The price of Bitcoin  $91,967 rebounded to $63,000 while altcoins saw gains exceeding 3%. On the last trading day of the week, cryptocurrency exchanges were also influenced by SPX performance, with MSTR and COIN stocks gaining between 5% and 10%. This raises the question: Is it the right time to buy LINK Coin?

$91,967 rebounded to $63,000 while altcoins saw gains exceeding 3%. On the last trading day of the week, cryptocurrency exchanges were also influenced by SPX performance, with MSTR and COIN stocks gaining between 5% and 10%. This raises the question: Is it the right time to buy LINK Coin?

Insights on LINK Coin

Chainlink  $13 (LINK) has established a strong presence in blockchain-based data feeds within the DeFi sector, showcasing significant long-term growth potential. However, the token has not performed as expected due to a prolonged focus on secondary benefits. The recent activation of staking pools has partially addressed this issue by involving investors in the network’s mechanics.

$13 (LINK) has established a strong presence in blockchain-based data feeds within the DeFi sector, showcasing significant long-term growth potential. However, the token has not performed as expected due to a prolonged focus on secondary benefits. The recent activation of staking pools has partially addressed this issue by involving investors in the network’s mechanics.

Crypto analyst Tony indicated that a recovery above the $12.80 support level could signal a buying opportunity for LINK Coin. This point is crucial for LINK, while a drop below $9.40 is being targeted as support.

Expectations for the Cryptocurrency Markets

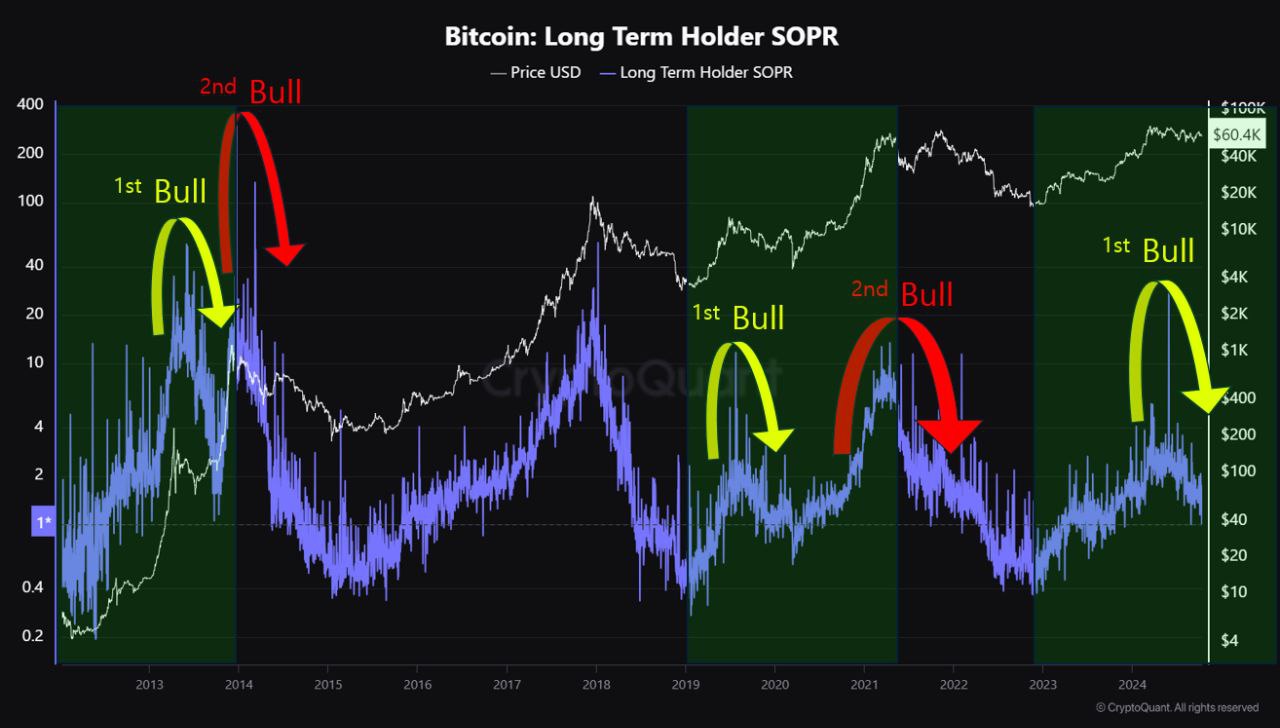

Kyle noted that current cryptocurrency trends remind him of the years 2013 and 2020. He stated that knowledgeable long-term investors are likely to notice this, and with increasing liquidity, a bullish trend that many have anticipated will eventually commence. According to the following chart, the first peak has formed, and the market must soon mobilize for a second peak.

“The cryptocurrency bull run reflects the surges of 2013 and 2020, signaling a second peak fueled by knowledgeable long-term investors.

As interest rate cuts approach, liquidity may increase, yet price movements might be rushed due to market excitement.

Buckle up for a long journey; positive momentum could yield returns by 2025.”

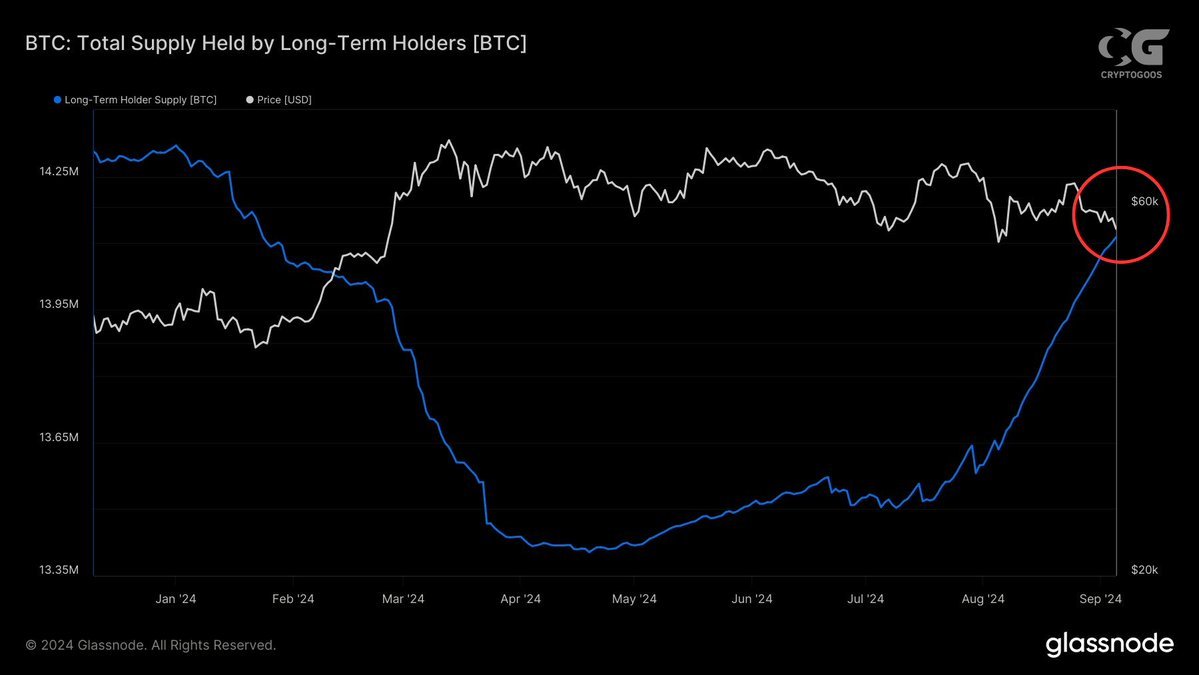

Conversely, long-term Bitcoin investors report significant buying activity. Crypto Rover shared the following chart, reminding us of the strong bullish expectations among experienced investors.

This suggests that further increases in both Bitcoin and altcoins are imminent. BTC is currently up 6%, priced at $63,224. As previously mentioned, SHIB has also seen double-digit gains.