Bitcoin (BTC) price experienced a rapid drop to $68,620 in the last 24 hours, erasing $4,400. However, it then reclaimed the $70,000 level and at the time of writing, it is finding buyers at $71,200. What is the reason behind this volatility in cryptocurrencies?

Why Did Bitcoin Fall?

Hours earlier, the Bitcoin price had surpassed $73,000 but then fell back below $70,000 and has not yet reclaimed its peak. The drop in Bitcoin’s price also triggered losses in altcoins. The inflation data released by the U.S. Bureau of Labor Statistics (BLS) was what sparked the market downturn.

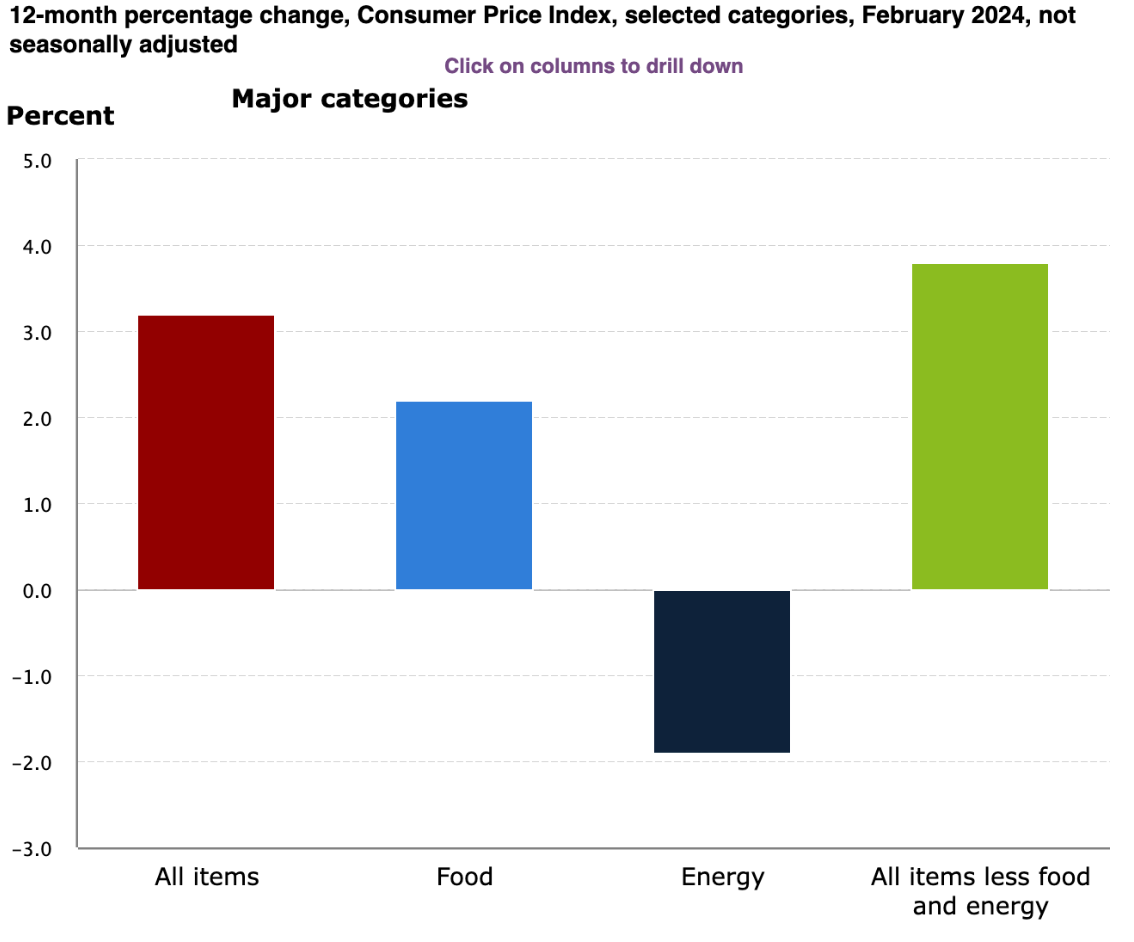

Inflation for February came in at 0.4%, higher than expected, supporting the narrative of Federal Reserve members that “there may be less easing this year than expected.” Although January’s data was not much heeded, this figure confirms the persistence of inflation and could be a main topic at the meeting at the end of the month.

The annual rate is at 3.1%, and compared to January’s forecast of 3.1%, it has risen to 3.2%. According to the BLS’s official statement, rising housing and gasoline costs contributed more than 60% to the Consumer Price Index (CPI).

Will Cryptocurrencies Rise Again?

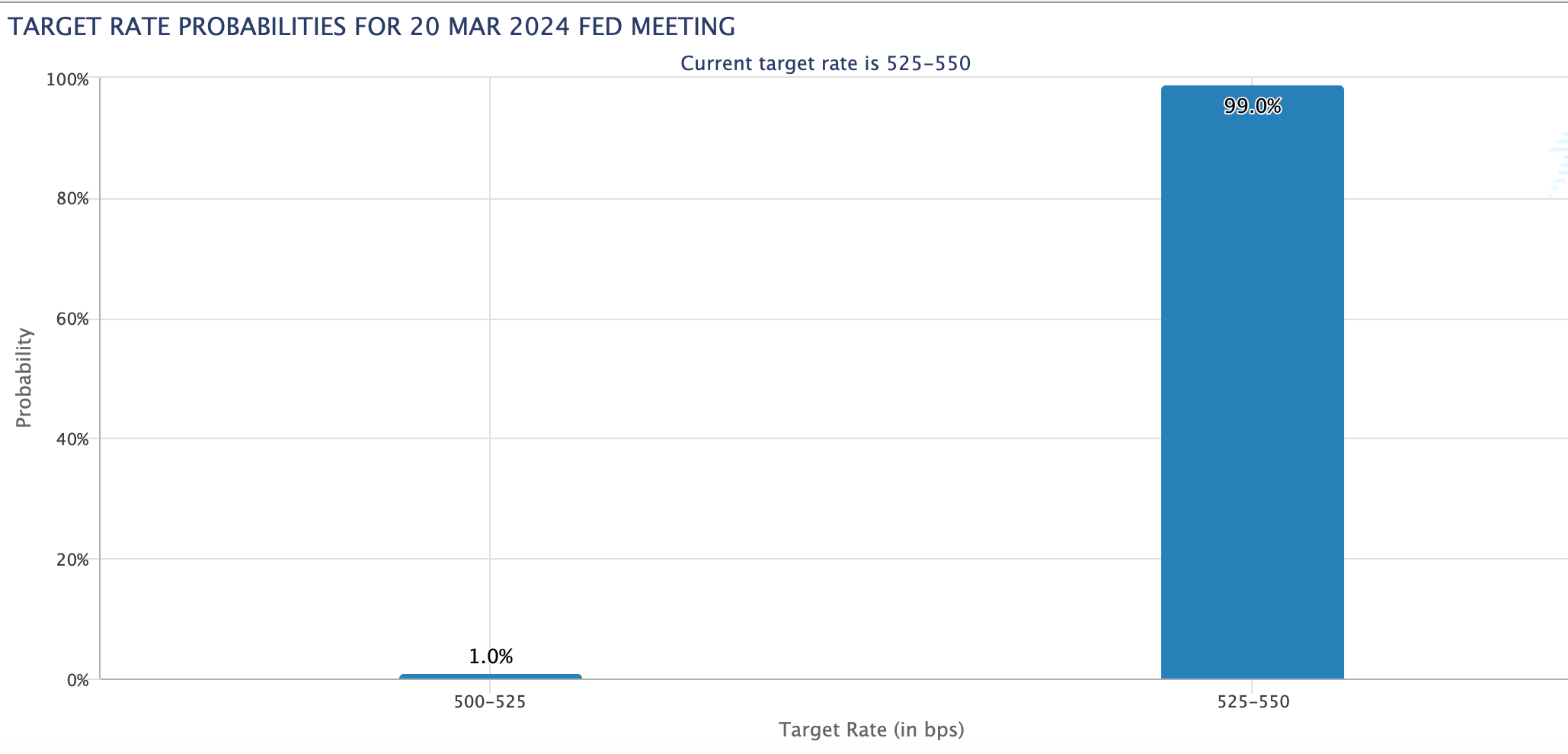

The Fed’s delay in easing its tight monetary policy could be a significant barrier to the rise of cryptocurrencies. According to the CME’s FedWatch tool, the probability of an interest rate cut by the end of March dropped from 15% to 1%. In December, this probability was over 80%. Moreover, predictions are shifting to July, and if data continues to come in poorly, it could be postponed even further.

Jamie Dimon, CEO of JPMorgan Chase, recently said about the Fed’s interest rate cut roadmap;

“You can always cut interest rates quickly and dramatically, … Their (the Fed’s) credibility is a bit at risk here; if I were them, I would wait until after June and watch everything resolve.”

Moreover, while BTC has reached a new ATH level, the possibility of a deeper drop is emerging as demand on the ETF side balances out. Price corrections around the halving date are famous, and even in bull markets, a 30% correction would likely be considered normal.

Of course, predicting the future is impossible, but investors should be aware of the risks and be prepared for a potential large sell-off scenario in altcoins, especially. In a possible BTC downturn, we might see the price needle down to $58,000.

Türkçe

Türkçe Español

Español