The price of Bitcoin is currently at $29,170 and has temporarily lost support at $29,250. Investors are not particularly excited about this recent movement as they have seen multiple drops to $29,000 followed by recoveries to the $29,500 region. However, historical data suggests that we may soon witness the actual price movement.

Current Status of Bitcoin Price

The US 10-year yields have surged to 4.28%, causing BTC to drop to $29,000. It is important to note that the macro outlook is not very positive, considering the numerous increases we have seen since the days when we were expecting interest rate cuts in March. Nevertheless, the Federal Reserve is not certain if inflation is at the desired level.

Although Powell sets a target of 2% by 2025, recent data indicates that the economy is resilient. Perhaps the recession, which large companies have been preparing for over the past year, will become a reality due to the Fed’s excessive tightening?

Will Cryptocurrencies Rise?

The latest report from Glassnode Insights emphasizes that Bitcoin has reached historically low levels of volatility. This indicates that the asset is trading within an extremely narrow range, causing only a 2.9% deviation between the Bollinger Bands. This phenomenon has only been observed twice in the history of Bitcoin:

- In September 2016, when BTC was at $604

- In January 2023, when BTC remained stable at $16,800

According to the report, periods of reduced volatility, combined with investor fatigue, lead to coins moving based on their current costs. This means that investors likely make marginal profits or losses when exiting their positions. The report concludes that establishing a new price range to encourage new spending will contribute to the expected increase in volatility.

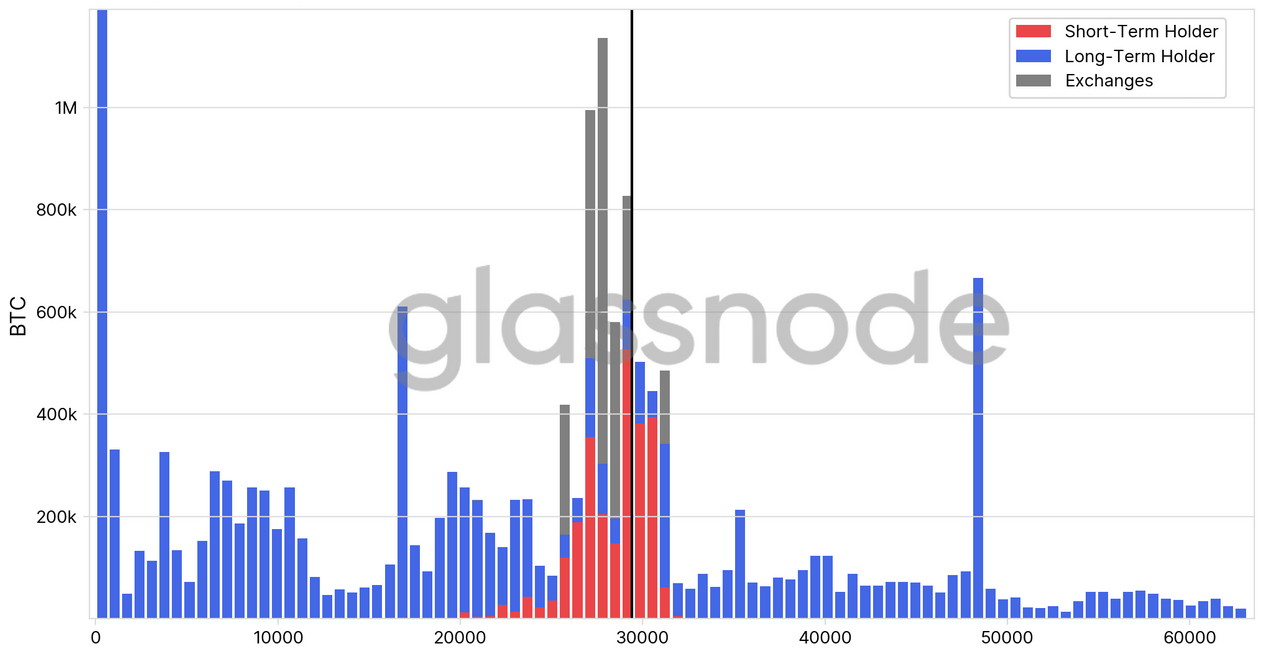

Therefore, if history repeats itself, BTC will stop its horizontal movement and experience a sharp decline or rise. Glassnode states that there is a significant concentration of short-term investors within the price range of $25,000 to $31,000. This pattern resembles similar periods during past bear market recoveries. However, data shows that many of these investors are still in positions with losses, creating short-term selling pressure.

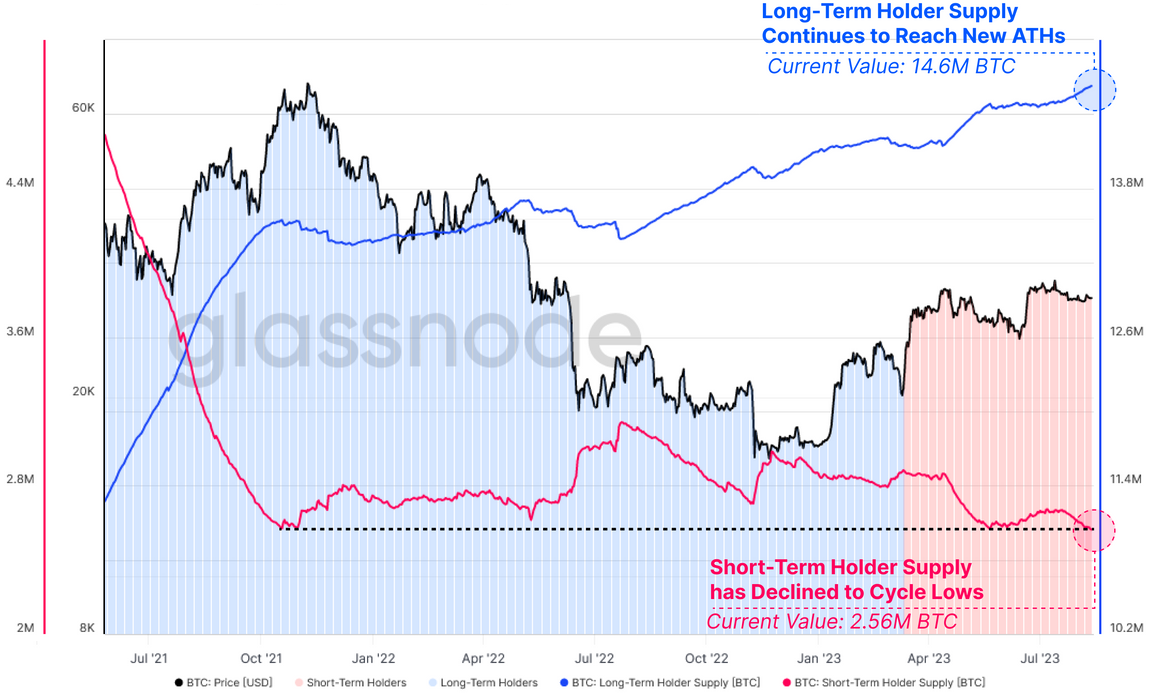

Additionally, the analysis firm highlights that short-term investor supply has dropped to its lowest level in recent years, reaching 2.56 million BTC. On the other hand, the supply held by long-term investors has reached its all-time high of 14.6 million BTC.

However, there is a problem. While historical data suggests that we should expect a rise as long-term investor accumulation increases, we have not experienced these times in the past. For example, the fact that US 10-year Treasury yields are approaching their highest level in 16 years is a new experience for BTC and the rest of the crypto market. Or the fact that the 30-year fixed average mortgage rate is approaching 7%.

Although it is certain that Bitcoin volatility will increase, it is difficult to be sure about the direction. In fact, we will witness the impact of the upcoming potential recession on the price for the first time. If BTC continues to behave as it has done so far and moves in sync with stocks, the recession will greatly affect it.

So why hasn’t the price of Bitcoin risen in the past few weeks while stocks have been rising in the US? This is because Bitcoin has its own regulatory issues and numerous other problems that cause it to deviate negatively. In other words, there are many obstacles that BTC needs to overcome in order to rise.