Bitcoin price is currently at $67,850 as this article is being prepared, and altcoins are showing signs of a weak recovery. According to the latest Spot Bitcoin ETF data, there was a net inflow of about $204 million on April 5th. The inflows, which were behind those of April 4th, remained relatively weak. So, what are the Bitcoin price predictions for the weekend?

Bitcoin Price Could Climb

Before moving on to optimistic predictions, we should mention that the apprehension may continue due to inflation data coming on Wednesday. Moreover, as mentioned earlier, the ETF data does not present a very bright picture.

Now let’s start looking at the brighter side of things. Firstly, Genesis has completed a significant amount of GBTC sales, and the pressure on the markets from the lack of demand through the ETF channel should lessen next week (at least the part due to Genesis).

The second positive development is the continued recovery of the Reserve Risk indicator from the green zone. This data compares the current Bitcoin price with the long-term investor cost base, indicating their potential to accumulate. Reserve Risk currently suggests that long-term investors may start accumulating noticeably again.

Weekend Bitcoin Predictions

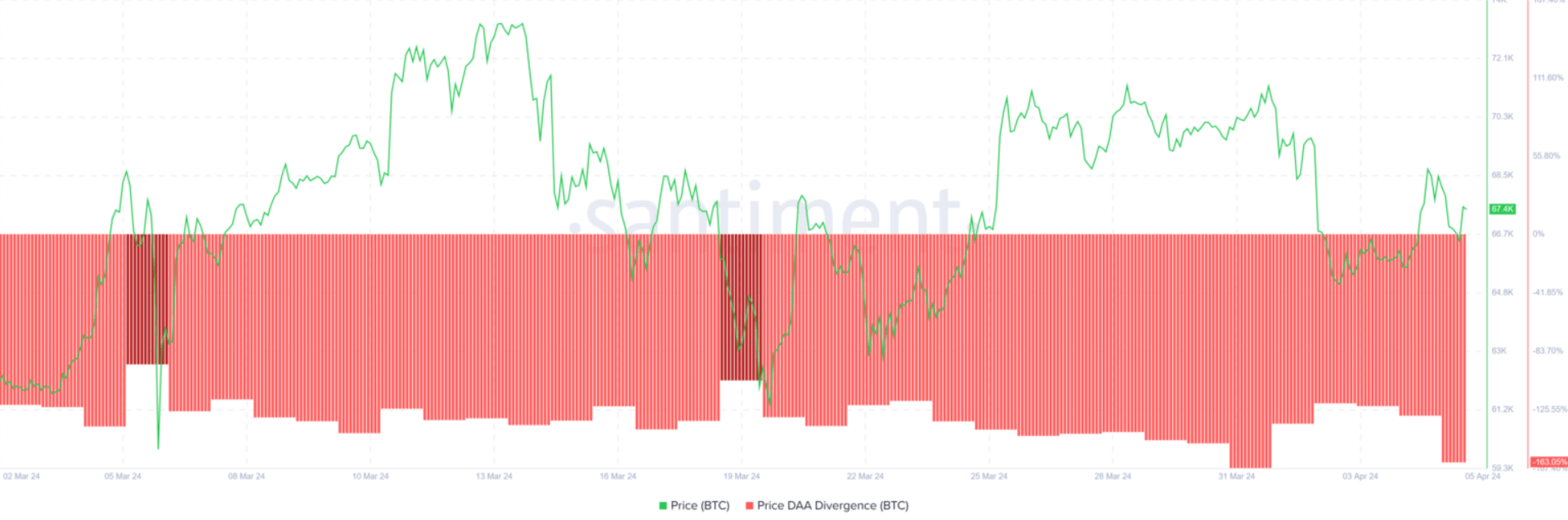

The third important data confirming the bullish outlook is the DAA Divergence. Daily Active Addresses (DAA) Price Divergence measures the disparity between the current price and the number of active addresses interacting daily. According to the indicator tracking user activity, we are now receiving a bullish signal because “the number of active addresses is increasing while the price is falling.” This supports the accumulation trend mentioned in the second bullish signal.

The upcoming halving is the fourth pillar for those remaining optimistic for the weekend. The Bitcoin block reward halving, expected to occur on April 20th, has historically led to parabolic rallies. Most investors agree that the long-term outlook is positive, as we are not seeing massive sell-offs below $69,000.

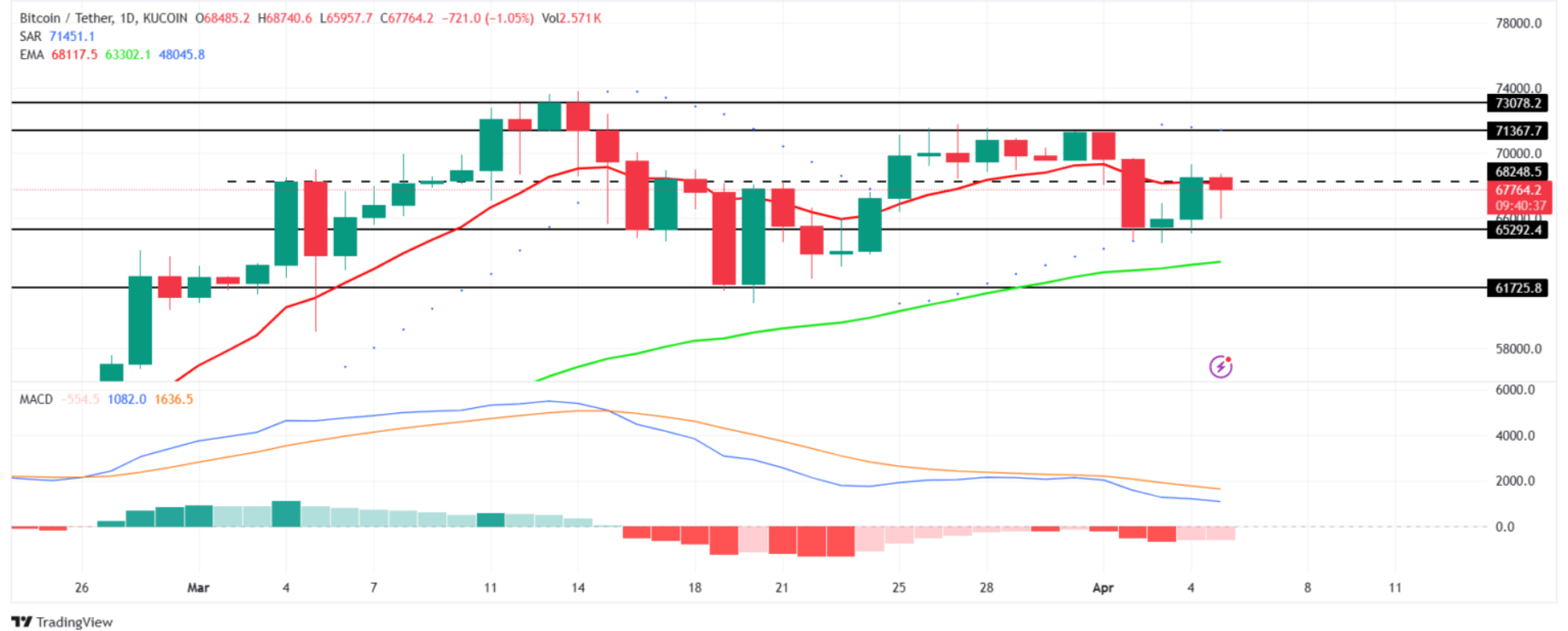

Considering all these indicators, the Bitcoin price could retest $70,000 over the weekend (April 6-7). If we can see closures above $71,370, we may enter the halving at a much higher price. On the other hand, as the Bitcoin price continues to show weakness at the resistance area of $68,250 (at the time of writing), and considering the reasons mentioned earlier, it is difficult to speak of a definite rally. And of course, we must be aware that no one can see the future and not forget the surprising nature of cryptocurrency. In a bearish scenario, the targets are $65,300 and $61,730.