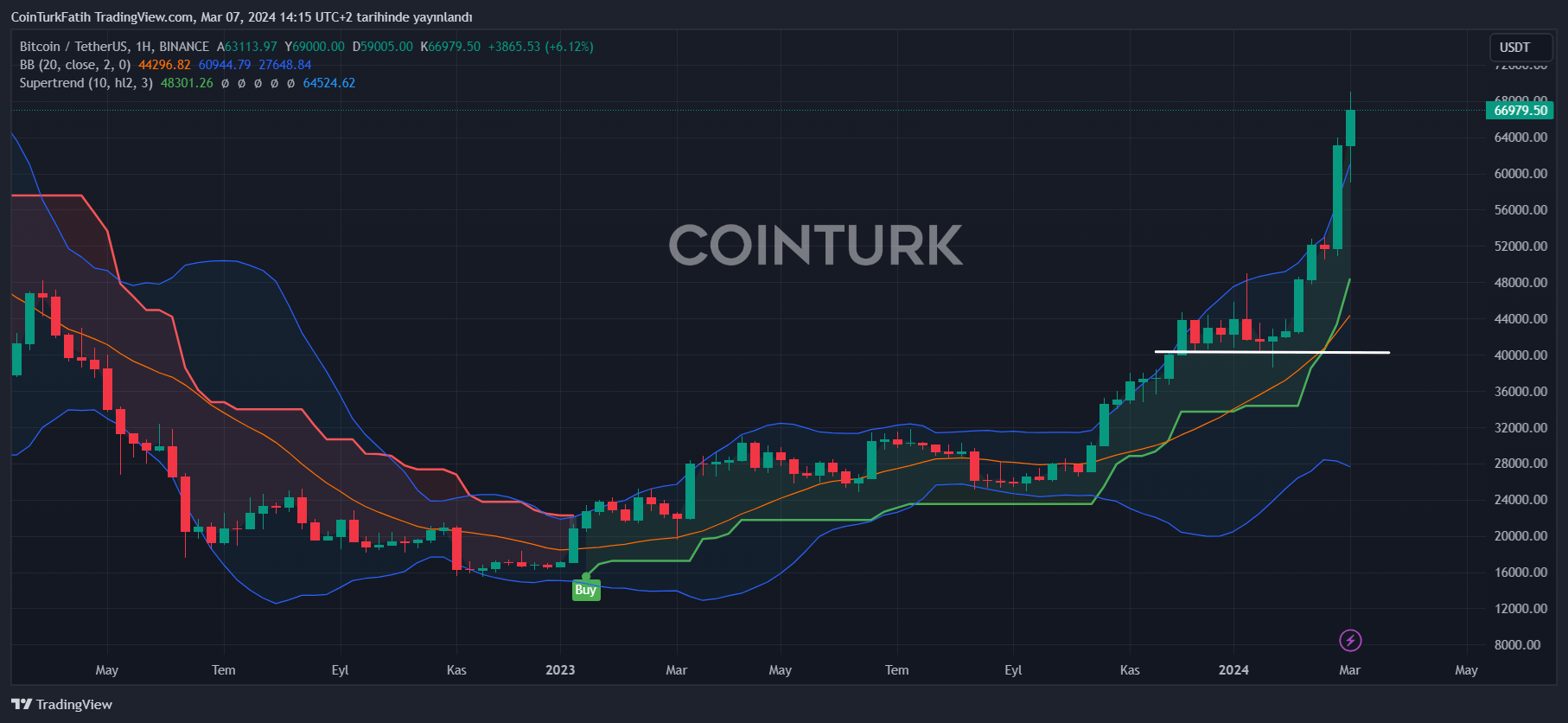

Bitcoin price has been moving sideways for a while, lingering around the $67,000 region. Even after a peak of $69,000, we saw rapid profit-taking, but the price rebounded just as quickly from $59,000. So, what are the latest market predictions from QCP analysts? What does the rapidly rising BTC price promise in the short term?

Crypto Experts Share Their Opinions

Even after the recent fast rally, the price remains calm at $67,000, consolidating in this area, which may signal more rises for altcoins. What’s exciting is that there’s still more than a month left until the block reward halving. QCP analysts wrote the following in their assessment published today;

“Individual speculative excitement is not over yet. Memecoins like WIF and BONK continue to rise, Altcoin funding rates are still above 50%, and funding rates on individual-focused exchanges such as Binance and Bybit continue to be higher than on Deribit.

Moreover, the spot-forward spread continues to be higher and more expensive! The BTC spot ETF consistently sees significant inflows, with a daily average of $550 million. We believe this demand will keep the crypto uptrend in place. On Monday, Blackrock applied to include BTC spot ETFs in the BlackRock Strategic Income Opportunities fund. There is no doubt that other asset managers will do the same and keep the demand for spot ETFs strong.

Another supporting factor was the Fed. Key speakers like Waller and Powell confirmed that the Fed is on track to lower interest rates this year. Following this, the USD fell, and even Gold saw its all-time high levels!”

The Upcoming Week is Critical

Tomorrow, data on employment and wage increases will be released. Next week, we will have a very busy week with inflation and other data. The data for the first month of the year did not worry Fed members much, but if the upcoming data is also abnormal, it could strengthen rumors that the Fed may cut rates less than expected.

Investors should not overlook the risk of speculative fluctuations of up to 30% while the current hype continues. Especially in meme coins, rapid rises are often followed by even faster falls.

Türkçe

Türkçe Español

Español