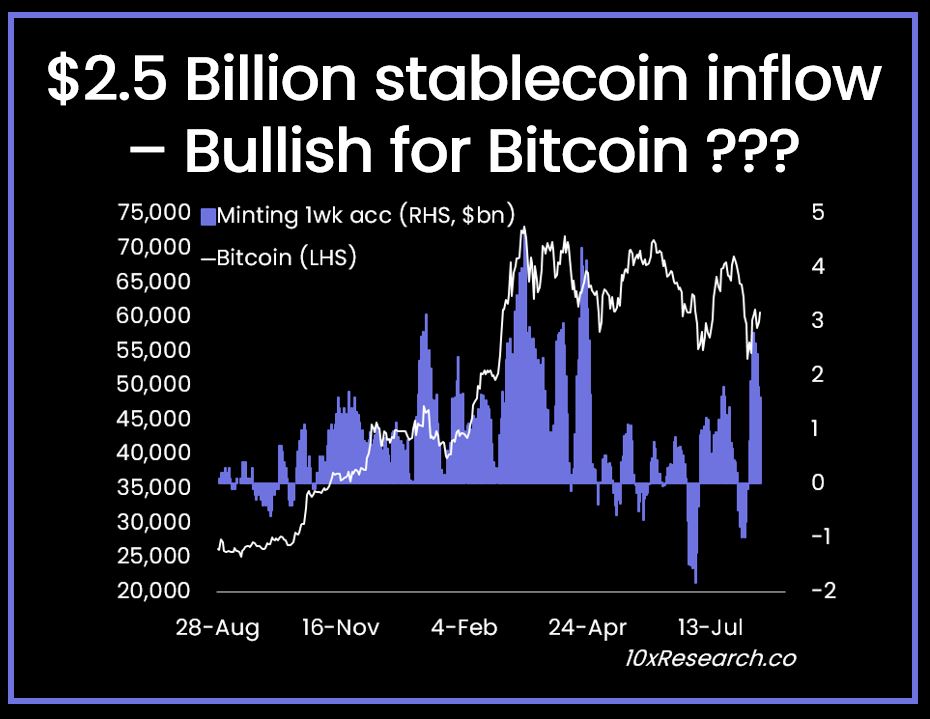

Recently, Bitcoin (BTC) and the rest of the cryptocurrency market made a notable recovery ahead of the US Consumer Price Index (CPI) inflation data. Bitcoin’s price has surged by 3%, reaching the $61,000 threshold after investors closed their active short positions. This strong recovery is backed by a $2.5 billion inflow of stablecoins into the market over the past week.

Stablecoin Inflows and Institutional Capital Flow

Recent data shows that issuers of stablecoins like Tether and Circle have increased the supply of USDT and USDC. Data shared by 10X Research indicates that institutional investors are preparing to inject fresh capital into the cryptocurrency market. This could be one of the reasons behind the recent wave of short position closures in Bitcoin.

Another significant factor in Bitcoin’s recovery is the increased institutional demand for spot Bitcoin ETFs. Banking giant Goldman Sachs reported a $418 million investment in spot Bitcoin ETF trading activities for the second quarter. This development confirms the growing institutional interest in the cryptocurrency investment class.

Recovery After Market Correction

On the other hand, 10X Research noted that capital flows have stalled since April 2024, leading to a correction in Bitcoin’s price. However, the recent increase in USDT and USDC supply has ended this stagnation, resulting in a revival of the cryptocurrency market. Tether’s issuance of over $1 billion USDT in the last 24 hours and its transfer to central exchanges (such as Binance, Coinbase, Kraken) confirms this trend.

Moreover, similar upward movements are observed in the altcoin market led by Ethereum. The current recovery trend in the cryptocurrency market appears to be directly linked to the revival in liquidity flow.

This week’s macroeconomic developments will play a key role in determining the direction of the cryptocurrency market. Particularly, the inflation data from the US, expected today at 15:30 Turkish time, will be a significant factor shaping investor market expectations.

Türkçe

Türkçe Español

Español