Bitcoin price continues to make new highs above $73,000, approximately 35 days before the halving, with the price at $73,160 at the time of writing. What do market experts expect after the Bitcoin block reward halving? What’s next for cryptocurrencies?

Bitcoin Halving

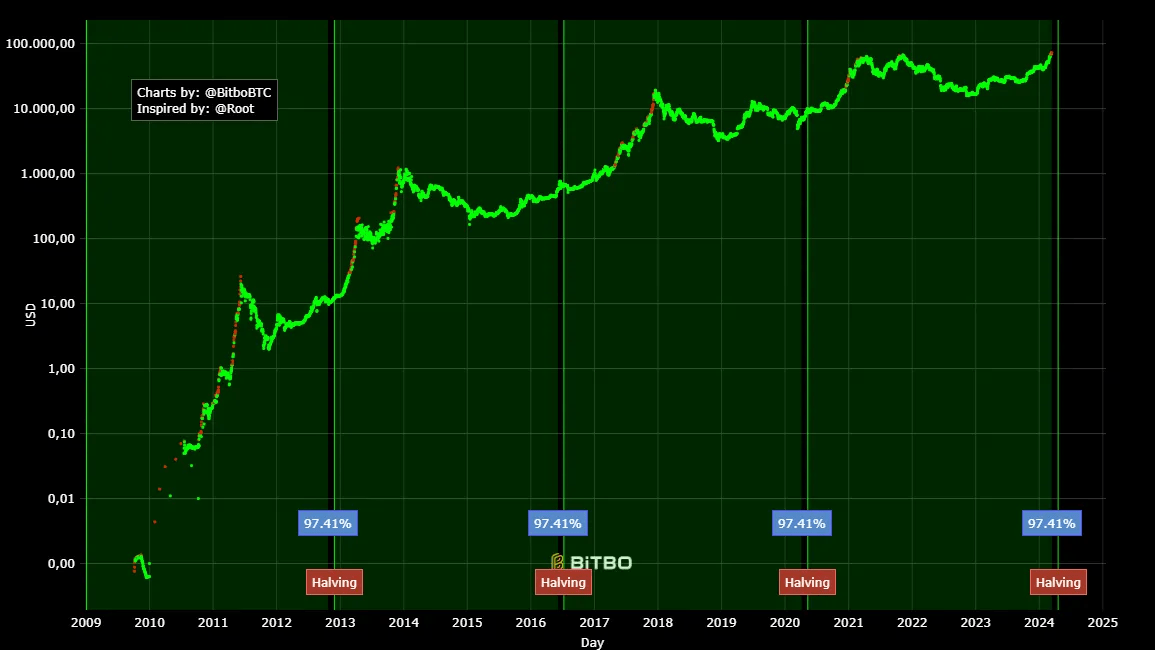

Every 210,000 blocks, the Bitcoin network cuts miner rewards in half. Initially awarding 50 BTC per block, the network will give a 3.125 BTC reward after the April halving. Unlike previous halvings, we are now in a very different environment. The cumulative value of cryptocurrencies has quickly climbed from 2 trillion to the 3 trillion dollar threshold.

The demand from the spot Bitcoin ETF channel is massive, and there was no such support during previous halvings. Moreover, ETF approval has transformed Bitcoin into an investable, legitimate asset in the US.

Expert Predictions

Wait a minute, if there’s already such demand in the ETF channel, shouldn’t it multiply with the halving? Indeed, this was the case in previous halvings, which were almost entirely driven by individual investors.

Ethan Vera, the COO of Luxor Technology Corporation, said;

“We expect continued institutional interest in both the underlying commodity and companies operating in this space, like miners.”

Joe Nardini, a senior managing director at Riley Securities, also thinks the halving will increase the risk appetite for institutions wanting to buy BTC. Nardini said there’s more evidence that BTC supply won’t balloon, which is a “clear positive” for many potential institutional investors.

Ruben Sahakyan, an investment banking director at Stifel Financial, believes that investors investing in Bitcoin for the first time will not be much affected. He also assumes that the demand for mining stocks might weaken due to those interested in monitoring the impact on miner profitability.

Chris Kuiper, research director at Fidelity Digital Assets (FDA), said;

“Currently, there are two major narratives and driving forces for Bitcoin. The first is the approval of spot Bitcoin ETPs, a significant milestone in Bitcoin’s history and its ongoing adoption. The second is the upcoming halving.”

In a recent market commentary, a JPMorgan analyst said that after the April halving event, the BTC price could drop to as low as $42,000. Lastly, Clark Swanson, the former CEO of Blockcap, suggests that this halving could be more exciting than others due to the supply shock caused by demand from the ETF channel.

Türkçe

Türkçe Español

Español