While the price of Bitcoin consolidates around $35,000, the recent increase in the altcoin market is mainly driven by major and speculative altcoins. Let’s take a closer look at what’s happening in the cryptocurrency market.

Bitcoin Loses Some Market Value

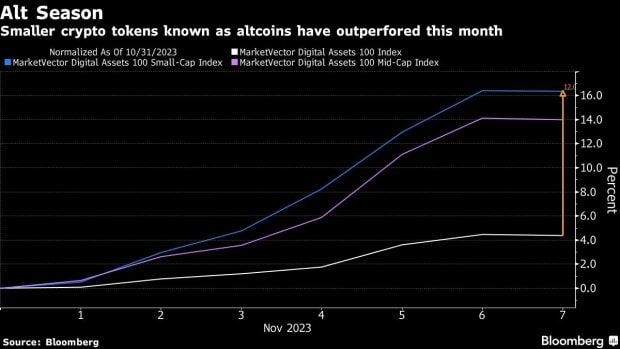

Altcoins in the top 100 crypto index tracked by MarketVector, as well as 30 mid-level altcoins, recorded gains of 16% and 14% respectively in the first days of November. These gain percentages surpassed the overall 14% increase in the index and the 1% increase in Bitcoin‘s price.

According to CoinGecko, Bitcoin’s share in the $1.38 trillion cryptocurrency market has dropped from the peak of 51.5% in October to approximately 49%. This decrease indicates an increased risk appetite in the market and investors’ shift towards altcoins. Richard Galvin, co-founder of Digital Asset Capital Management, commented on the market evaluation:

This rally is definitely broader and more sustainable than any price movements we have seen since January. In an environment that is still relatively weak in terms of liquidity, we are seeing some significant upward movements.

Among smaller cryptocurrencies, Ripple‘s associated token XRP saw a notable 14% increase in value in November. This positive trend is based on Ripple’s partial legal victory in the ongoing case with the U.S. Securities and Exchange Commission (SEC) regarding the classification of XRP as a security.

The setting of November 9 as the deadline for a briefing program on unresolved issues in the case triggered speculation that the SEC may reach a settlement. Although the specific catalyst for this price increase is not yet clear, it can be expected that investors will respond positively to the positive developments in Ripple’s legal situation.

Possible Continuation of BTC Price Rally

Bitcoin showed an impressive 28% increase last month, delivering its strongest performance since January. This increase is largely driven by expectations that the first spot exchange-traded funds (ETFs) focused on direct investment in cryptocurrency in the United States will be approved soon. Furthermore, the overall cryptocurrency market is experiencing increased optimism due to speculation that the Federal Reserve has completed its interest rate hike cycle.

Recent employment data in the United States also indicates that the Fed may have completed its interest rate hike cycle. Experts also expect the Fed to start lowering interest rates as early as March 2024.