BTC price has anchored in the $50,000 region and at the time of writing continues to find buyers at $49,960. What does the current on-chain outlook for BTC indicate? While technical analysis can provide some foresight, fundamental analysis has the potential to give sharper signals about major movements as it measures investor behavior.

Bitcoin (BTC) On-Chain

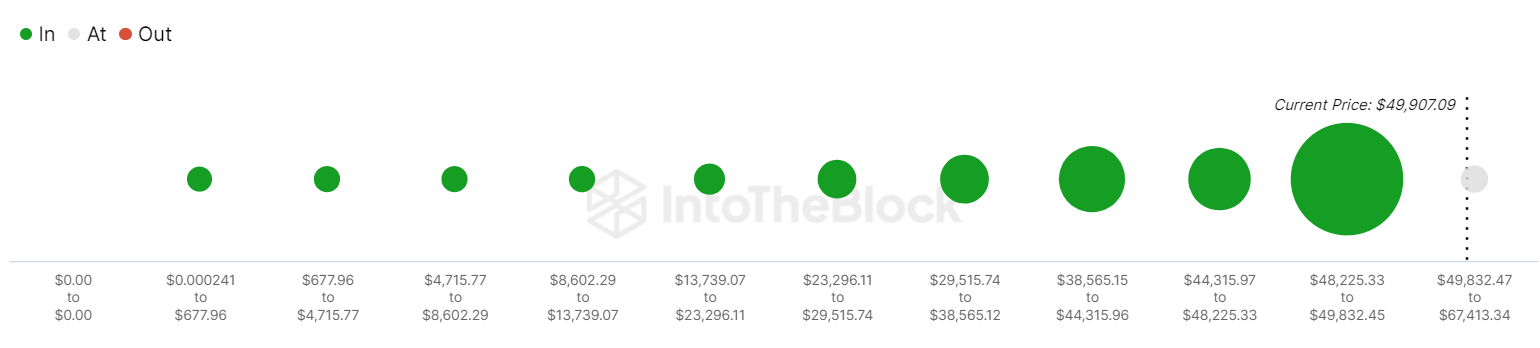

The average cost of recent active addresses is quite high and close to the current price, reflecting the strength of buyers. Moreover, as the price rises and investors’ losses are covered, it would make sense for profit-taking to subside due to optimism about the upcoming period.

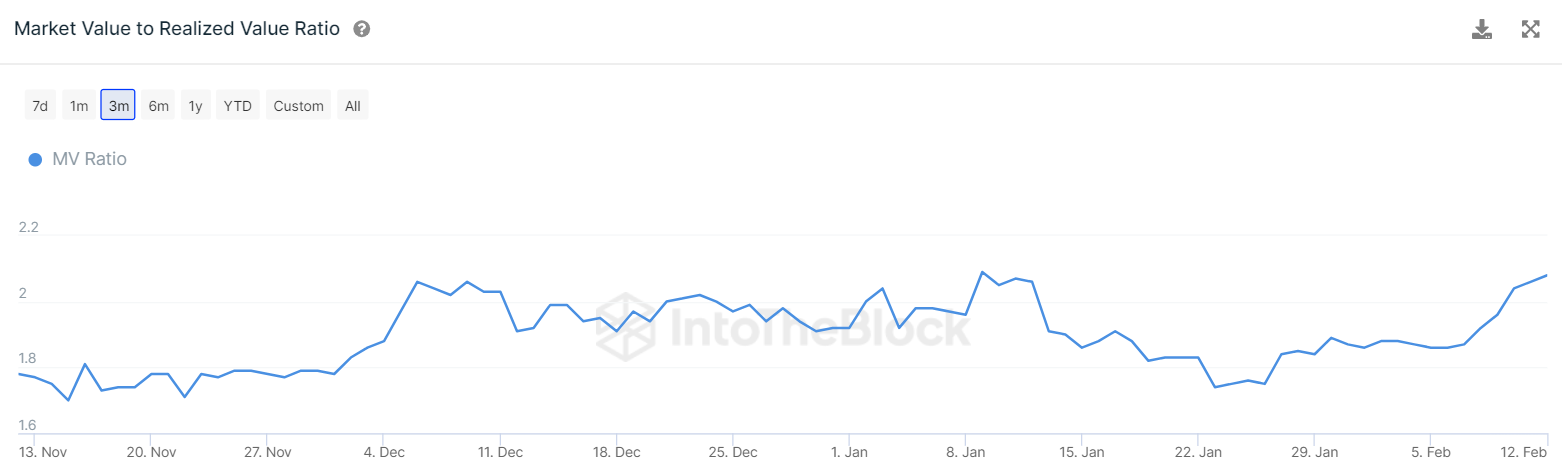

MVRV is climbing back to the peak levels of January. This situation is conducive to further increases for a while, but it also warns of a mandatory price correction in the future. According to the data, the rapid rise may not continue in the coming days as it has in the last few.

In the table below, you can see the correlation rates for altcoins that are most/least affected by the BTC rise. This indicates which altcoins may make sharp movements tied to BTC in case of potential declines or rises.

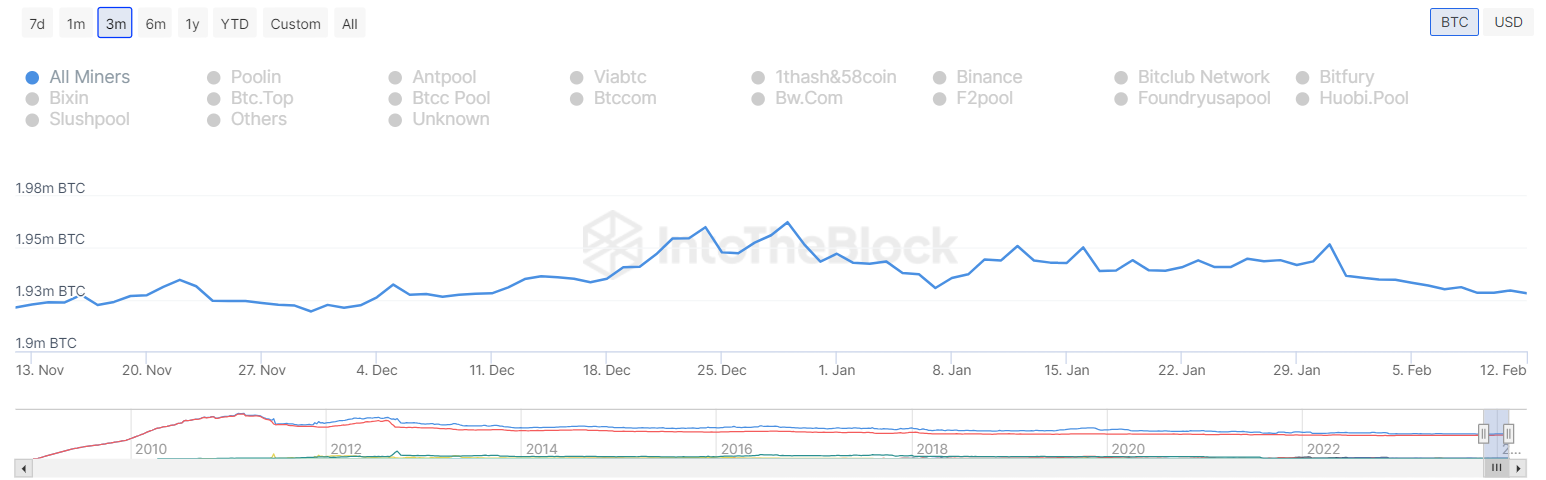

One of the most important issues is miner reserves. They have reached the lowest level in the last month, and generally, this indicates a local bottom, so the risk of further sales from miners seems weak for now. Moreover, the upcoming halving and the long-term positive market outlook should reduce the motivation to sell. Miners have already been selling to secure cash needs for a long time.

Bitcoin (BTC) Predictions

Recent ETF entries have been quite positive, and the selling pressure of GBTC on the crypto markets has weakened. In fact, the negative premium has returned to the neutral zone, so we are likely to see clear entries from the Grayscale front in the coming days.

However, as we see in the on-chain data, a price correction is approaching. We had written on January 11 that a correction could come as investor profitability had increased significantly. These data are also monitored by large investors with hundreds of millions of dollars in assets, and profit-taking by this group of investors is highly satisfying.