Bitcoin (BTC) experienced a sharp sell-off after its price exceeded $69,000, leading to a drop of over 10% down to $59,500. It then recovered and the price rose back to the $67,000 mark. Following this, the broader cryptocurrency market saw a loss of over $150 billion in the last 24 hours.

Will Bitcoin (BTC) Price Drop Further?

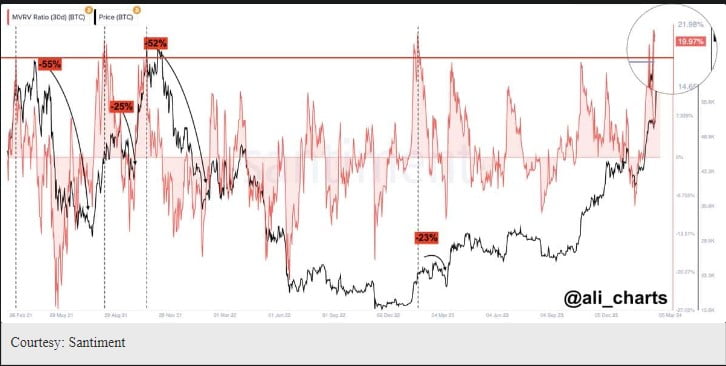

Focusing on data shared by Santiment, renowned crypto analyst Ali Martinez published a chart regarding Bitcoin‘s current MVRV (Market Value to Realized Value) ratio of 19.57%.

Martinez pointed out that each time the MVRV ratio exceeded the 18% threshold since February 2021, Bitcoin’s price experienced a decline ranging between 24% to 55%, indicating a concerning trend.

Investors should take a closer look at the MVRV ratio as it points to a possible price correction for Bitcoin. Martinez’s warning emphasizes the importance of cautious trading and proper risk management in the volatile crypto market.

Other data from CryptoQuant revealed a significant transfer of approximately 1,000 Bitcoins, worth around $69 million, heading towards Coinbase.

This Bitcoin transfer originated from miner addresses that had been holding onto the coins without selling for over a decade. The movement occurred just before Bitcoin reached the $69,000 level again, and the price subsequently dropped to $59,500 on Tuesday evening.

Bitcoin critic Peter Schiff stated the following:

Earlier today, Bitcoin reached a new record high above $69,200. About four hours later, the price dropped to as low as $59,300. This represents a nearly $10,000 drop per Bitcoin and a startling 14.5% decline within a single day. Nothing this volatile can be described as a safe haven or a store of value!

BTC Analysis and Charts

Data provided by Santiment showed that the excitement following Bitcoin’s all-time high gave way to concerns as the price dropped by over 7%. The data on buying the dip reached the highest levels in recent months.

According to Santiment, the open interest in Bitcoin on exchanges significantly decreased after reaching today’s ATH (All-Time High) level.

The decrease in exchange open interest for Bitcoin might indicate a reduction in trading activities based on rumors. This decline in open interest is interpreted as a decrease in speculative excess in the markets.