Bitcoin price is lingering at $64,660 while altcoins continue to lose value. In recent days, geopolitical risks have made things tougher in the crypto market. Investors with weakened risk appetite are selling altcoins, causing new price lows.

Latest Developments in Cryptocurrencies

Bitcoin mining difficulty peaked as expected on July 31. Yesterday, it reached an all-time high of 90.66 trillion. This indicates that miner earnings will decrease further in the future, supported by large miners expanding their operations. Miner reserves hit a 10-year low of 1.9 million on July 23 but have been recovering in recent days. On July 30, reserves rose to 1.97 million.

Spot Ethereum ETF

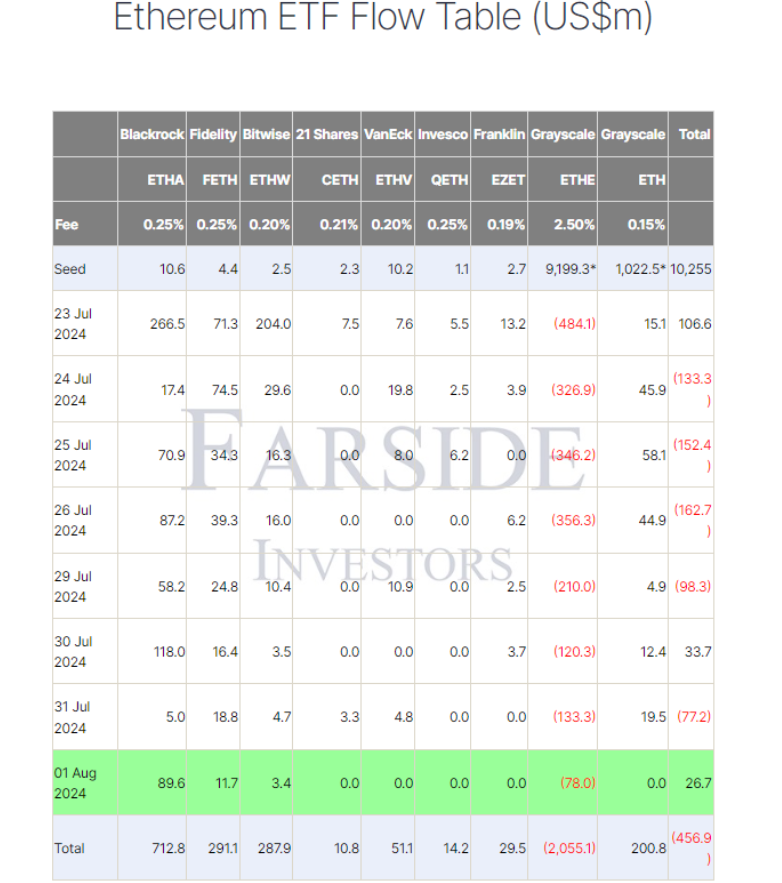

ETHE experienced over $2 billion in outflows, reminiscent of Grayscale’s GBTC sales but at a faster pace. This increases hopes for a rebound as consistent net inflows can motivate new investors to be bullish.

On August 1, eight ETFs saw a total net inflow of $26.7 million. Why is ETHE experiencing rapid sales? We discussed the details; with attractive negative premiums and upcoming ETF approval news, selling now means roughly a 50% gain for investors, which is understandable. However, since 22% of the trust converting to an ETF has been sold, a slowdown is expected here.

Bitcoin Decline

Signals that Iran might soon launch missiles have lowered BTC prices. They will likely wait for the US markets to close and send their drones within the next 24 hours. Missiles sent from Lebanon had little impact. Concerns about rising tensions until Monday could keep markets under pressure.

Especially over the weekend, we might see high volatility in cryptocurrencies due to surprise headlines. Despite the death of its top executives, Iran failed to respond effectively, so expecting Iran to escalate tensions after the latest incident might be a mistake. Generally, such claims and threats are not substantiated, leading to fewer similar declines over time.

Türkçe

Türkçe Español

Español