The price of Bitcoin is currently finding buyers at $29,340. The crypto king continues its boring movement. Despite macro data this week, investors are expecting the price to break free from its narrow price range. However, there is an interesting detail. An interesting contradiction has emerged in transaction volume data.

Why Isn’t Bitcoin Rising?

Bitcoin investors are not happy with the recent price trends, especially because the price has failed to surpass the $30,500 level in the past four weeks. This disappointment is further amplified by the fact that several requests for spot Bitcoin exchange-traded funds (ETFs) have either been postponed or are awaiting regulatory review.

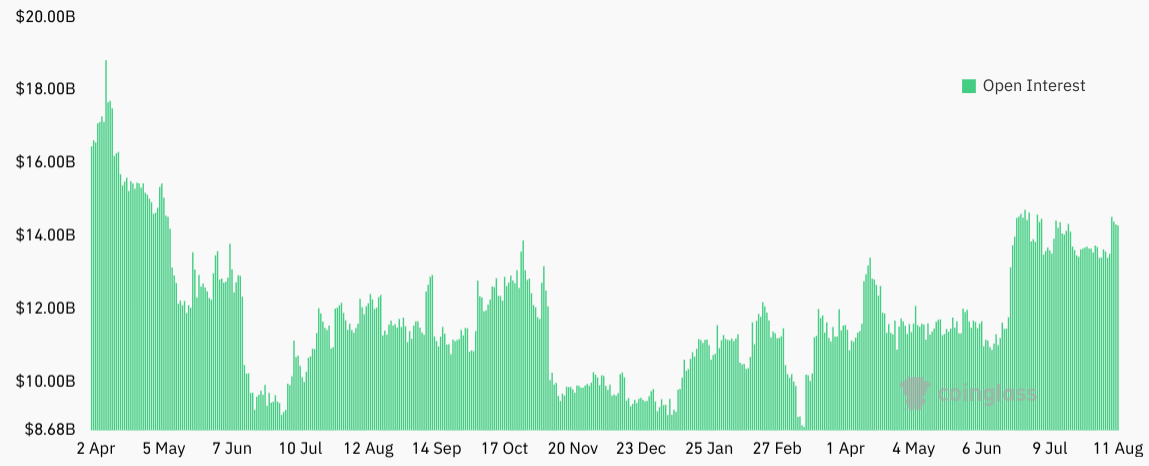

Interestingly, there has been a noticeable increase in the open interest of Bitcoin futures contracts, indicating a likely increase in demand from institutional investors. On the other hand, activity in the derivatives markets remains subdued. This contradiction in market dynamics has made it difficult for investors to gather enough momentum to trade at or above the dollar level. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

The main factor cited by many analysts for the lack of buyers pushing Bitcoin above $30,000 is the expected lawsuit against Binance by the US Department of Justice. Additionally, the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are currently conducting their own legal proceedings against the exchange and its founder, Changpeng “CZ” Zhao.

Will Bitcoin Price Rise?

Looking at the situation from a broader perspective, concerns about a potential global economic slowdown triggered by central banks’ efforts to control inflation are also increasing. The latest US core Consumer Price Inflation (CPI) figures, excluding food and gas prices, showed a 4.7% increase compared to the previous year after a 4.6% increase in June. This data ensures continued demand for less risky assets. Of course, risk markets, including cryptocurrencies, are negatively affected in this process.

Recent data indicates that BTC futures trading volumes have fallen to their lowest levels since December 2022, dropping below an average of $7 billion per day. This indicates that investors are avoiding risks and shifting towards areas with greater profit potential.

As a result, for us to see impressive volatility in Bitcoin price, a few important events can act as triggers:

- The US Department of Justice and Binance reach a settlement with a fine.

- Approval of a spot Bitcoin ETF (very difficult before the first quarter of 2024).

- A major US company adds Bitcoin to its reserves.

- The Fed begins early interest rate cuts (very difficult).

So, it seems that the markets need a miracle for a sustained rise.

Türkçe

Türkçe Español

Español