Bitcoin price had reached up to $64,000 at the time of writing before falling below $62,000. It has risen more than $20,000 in a month. I had emphasized that such a scenario could be helped by excessive demand even before an ETF approval had arrived. Some experts were warning about a supply shock, and the story is becoming a reality.

Spot Bitcoin ETFs and the Bull Market

Bitcoin miners have cut their sales in the last few days and are waiting for the peak. Then the price began to rise rapidly. After seeing a net inflow of over half a billion dollars yesterday, we started to feel the support of ETFs even more today. Altcoin investors may not yet feel the full impact, but their time will come.

For Bitcoin, the important thing for now is to close the week above $58,000 and aim for the $65,000 region again. ETF inflows are approaching $8 billion (cumulative), and this hype does not seem to be fading anytime soon. ETF-driven investors, creating demand over 20 times the daily new Bitcoin supply, will play a significant role in the post-halving ATH journey.

Spot Bitcoin ETF Trading Volumes

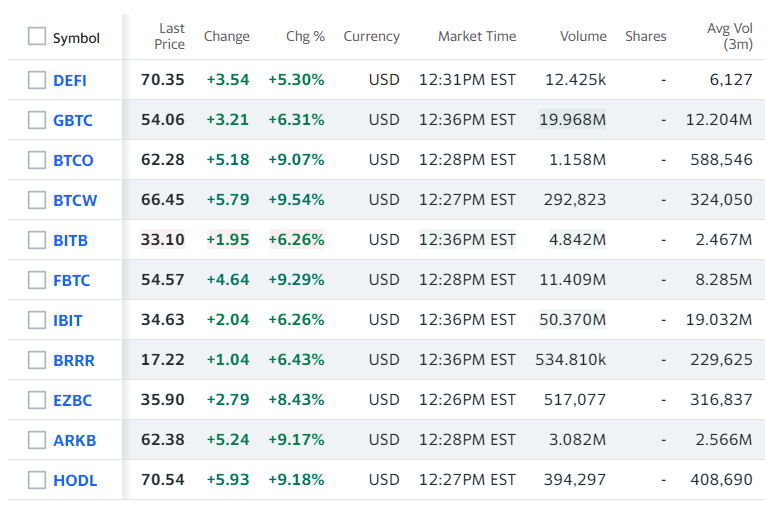

Today’s most important agenda item should be ETF volumes. However, people will probably start discussing this after the market closes and the clear data comes in. In the volume ranking, we saw two spot Bitcoin ETFs in the top 10 among all ETFs.

BlackRock saw a volume of 50.6 million at a price of $34.6, reaching a volume of $1.75 billion. Considering our cumulative trading volume record is $2.4 billion, today is indeed a historic day. Fidelity, while the markets still had hours to close at the time of writing, surpassed a volume threshold of $730 million. ARK created a volume of $230 million. So, the cumulative volume of just these 3 ETFs exceeded $2.7 billion.

By the end of the day, we will likely see a massive trading volume of around $3.5 billion. It’s clear that ETFs are the main reason for today’s rise in Bitcoin price. If this momentum continues, BTC could sustain its peaks with very short breaks.