Bitcoin price remains at $58,900 despite positive PPI data, and altcoins are in the red. Mt Gox is nearing the end of its sales, with nearly $2 billion moved today. Will cryptocurrencies rise again after the major sales that triggered a drop to $49,000? Why is the M2 money supply detail important?

Cryptocurrencies and M2 Supply

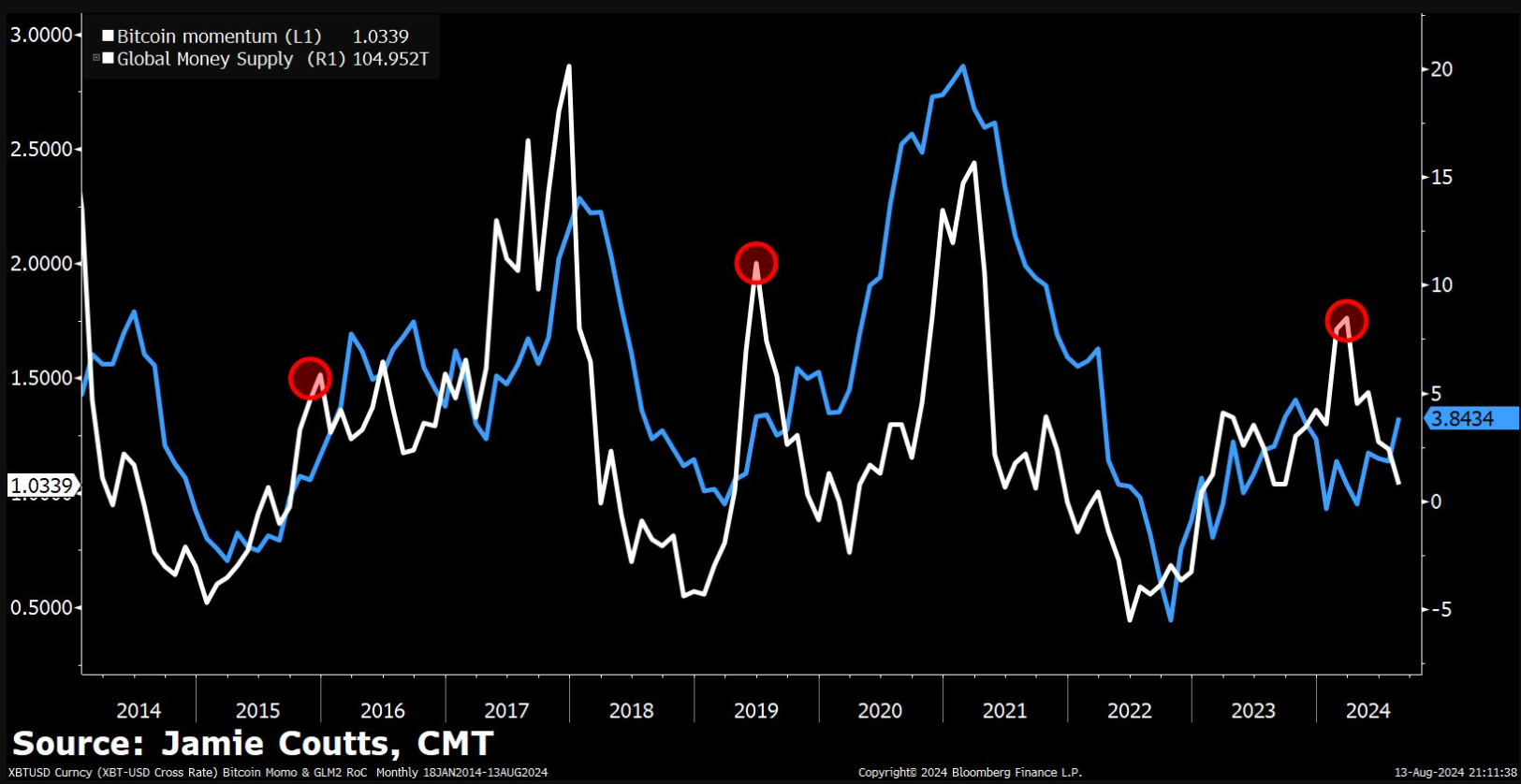

Jamie Coutts, the chief crypto analyst at Real Vision, believes the cycle has reached a phase that will trigger a significant rise in crypto. Evaluating based on the M2 supply, Coutts wrote:

“Over the past decade, Bitcoin has tended to bottom a few months before the global M2 bottomed. It then experienced a correction mid-cycle, moving well ahead of liquidity.”

According to the analyst, a perfect setup is forming when reading spot Bitcoin ETFs alongside the global money supply cycle. Although the analyst is hopeful, stating the market is in a recovery trend after last week’s massive sell-off, BTC is still below the psychological threshold of $60,000.

Cryptocurrency Predictions

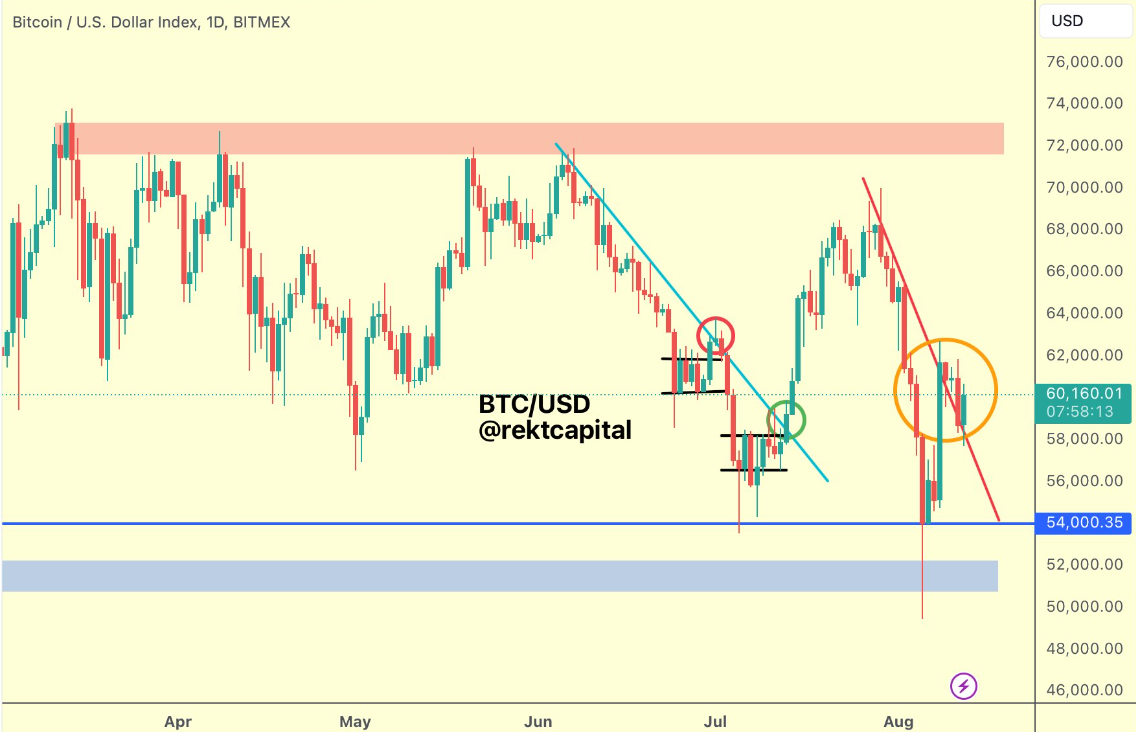

The downtrend that began on July 28 is still unbroken. Even in bull markets, such downturns are common and can be particularly exhausting for altcoin investors. Although the increasing demand in the ETF channel and the upcoming November elections are motivating, short-term unpredictability persists.

Analyst Rekt Capital, known for accurately reading long-term movements and short-term fluctuations, wrote in his latest assessment:

“Over time, the downtrend represents lower prices, meaning retest attempts can go to lower prices and still be successful. The key point here is the continuation of the trend. Bitcoin needs to experience strong buying volume during the retest of its downtrend.”

Some analysts expect one last correction down to $55,000, but if tomorrow’s inflation data is positive, the potential for investor sentiment to recover is strong. On the other hand, companies continuing to accumulate ETFs will complete their reporting in the next few days, and we may see many companies reporting ETF purchases for the first time this week. These upcoming reports for the second quarter could also increase risk appetite as before.

Türkçe

Türkçe Español

Español