Bitcoin price at the time of writing is above $45,000 and is finding buyers at $47,700. Experts consider these levels reasonable. With the weekly close approaching, closing above $45,000 could set the stage for further recovery. At least that’s what the current technical analysis data suggests.

2024 Crypto Optimism

Crypto industry follows respected experts like CryptoQuant CEO Ki Young Ju, who has enlightened the community on many key issues. As the head of one of the largest on-chain data analysis companies, he has addressed current Spot Bitcoin ETF inflows along with historical data.

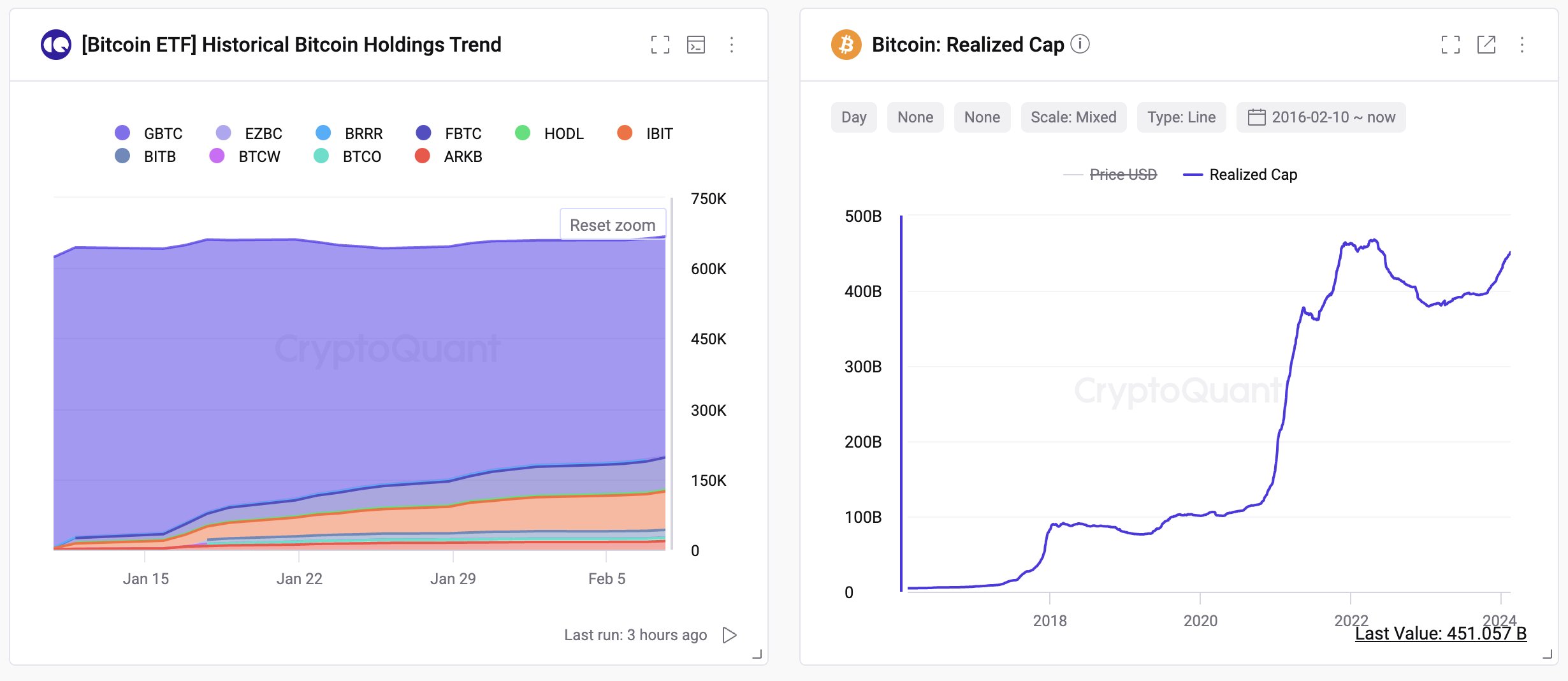

Based on his evaluations, he is hopeful about new investor entries, predicting the best and worst targets for the 2024 peak. We have witnessed non-GBTC ETF issuers attracting exciting levels of investment with over $10 billion in BTC reserves.

What Will Bitcoin’s Price Be This Year?

Daily outflows from GBTC dropping to $50 million and the continued net inflows to other ETFs are definitely boosting motivation. As for the targets, Young Ju clearly stated:

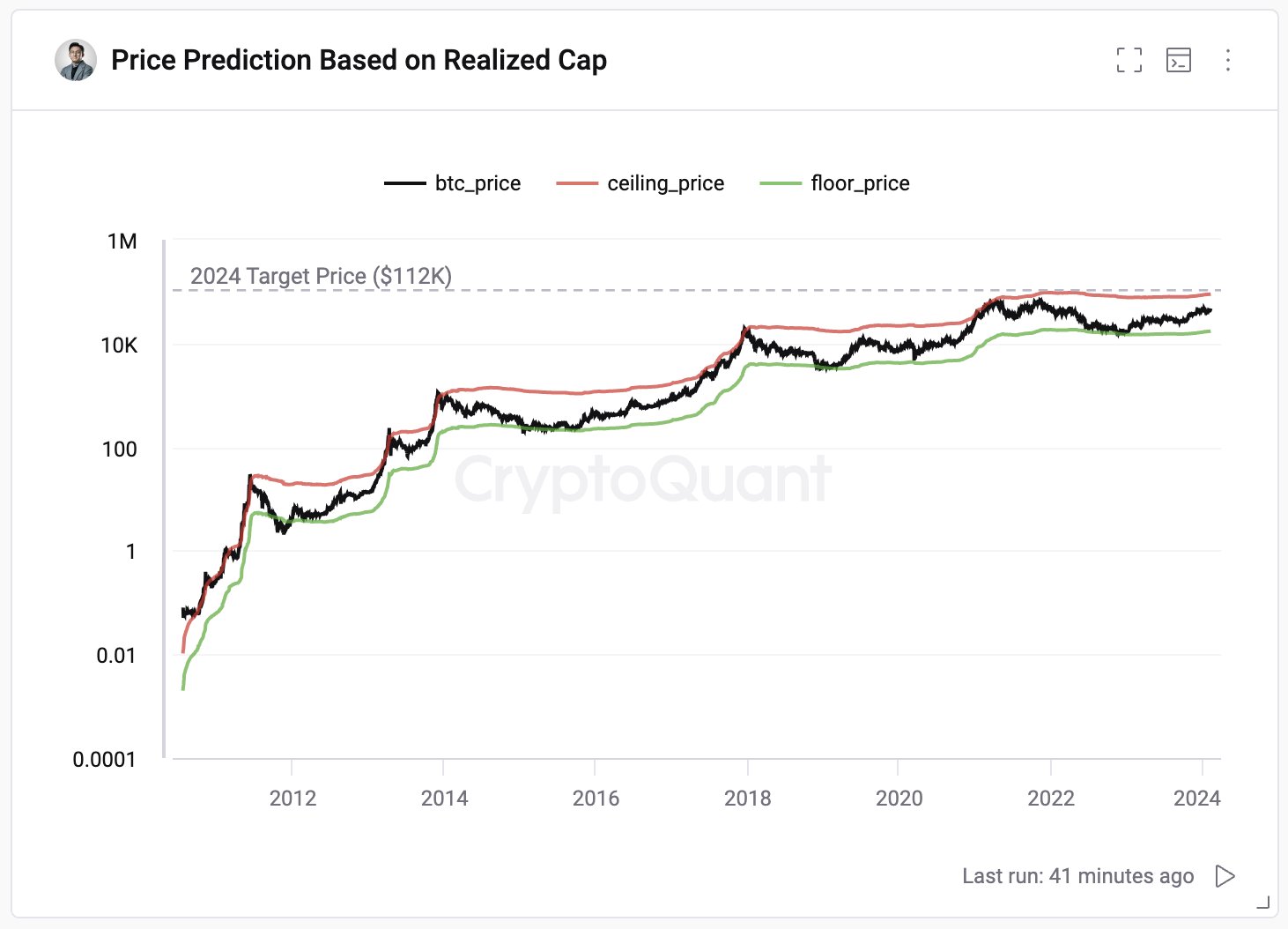

“Bitcoin could reach $112,000 this year thanks to ETF inflows, or at worst $55,000.”

“The Bitcoin market has seen monthly spot ETF inflows of $9.5 billion, potentially increasing the upper limit by $114 billion annually. Even with GBTC outflows, a $76 billion increase can raise the upper limit from $451 billion to $527-565 billion. Historically, $BTC market bottoms occur at 0.75 MVRV and peaks at 3.9.

With current spot ETF inflow trends, the highest price could reach $104k-$112k. Without hype, maintaining the current level of 2.07, the price will be $55-59k.”

If he is right, investors may not have to wait much longer for triple-digit BTC prices. We are nearly halfway through February, and investor caution is waning in this new month, which is passing even faster than January.