Bitcoin price volatility has made things difficult for altcoins today, with most altcoins continuing the day with a decline. The king cryptocurrency’s drop of roughly $8,000 from its peak has triggered concerns that the feared major price correction may have begun. Consequently, we saw nearly 10% daily losses in altcoins. So, what’s the latest with MINA Coin?

Cryptocurrencies on the Decline

Firstly, we need to briefly touch on the decline in the cryptocurrency markets. In bull markets, investors make money no matter what they buy. Looking at the last three months, a 100% gain in cryptocurrencies was an achievement anyone could attain. The problem is that new investors act on the assumption that this will continue forever.

However, cryptocurrency markets do not distribute money, so losses of 20-30% or even greater are normal for cryptocurrencies, as we see today and possibly even deeper corrections tomorrow. What investors, especially new ones, disregard is the scenario of making gains by focusing on medium and long-term goals.

In bear markets, those who disregard cryptocurrencies and enter the market today when prices are somewhat inflated should know this: you are here today so that those who capitalize on the lows can make greater gains. It has always been like this in the past.

MINA Coin Burns and Price Prediction

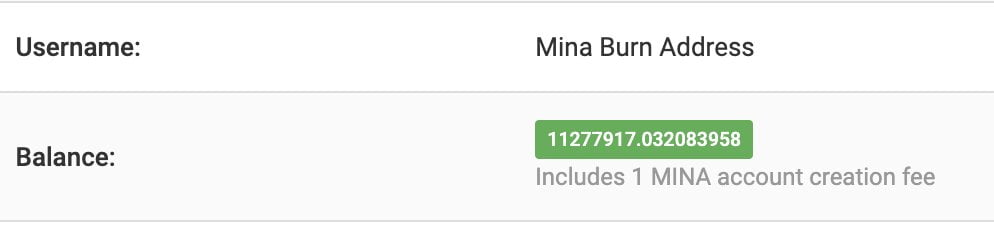

Today, the Turkey Community Manager for MINA Coin, @talhaB62, touched on an important detail and shared the current status of MINA Coin burns. Accordingly, to date, MINA Coin has sent approximately 11.3 million tokens from supercharged stake rewards to the burn address. Although this figure is not huge for a roughly 3-year period, sending about $15 million to the burn address is positive.

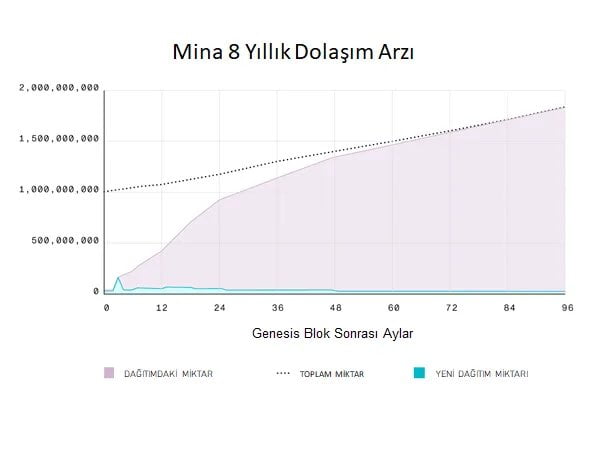

Another minor detail is the circulating supply graph below. We are in the 36th month today, and the circulating supply has already increased significantly. Therefore, the pressure of token inflation on the price (since a significant amount has entered circulation compared to the past) should now gradually weaken.

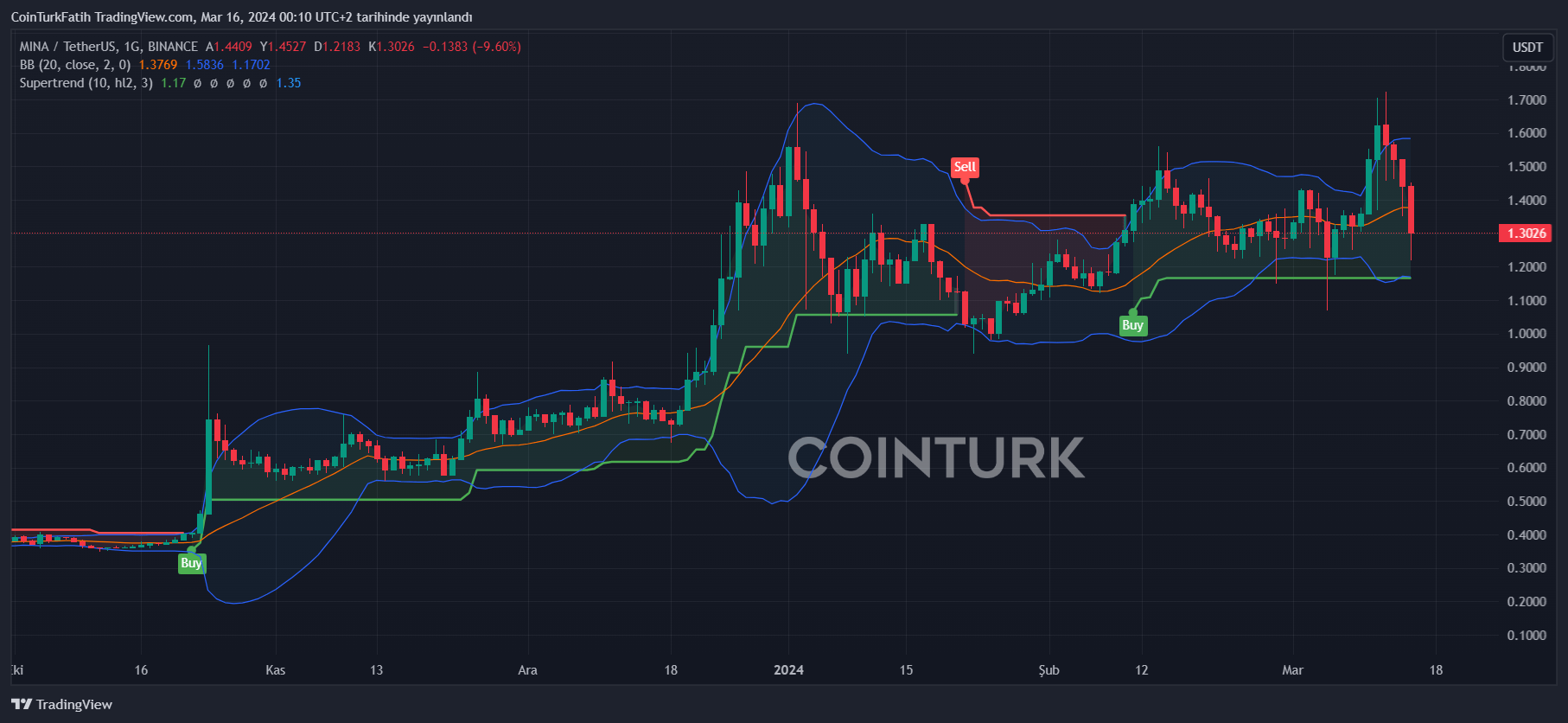

According to the price graph below, the $1.2 region is an important support point for the continuation of the rise for MINA Coin.

BTC price losses could deepen, potentially leading to further declines to $0.93 and $0.88, followed by the $0.7 region. However, in the long term, closures above $1.65 could trigger peaks of $2.12 and $2.61. The bull target should be shaped depending on how much demand increases with the surpassing of $5.5.

Türkçe

Türkçe Español

Español