Bitcoin price climbed above $52,800 a few hours ago but then fell below the key resistance area again. Earlier today, experts had mentioned that the $52,300 resistance could be a strong defensive area for bears. Another analyst predicts a rapid decline in price after aiming for a higher peak.

How Much Will Bitcoin (BTC) Be Worth?

Despite news of Genesis’s $1.3 billion GBTC sale, the leading cryptocurrency continues to rise. On the other hand, the total amount of Bitcoin (BTC) held by BlackRock and Fidelity has surpassed $10 billion. MicroStrategy’s reserve also exceeds $10 billion today, and they are expected to hold off from selling in the long term.

Experts, meanwhile, support the continuous rise scenario by noting that only $200 billion worth of BTC is available for short-term market movements.

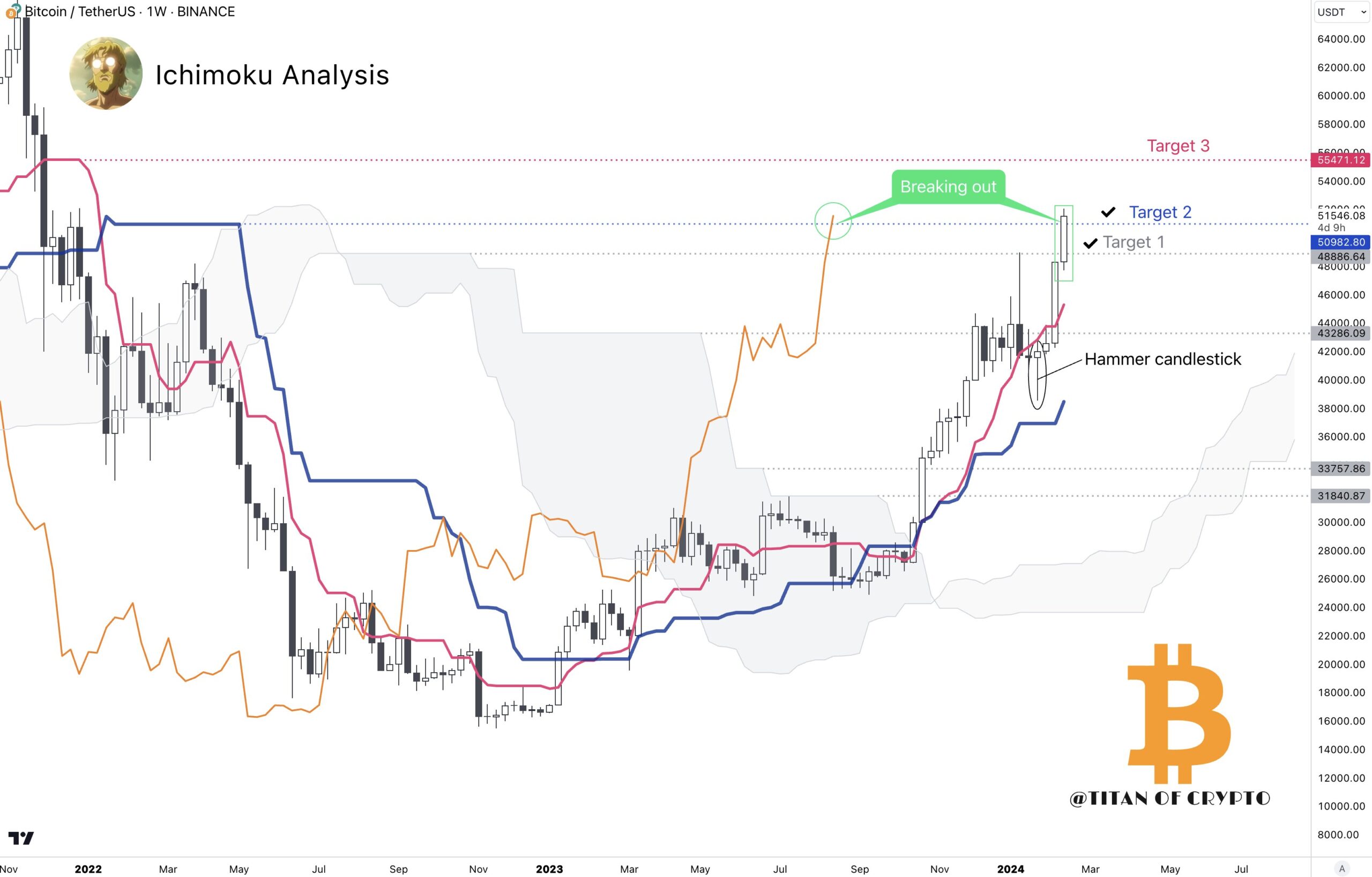

Popular crypto analyst Titan of Crypto, in his latest market assessment, wrote that the BTC price could rise to $55,400. This represents an increase of about $3,400 from the current price. Titan of Crypto, capturing the general market sentiment, has been increasingly prominent lately and is confident that extreme optimism will drive the price to his target.

Cryptocurrency Downturn

If you’ve spent enough time in the field, you’ve seen that there won’t always be a continuous rise in cryptocurrencies. Having experienced the psychological impacts of market fluctuations for about 7-8 years, I must say that only those who have lived through it can understand it.

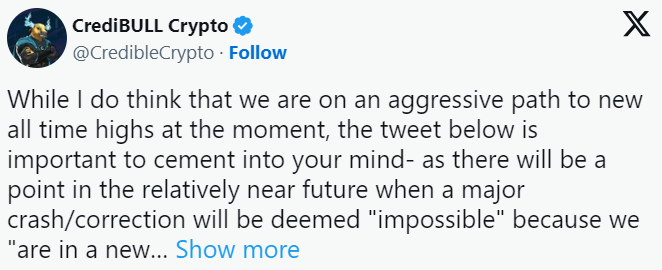

At some point, the excessive demand will need to balance out, and optimism will have to return to more measured levels. Overheated markets are also a concern for analysts. In a lengthy post, crypto analyst Credible Crypto warned that even if all-time highs are surpassed and BTC exceeds $100,000, the likelihood of a sudden correction increases.

“At the end of the day, every major parabolic rise has a major crash, and the reverse is also true. Greed and excitement (and the vertical price increase that comes with it) cannot be achieved without an equal and opposite reaction when this excitement reaches its peak.”

Indeed, Michael Poppe also emphasized the need for a slight price correction.