Bitcoin’s price rose to a daily high of $63.293, marking a significant increase. This rise is notable as it represents the most significant gain in nearly two months. Following the weekend’s upward momentum, Bitcoin recovered from Friday’s level of $56,538, closing its fourth consecutive day with gains.

Bitcoin Price Recovered After Decline

The cryptocurrency BTC reached an all-time high of approximately $73,777 in mid-March with the launch of US exchange-traded funds. However, Bitcoin’s price later fell due to declining inflows and concerns about the sale of seized tokens from the bankrupt Mt. Gox exchange. By July 5, Bitcoin had dropped to $53,499, a level last seen in February, following continued sales.

Despite recent fluctuations, Bitcoin managed to recover. After days of consolidation, the cryptocurrency began to rebound. From a technical perspective, this price increase was aided by a significant breakout as Bitcoin surpassed the key level at the 200-day Simple Moving Average (SMA). This breakout was a crucial factor in boosting bullish sentiment and pushing the price upwards. Crypto analyst Ali Martinez had previously predicted that breaking above the $59,200 resistance level, which coincides with the daily SMA 200, could push Bitcoin to $63,800.

Latest Data for Bitcoin

According to the latest data, Bitcoin was trading at $62,745 with a 4.12% increase in the last 24 hours after reaching a daily high of $63,293. This price jump is part of a broader rally in the cryptocurrency market, with other major cryptocurrencies also seeing significant gains. The upward trend was further underscored by CoinGlass reporting that $125 million worth of positions were liquidated in the last 24 hours.

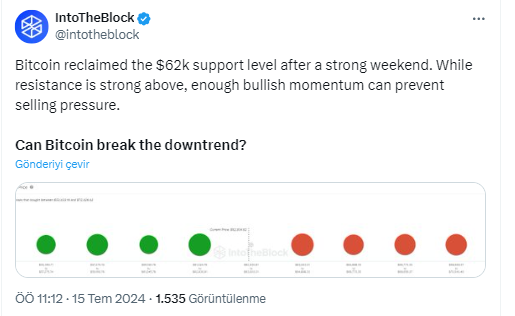

Nearly half of the liquidated positions were Bitcoin, with short positions losing $49.45 million. The liquidation of these downward bets further fueled the bullish momentum in the market. According to on-chain analysis firm IntoTheBlock, while Bitcoin has regained the $62,000 support level, resistance above this level remains strong. However, sufficient bullish momentum could prevent the formation of selling pressure.

Türkçe

Türkçe Español

Español