Bitcoin price reached approximately $56,550, its lowest in two months, and just three days later, it surged more than 12.5%, climbing above $64,000 on May 4th. This resurgence primarily occurred after the US Federal Reserve’s commitment to maintain interest rates unchanged through 2024.

Why Is Bitcoin Rising?

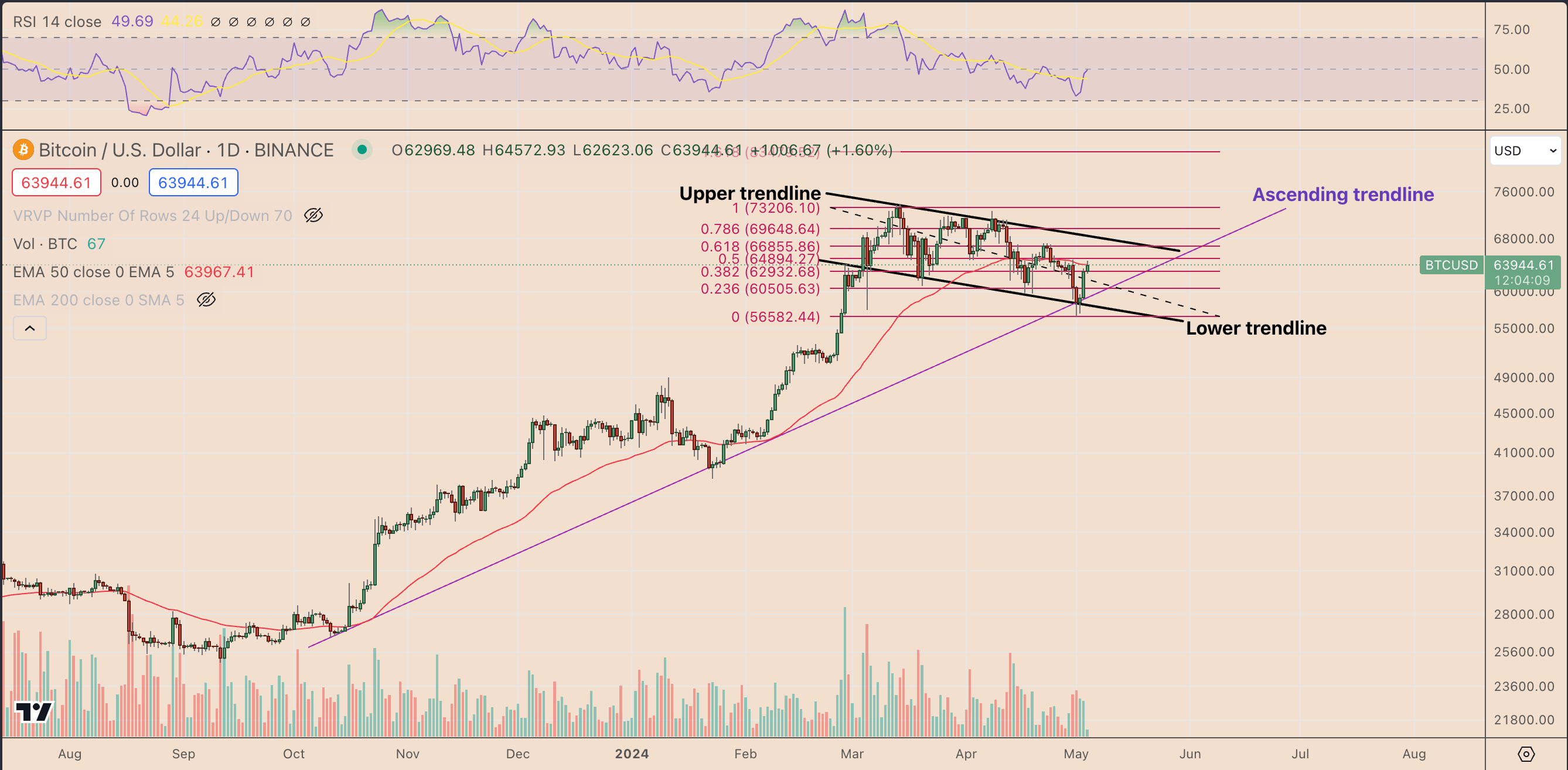

As of May 4th, Bitcoin was observing a definitive close around $63,966, above its 50-day exponential moving average (50-day EMA; the red line in the chart below). This positioning could direct the price towards the upper trend line resistance near $69,650, located at the 0.786 Fibonacci retracement line.

Although Bitcoin managed to surpass the 50-day EMA on May 4th, it struggled to maintain momentum for further breakouts and encountered resistance near the 0.5 Fibonacci retracement level at approximately $64,895. If Bitcoin cannot decisively overcome this resistance, it could initiate a consolidation or even a reversal period, with the next downward target being around $60,500, near the multi-month rising trend line support (purple line).

Meanwhile, a further breakdown of the rising trend line support could potentially send Bitcoin’s price down to the 0.0 Fibonacci retracement level near $56,580 in May. Interestingly, analyst CrediBULL Crypto predicts a similar level drop if the price retreats from the resistance area between $62,000 and $64,450.

What’s Next for Bitcoin?

A segment of the Bitcoin market continues to be optimistic about the possibility of a prolonged Bitcoin bull run in the coming months. This includes independent market analyst SHIB Knight, who predicts Bitcoin’s price could reach $85,000 due to a prevailing bull flag setup.

Another analyst, Steph is Crypto, addressed a six-figure Bitcoin price target by referring to a breakout in what is known as the relative strength index (RSI). Specifically, as of May 4th, Bitcoin’s daily RSI reading was above a declining trend line resistance, similar to breakouts in January 2024 and October 2023. These RSI breakouts preceded a strong bull run, including a rise to $75,000 in March 2024.

Türkçe

Türkçe Español

Español