Bitcoin price rise over the last 2 weeks has turned investors back to cryptocurrencies. Donald Trump’s pro-BTC stance in the US elections and the recent Elon Musk event led to a significant event, with BTC price reaching $68,000 for the first time in a long period. During these events, Ark Invest analyst group published a notable report on BTC, drawing attention to it once again.

Experts’ Bitcoin Comments

ARK Invest analysts noted that several indicators for Bitcoin currently point to favorable market conditions. In the new report, ARK mentioned that despite the end of large-scale sales by the German government starting in July and ending recently, BTC still hosts excessive sales.

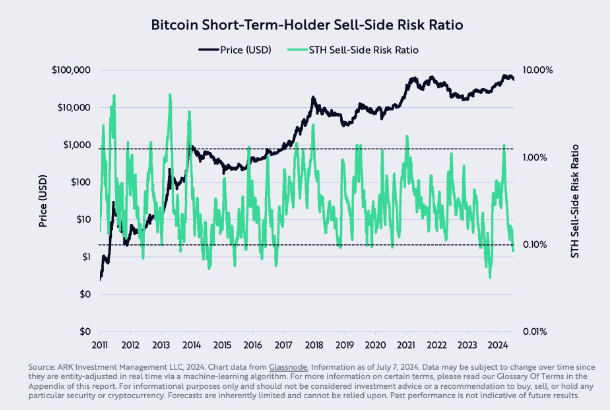

According to an analysis by David Puell at ARK Invest, the selling side risk ratio for Bitcoin’s short-term holders (STHs) is currently in the “deep value” zone after a market correction lasting several months.

The selling side risk ratio indicator, which points to short-term investors, aims to reveal whether STHs are inclined to dispose of their BTC and potentially cause a correction.

Puell said,

Another measure with apparent deep value was the selling side risk ratio of short-term holders, showing oversold values as in late 2023.

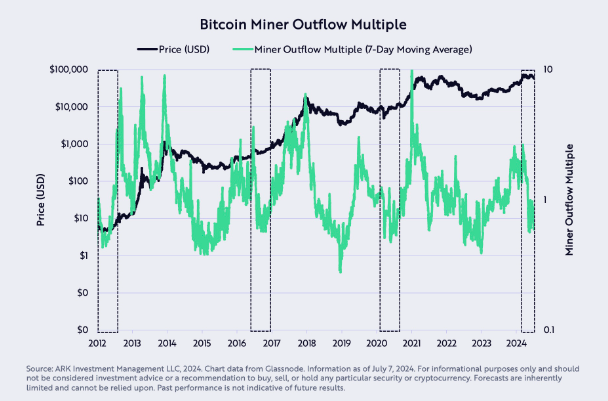

Puell also noted that the miner outflow multiple, indicating the amount of BTC transferred out by miner addresses relative to the historical average, currently points to a level paralleling positive market movements.

The miner outflow multiple, used to measure miner capitulation in the Bitcoin ecosystem, traded at 80% of its annual average and was generally associated with positive market reversals.

According to Puell, emerging economic data is believed to help the Federal Reserve lower interest rates and boost Bitcoin contrary to the Fed’s current hawkish sentiment.

What is Bitcoin’s Current Price?

As of the time of writing, Bitcoin price continues to find buyers at $67,300, marking a 1% increase in the last 24 hours. Bitcoin’s market cap remains above $1.3 trillion, with the rise in price being proportional to the increase in market cap.

More importantly, the 24-hour trading volume increased by over 60%, reflecting strong buying and selling activity by investors.

Türkçe

Türkçe Español

Español