The largest cryptocurrency by market value, BTC, was highly volatile over the weekend, reaching over $30,000. Yesterday, altcoins also saw an increase. If BTC continues to close at these levels, it could trigger parabolic rallies for altcoins. However, there are skeptics, with Capo being one of them. So, what did he say?

Bitcoin Price Prediction

We recently discussed the market predictions of QCP analysts. In their latest report, they stated that if there is no ETF approval or significant development to drive cryptocurrency upward, shallow volatility will continue. Experts also mentioned that recent macro developments will influence the direction of crypto, and there may not be a breakout at the $32,000 or $25,000 levels.

Now, the king of cryptocurrencies is targeting the $32,000 level. At the time of writing, the price has retraced to $29,700, but the daily closing was at $29,900. If we start seeing daily closes above $30,650, it could lead to an upward breakout.

Crypto Expert’s Commentary

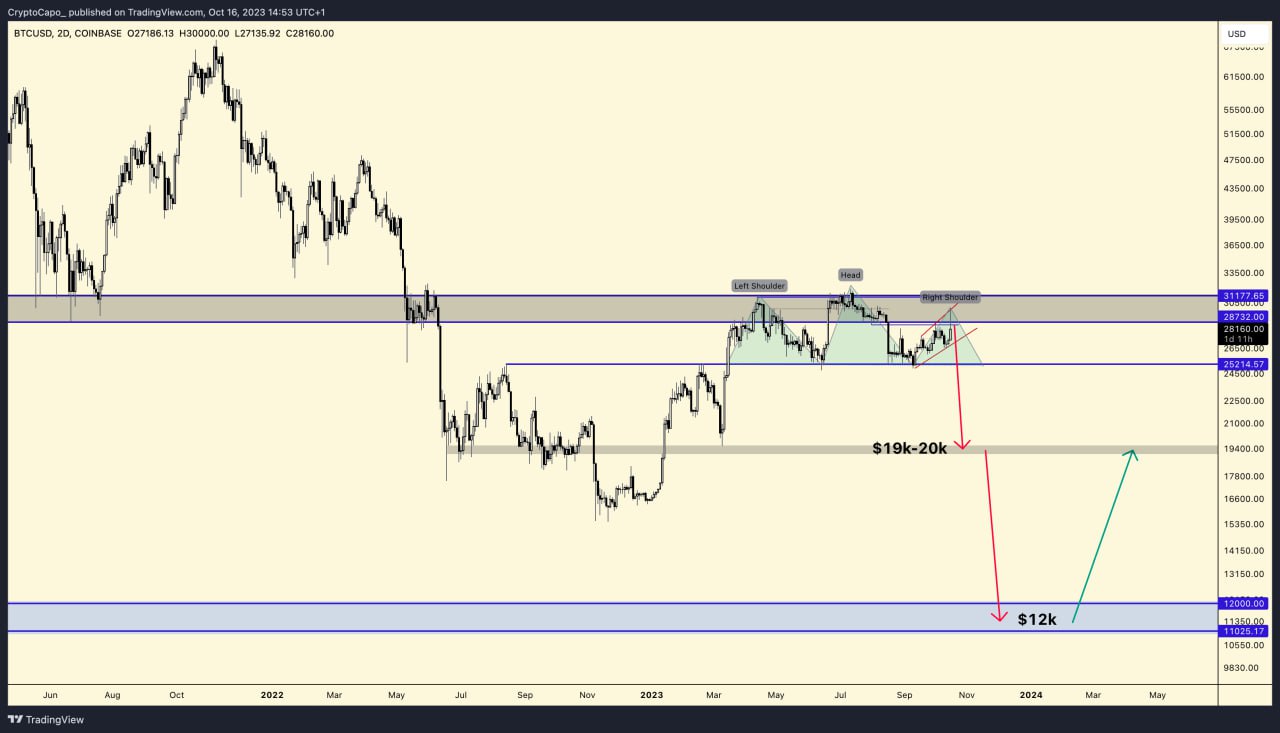

Analyst Capo, who has been indicating a continued decline for cryptocurrencies since mid-2022, is back in the spotlight. According to Capo, BTC still has the potential to drop to $12,000. Moreover, he has ambitious targets for altcoins as well.

Capo has been correct in many of his predictions, except for the first quarter of this year. He previously mentioned that short positions, except for TRX, were profitable in altcoins. He attributed the uncontrolled rallies this year to stablecoins and warned those buying at resistances.

In his recent market analysis, he stated:

“Once again, TUSD and other stablecoins are being printed out of thin air to pump the market, make you think there is a rise, and sell to you at resistance. Hopefully, you won’t fall into this trap. I think rejection is coming, soon.”

If the Fed tightens further, SEC finds new excuses to reject ETFs, and BlackRock and others withdraw their applications, Capo’s $12,000 target could be realized. However, the Fed has no more room to go. Even Powell is unsure of its sustainability. It seems unlikely that the Fed will deliver devastating blows to the economy while spending massive amounts of money to finance wars and fight inflation.

On the other hand, if the SEC has stronger reasons for rejection, why was the GBTC case lost? Why didn’t the SEC present these arguments? Whether Capo is right or not, BTC will be at these levels for the last time someday (if the narrative of the last bull cycles hasn’t ended yet).