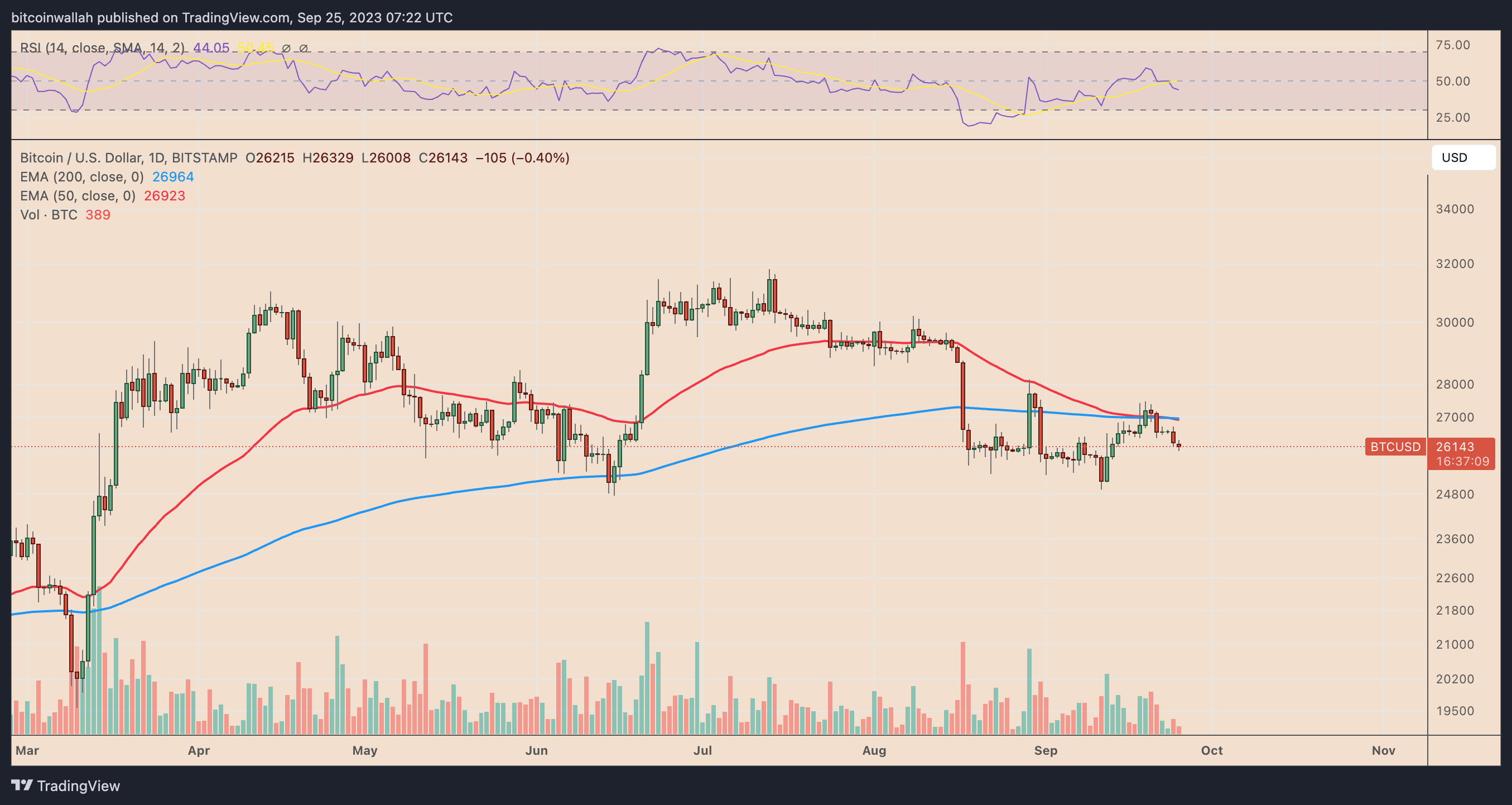

Bitcoin continues to hold above $26,000. After failing to show any signs of recovery following the US Federal Reserve’s interest rate decision last week, Bitcoin continues to raise questions in investors’ minds. Investors are waiting for the approval of spot Bitcoin exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC). This situation increases investors’ hopes as the approval of spot gold ETFs in the past led to a significant increase in gold prices.

Bitcoin: Fed and SEC Decisions

On September 21, the Fed announced its decision to keep interest rates unchanged. However, the statements made after the meeting revealed that many officials are in favor of raising interest rates again in 2023. After these statements, the price of Bitcoin dropped by 4.25%. Especially for investment instruments like Bitcoin that do not have a guaranteed income, the Fed’s interest rate decision can cause a significant decrease in the market.

With this decrease in the price of BTC, it has been shown that high interest rates can lead to significant losses for investment instruments like Bitcoin in recent years. With the decision to increase interest rates, investors are turning to safer assets like the US dollar. The reason for this is quite simple; easy income.

In addition, the 20-day average correlation coefficient between Bitcoin and the US Dollar Index dropped to -0.73, reaching its lowest level since September 2022. This situation proves the inverse relationship between Bitcoin and the US dollar.

Furthermore, BTC investors have pinned their hopes on the approval of spot Bitcoin ETF applications by the US Securities and Exchange Commission in October. Their biggest hope is the 300% increase in gold prices following the approval of spot gold ETF in 2003.

All these developments support each other, and the price of Bitcoin is experiencing the least volatile period in history. Bitcoin’s historical volatility index has dropped to 13.39 this month. This data is obtained by measuring the BTC price at one-minute intervals for 30 minutes. To explain this situation, the index peak was 190 in February 2018.

Buying Opportunity for Bitcoin

Although all indicators are negative, many analysts believe that Bitcoin’s price will lead a long bull run in the late 2023 and throughout 2024. Especially when various charts are shared based on X, the charts have one common point; a bull run.

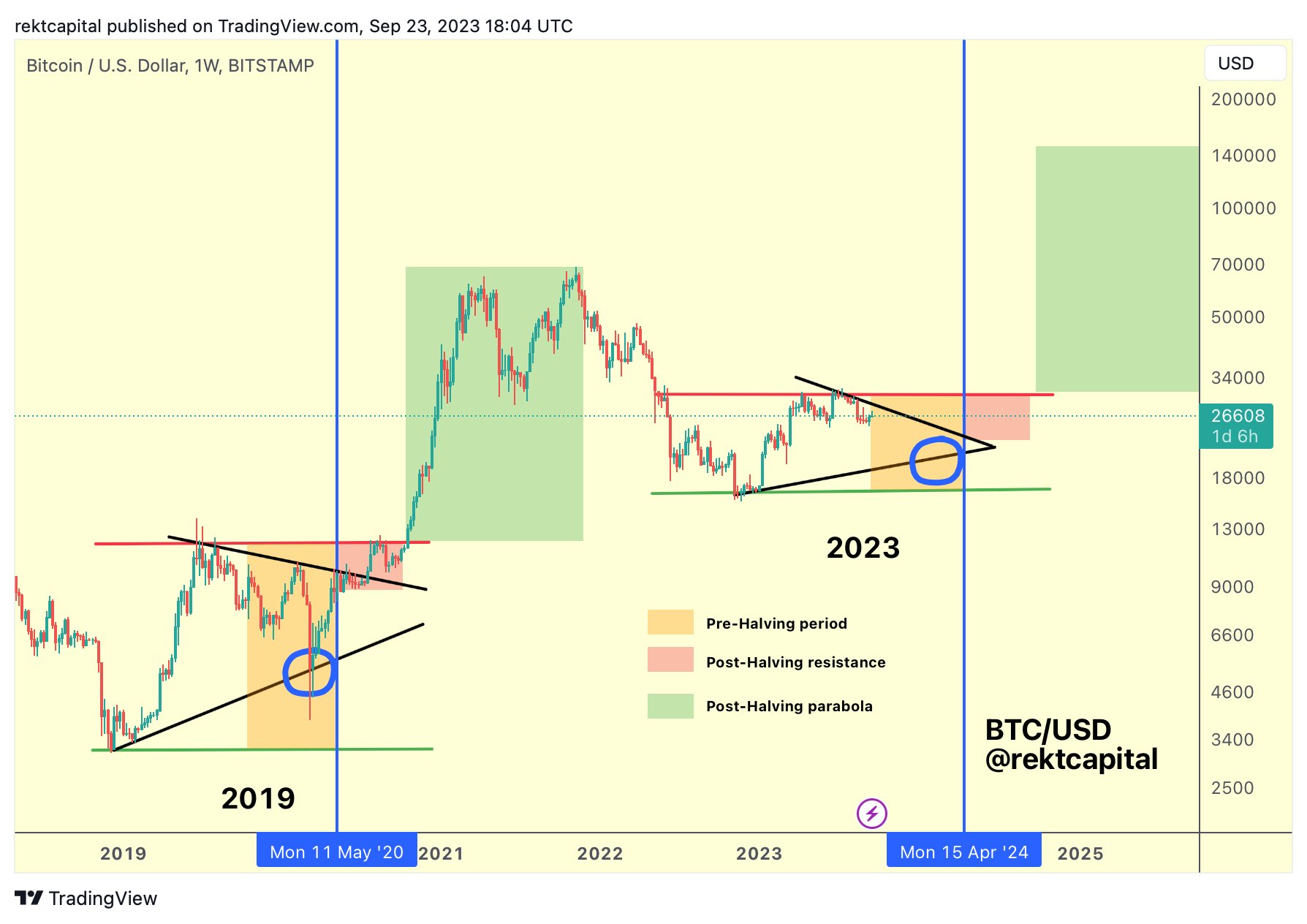

Famous analyst Rekt Capital sees the ongoing sideways movement of Bitcoin as a buying opportunity before the halving event. The analyst argues that previous halving events triggered the BTC price.

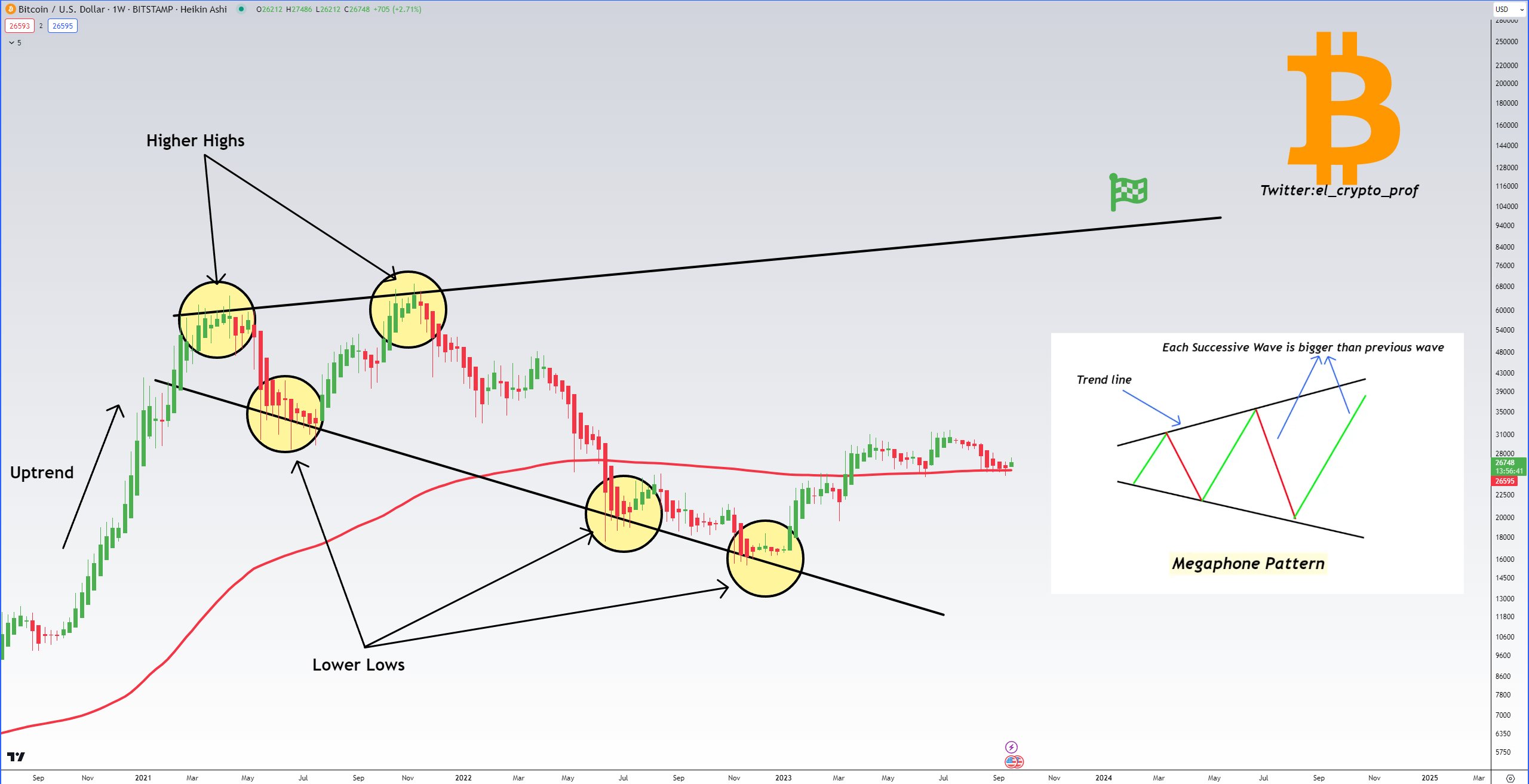

A similar thought comes from popular analyst Moustache. Supported by a classic Megaphone formation for a bull run plan specifically for Bitcoin, the analyst’s predictions exceed $100,000.