Bitcoin price direction continues to be uncertain. This uncertainty has split the community into two groups: bulls waiting for a new uptrend to begin and bears looking for signs of a reversal. Following yesterday’s rise, there are expectations that the price may fall again. So, is this recent surge a dead cat bounce?

Tides of Bitcoin’s Price

BTC price movements are showing signs of a correction. In the second week of March, Bitcoin formed a bearish failure pattern (SFP), indicating a decrease in bullish momentum. This sell signal led to an 11% correction the following week.

Bitcoin’s weekly sell signal, after forming a bearish SFP, predicted that BTC could surpass its current all-time high (ATH) of $73,777 or create a new ATH at $75,000. BTC is poised to make this leap.

However, the strength of this leap will be tested near the ATH, and at that point, it will be decided whether the uptrend will continue or not.

Two Main Reasons Supporting the Dead Cat Bounce Theory

One of them is the pre-halving ATH. It’s quite rare for Bitcoin’s price to create an ATH before a halving. However, a report by Glassnode suggests that the buying pressure following an ETF approval could lead to a sell-off, potentially turning the halving into a sudden new sell event.

The second reason is the Decreasing CME Open Interest (OI). Instead of focusing on ETF inflows, we mainly focus on the Open Interest (OI) for Bitcoin futures at the Chicago Mercantile Exchange (CME). This metric showed a decrease of about 6%, from 170,440 BTC on March 20 to 160,360 BTC on March 25.

The uptrend in Bitcoin’s price was driven by traditional finance BTC buyers through CME futures. However, if ETF inflows start to decline and BTC CME futures OI decreases in parallel, this could trigger a correction in the Bitcoin price.

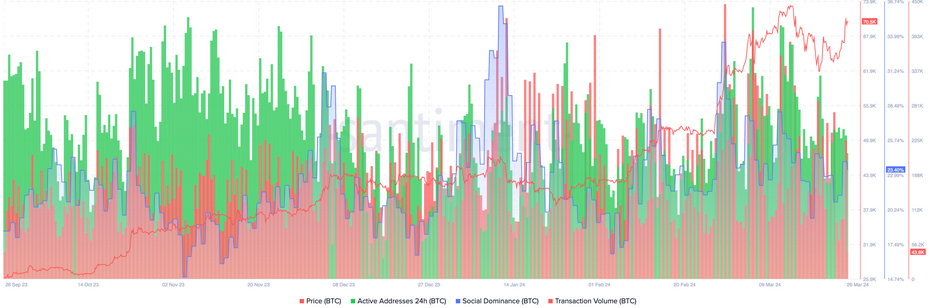

The fundamental on-chain metrics for Bitcoin (BTC) have been showing a pessimistic outlook in recent days. Active addresses, social dominance, and transaction volume started the week with an increase but then entered a downtrend. This suggests that the bullish trend is weakening and serves as a warning sign for investors.

What Levels Are Expected for Bitcoin?

Specifically, uncertainties about how low BTC can go are increasing. The ongoing rally could lead to a correction and may also indicate a waiting period for investors looking to re-enter the market.

However, the decreasing CME BTC futures open interest (OI) is emerging as a worrying development. Yet, if this situation improves, Bitcoin’s price is predicted to rise above $73,000. As long as the uptrend is maintained, BTC has a high probability of testing a new historic peak at $75,000. But if Bitcoin establishes a base at these levels, the uptrend could continue. In this case, the next psychological level for the bull market, $80,000, is expected to be within reach.

Türkçe

Türkçe Español

Español