Bitcoin price has increased, although it does not fully reflect the recent impressive inflation data at the time of writing this article. This data, which has worried cryptocurrency investors, is extremely positive. With unexpectedly low inflation combined with recent weak employment data, a highly promising picture emerges.

US Overcoming Inflation

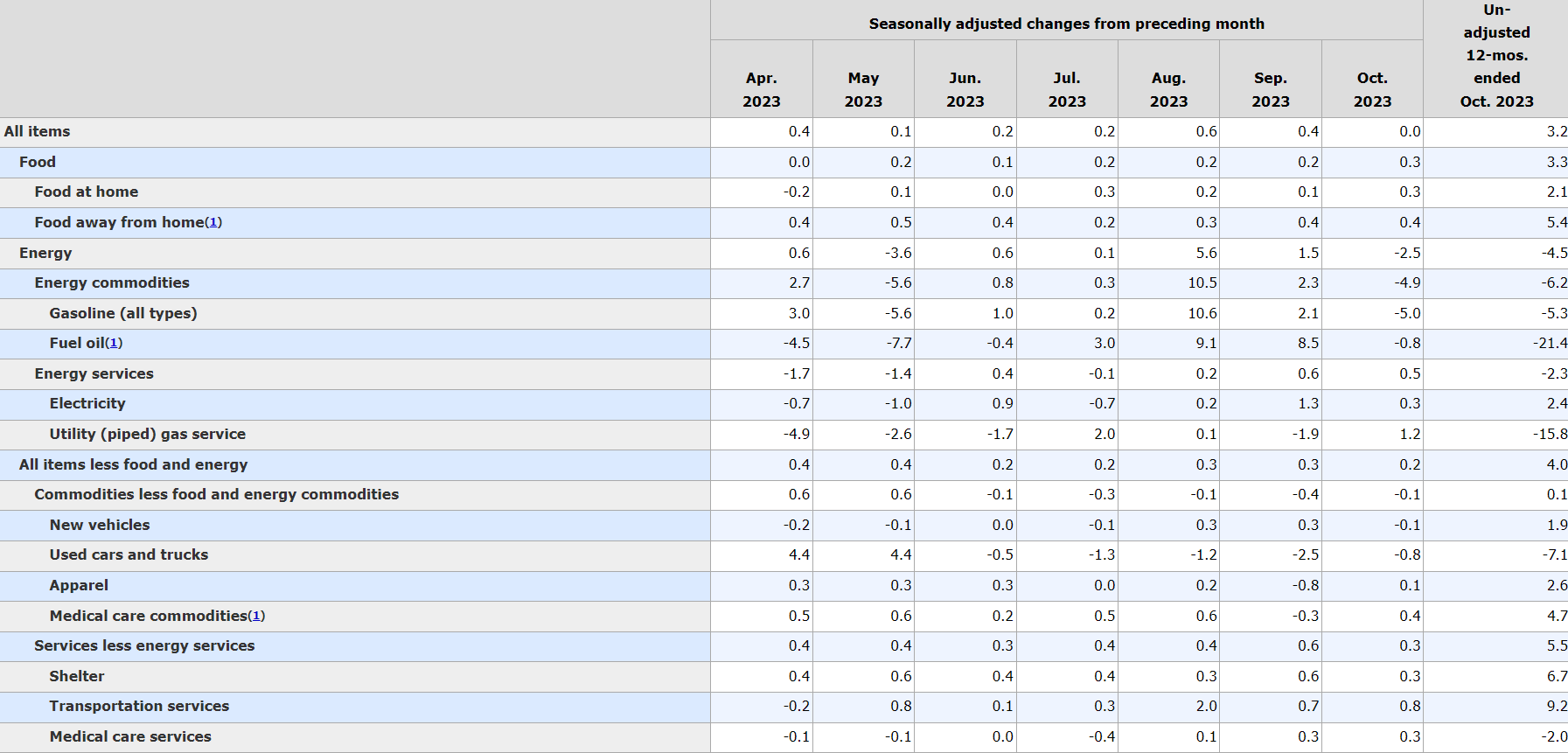

The Federal Reserve (Fed) has finally started raising interest rates in 2022 and has increased them at a faster pace than expected. Front-loaded interest rate hikes have risen at an unprecedented speed in history. Now, Powell and his team are reaping the benefits. With the support of falling oil prices, US inflation came in below expectations. The inflation rate, which was announced as 3.7 percent last month, was reported as 3.2 percent this month, compared to the expectation of 3.3 percent. While core inflation was expected to remain stable, it actually decreased.

As you can see in the table, the decrease in energy prices has had a significant impact on inflation. The US Bureau of Labor Statistics stated the following:

“The housing index continued to rise in October, offsetting the decline in the gasoline index, and as a result, the seasonally adjusted index remained unchanged throughout the month. The energy index fell 2.5 percent during the month as the 5.0 percent decrease in the gasoline index offset the increases in the energy index. The food index increased by 0.3 percent in October following a 0.2 percent increase in September. After rising 0.3 percent in October, the index for all items except food and energy increased 0.2 percent in October.”

Crypto Bull

As investors abandon the view that the Fed can raise interest rates further and strengthen the expectation of interest rate cuts in 2024, this is an extremely positive development for the risk markets. With the weakening employment data, the recent inflation can now convincingly persuade the Fed that there is no need for further rate hikes. This could lead to rallies in cryptocurrencies due to the improvement in the 2024 expectations.

If everything goes well, we may have reached the end of the challenging market. According to Fed interest rate futures, a 25bp rate cut could begin from May. There will be speeches by FOMC members on Thursday and Friday. The messages given in these speeches are quite important. For now, investors can take a sigh of relief and continue with their day.