Before and right after the announcement of the minutes from the Federal Open Market Committee (FOMC) meeting in June, the price of Bitcoin was under selling pressure, dropping to as low as $30,225. After this pullback, the king of crypto rebounded above the intermediate support of $30,500, leaving investors wondering what’s next for BTC.

FOMC Minutes Caused a Dip in the Crypto Market

The crypto market, along with global markets, had its eyes on the minutes of the FOMC meeting from June, which was announced on July 5th. The standout details from the revealed FOMC meeting minutes were as follows:

- Some participants stated they could support a 25 basis point interest rate increase.

- All participants agreed that the target interest rate should remain unchanged.

- Participants maintained a mild recession expectation towards the end of the year.

- All participants supported the continuation of tight monetary policy.

- Nearly all participants agreed that further interest rate increases would be appropriate throughout the year.

After the announcement of the FOMC meeting minutes, the price of the largest cryptocurrency dropped below the $30,500 intermediate support level. At the same time, the price of Ethereum (ETH), the king of altcoins, fell below a significant level of $1,900. The total market value dropped by 1.2% to $1.23 trillion. The selling pressure wasn’t limited to BTC and ETH, as many altcoins also saw significant drops. As of writing, BTC is trading above the $30,500 intermediate support level, and ETH is above the $1,900 level.

What’s Next for Bitcoin?

Market observers expect investors to digest the announced FOMC minutes over the next few days. The fact that nearly all participants agreed on additional interest rate increases throughout the year could reshuffle the deck for the crypto market along with global markets. The market had so far been pricing in no further increases after the Fed halted its rate hike and was even considering a rate cut by the end of the year.

Major institutional investors such as Blackrock and Fidelity Investments turning towards the crypto market with their spot Bitcoin ETF applications from scratch or revamped ones had been driving a recovery in market sentiment over the past few weeks. Indeed, to maintain and continue this recovery, Bitcoin needs to stay above $30,000. A price drop below this level could invite serious problems, and a slight deterioration in market sentiment could trigger panic selling among individual investors who are known for following the trend.

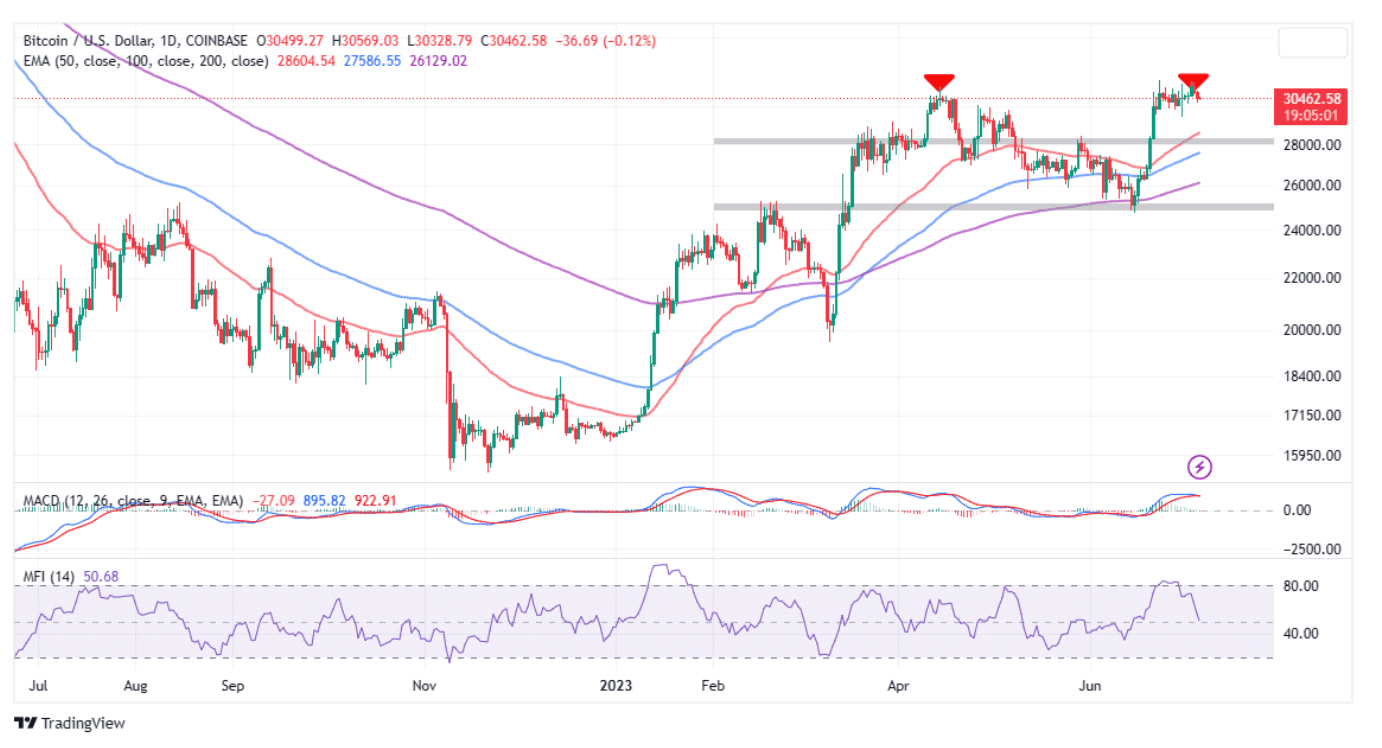

On the other hand, the Moving Average Convergence Divergence (MACD) indicator is very likely to give a sell signal in the coming days (perhaps even before the weekend). This signal will come when the blue MACD line crosses above the red signal line. Additionally, the double top formation observed on the daily chart could increase the probability of Bitcoin falling below $30,000.

Another sell signal for Bitcoin is given by the Money Flow Index (MFI), which tracks the volume of funds entering and exiting the market. The MFI indicator located at the bottom of the chart falling sharply means increased selling pressure, with the volume of outgoing funds significantly exceeding the volume of incoming funds. In other words, there is currently more selling volume compared to the existing buying volume. This situation shows that the Bitcoin price is under pressure and the chance of overcoming the strong resistance level at $31,000 is low.