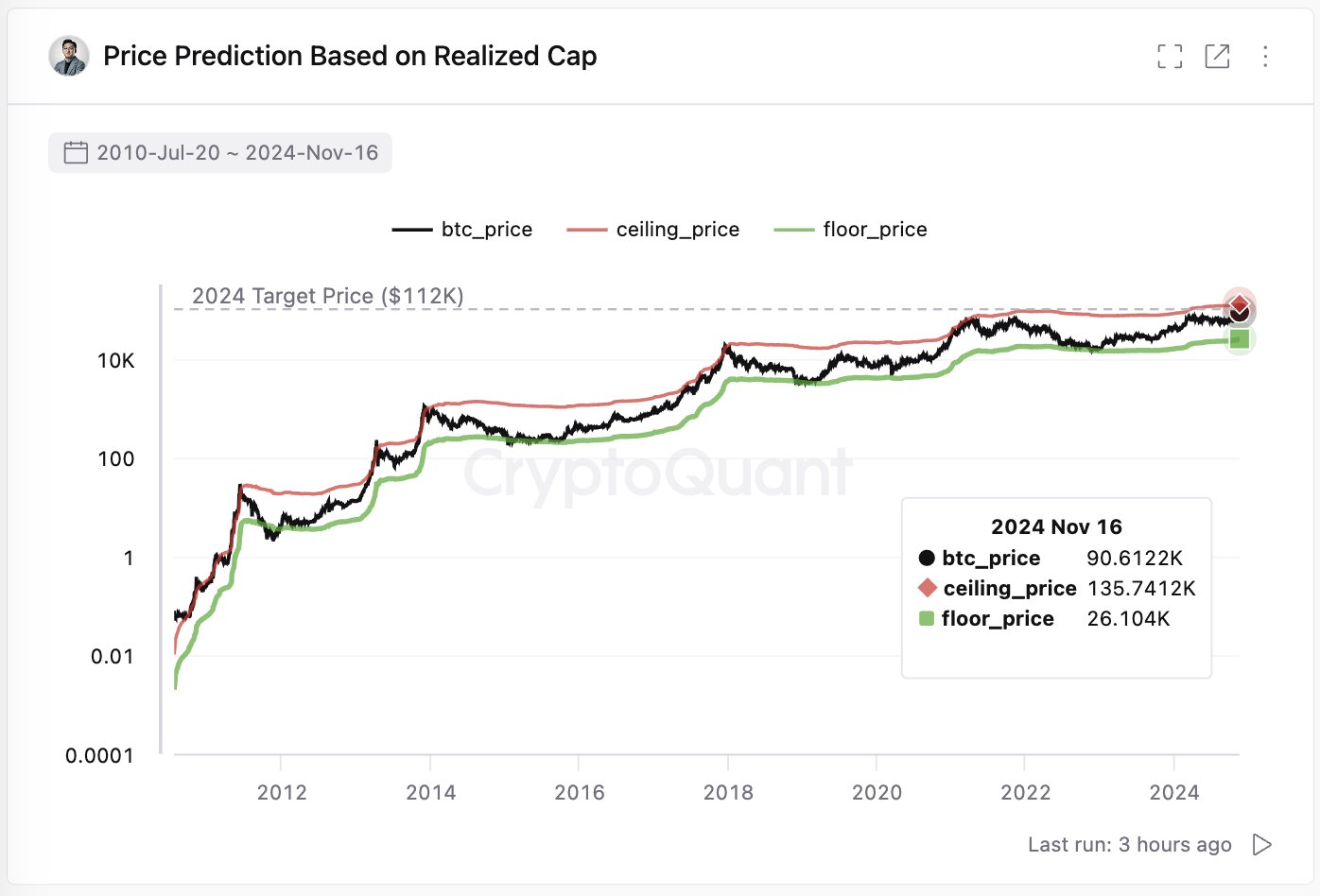

No, many investors sold at a loss during this two-year period and could not benefit from it. We are currently experiencing a similar psychological test period. Young Ju, CEO of CryptoQuant, one of the largest on-chain analytics companies, stated in his recent evaluation;

“We are in a bull market. Bitcoin will rise. I apologize for my incorrect prediction regarding a short-term correction. I did not imply a bear market, just a correction. Based on the cumulative capital flowing into the Bitcoin market, the current upper limit appears to be $135,000.”

When considering the reality of weakening growth from cycle to cycle, it is reasonable to view $135,000 as the peak for 2025.

Comments on SOL, DOGS, and DOGE

In today’s analysis, Carl noted that the price of DOGE could soon break from a descending wedge. With daily closes above $0.367, DOGE may reach its peak target between $0.44 and $0.7.

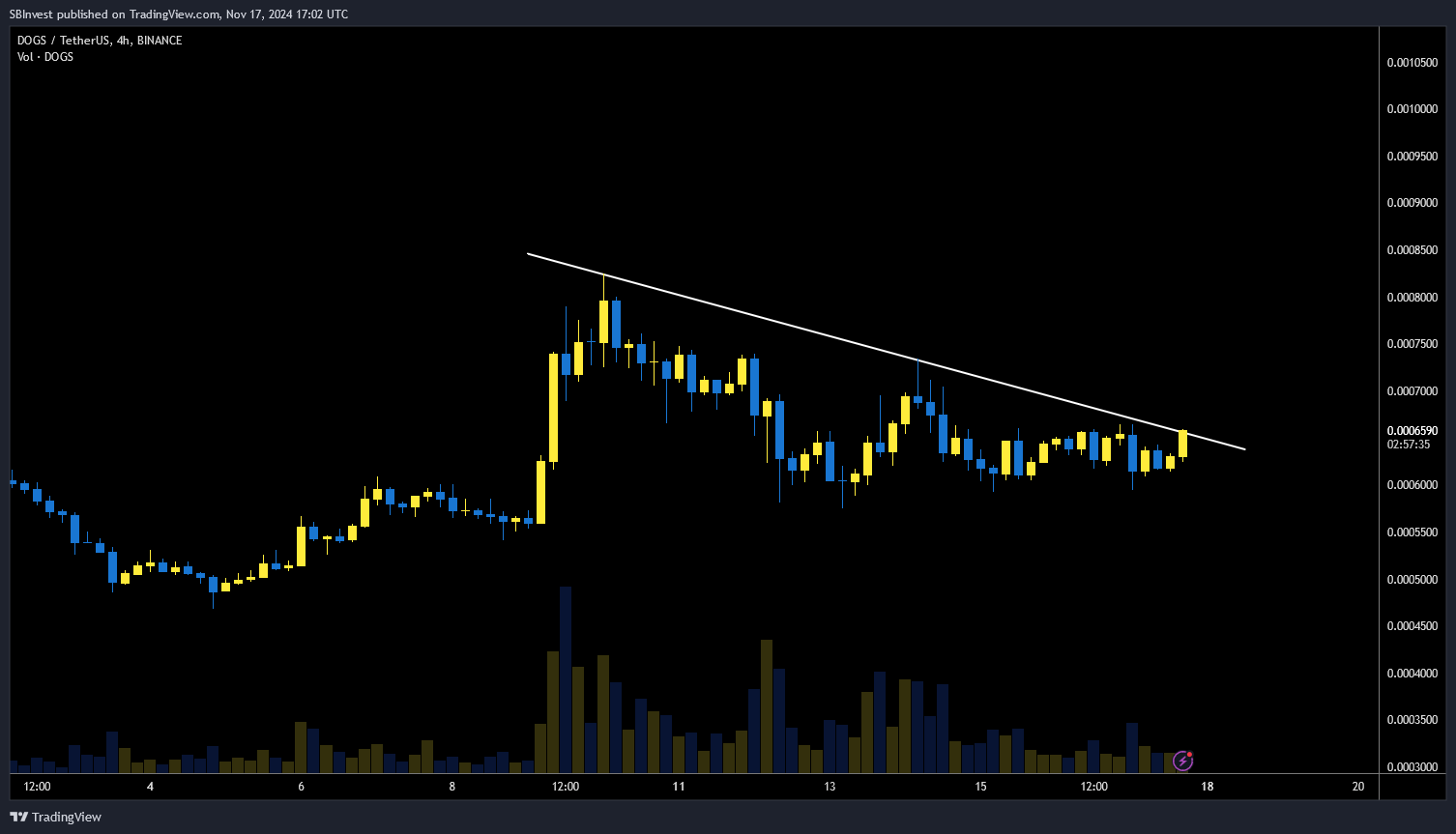

SilverBulletBTC focused on TON Coin and its relatively new meme coin DOGS. He mentioned that the downward trend has been broken, and prices could rise again, targeting $0.00085.

Daan Crypto Trades brought focus to SOL Coin in his analysis.

“SOL has surpassed a significant weekly resistance level and is approaching its all-time high from 2021. Just two years ago, almost no one expected it to return to this point. This shows a remarkable resurgence and strength.”

The analyst targets new peaks above $256-$260.

Türkçe

Türkçe Español

Español