Bitcoin price continues the day with a 6% increase and closes at higher levels for new peaks. The price, just below the all-time record level, is finding buyers at $71,137. Bulls have finally broken free from the boring range that has persisted for weeks, and altcoins have turned green. So, what’s next?

Bitcoin’s Rise

ETH is at the $3,800 threshold, and BTC is running towards new records. Investors convinced of the ETF rejection are now bewildered amid SEC’s surprise approval signals. Everyone thought the rejection decision was only a matter of time because SEC clearly signaled this with the lawsuits it filed.

The rise is not solely due to developments in the ETH ETF channel. The decreasing exchange supply and the return of the Spot Bitcoin ETF flow to net positive, along with macroeconomic developments, have also been influential. GBTC outflows have reversed, and significant inflows are occurring. On the other hand, since more inflows are not needed to close outflows, ETFs are seeing stable growth.

Bitcoin Liquidations

In futures trading, those expecting the price to fall open leveraged short positions. Through these positions, as the BTC price falls, they gain from their “short” positions. However, there are also liquidation prices. If BTC suddenly rises and reaches the liquidation price while a fall is expected, all positions are closed and liquidated.

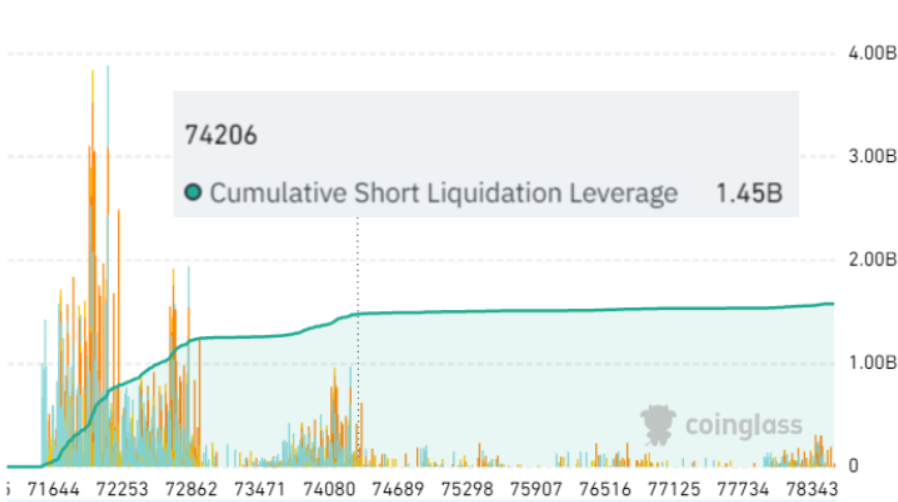

In the last 24 hours, $264 million worth of short positions were liquidated. This surprise rise was the first shock for crypto bears expecting a drop back to $59,000. If the Bitcoin price surpasses $74,300 and sets a new all-time record, $1.4 billion worth of positions could be liquidated. This would be devastating for crypto bulls. The short squeeze triggered by those trying to save their positions could fuel a new peak close to $80,000.

However, it should be remembered that there are always surprises in crypto. This week, there are two important events: Biden’s potential veto of the crypto law and another crypto law vote on Thursday. If there are surprising developments against crypto in these events, panic selling could occur in the absence of new supportive news in the ETF channel (considering the pressure from speculative traders).