Bitcoin price today rose to $61,360 and has gained over $20,000 this month. Such a large green monthly candle is not something we are used to seeing. In fact, it is poised to close even better than the February candle of 2021. Of course, the primary reason for this extraordinary rise is the spot Bitcoin ETFs.

Spot Bitcoin ETFs

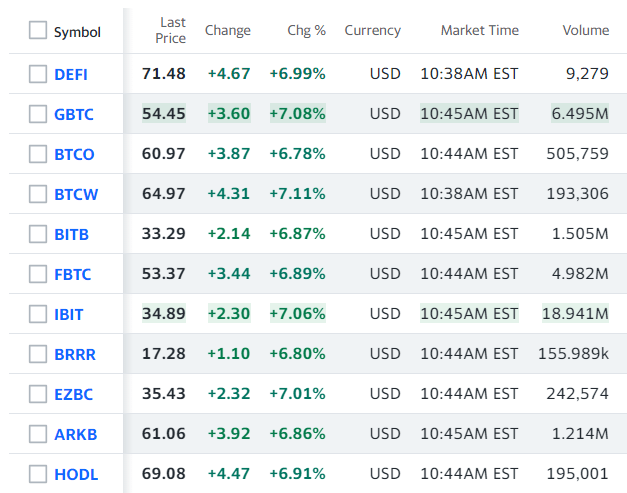

ETFs traded on the US stock markets reached volumes of hundreds of millions of dollars as soon as they started trading today and continue the day with a 7% increase. ETFs are already setting all-time high (ATH) levels and the ongoing interest has put Bitcoin into an interesting upward spiral. It is likely that the spot price will continue to rise until we see significant profit-taking in the ETF sector.

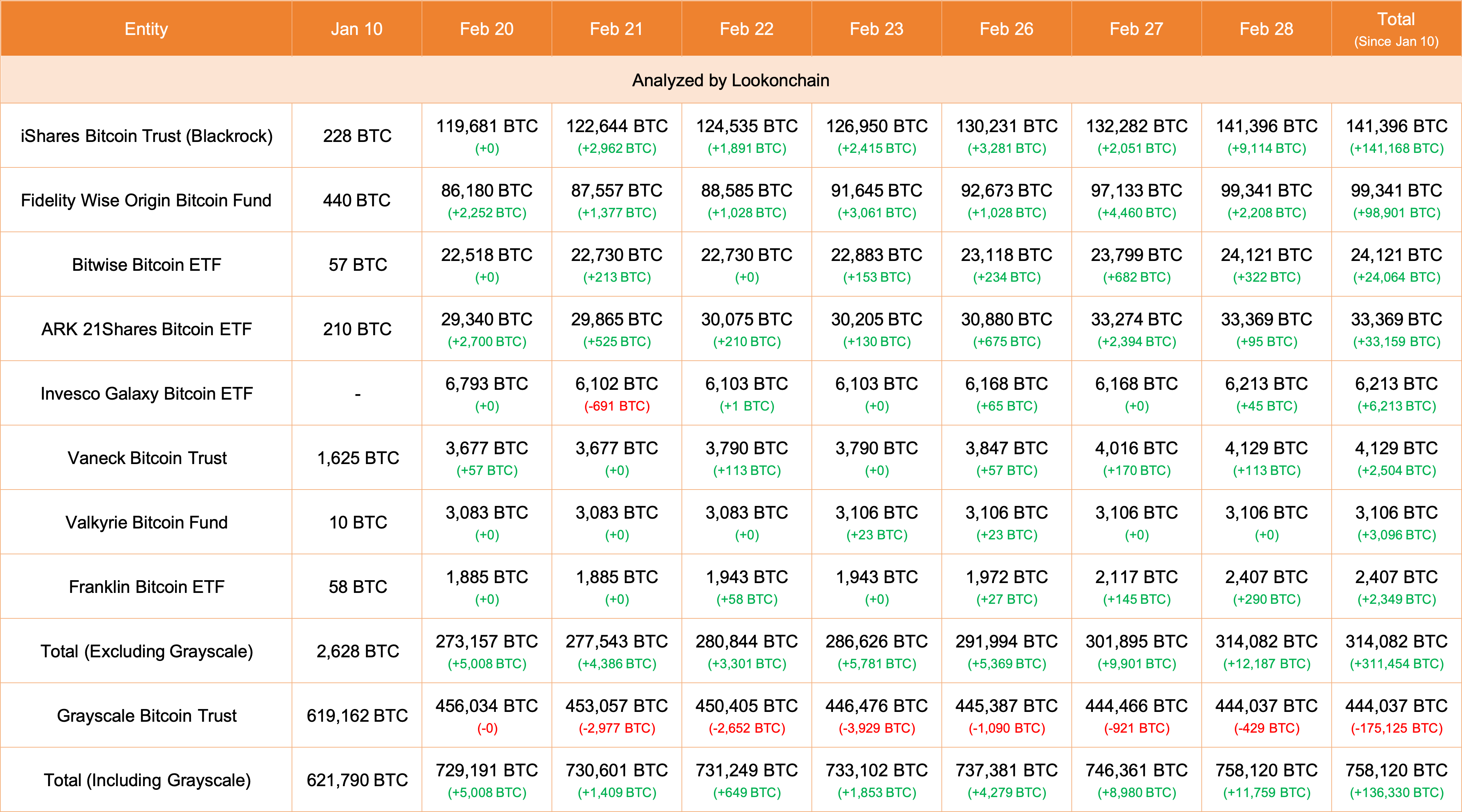

Spot Bitcoin ETFs, which have seen over $5 billion in net inflows, have significantly filled the buyer gap in the market. The current size of cryptocurrency investment funds has almost reached the ATH levels of 2021. All these suggest that Bitcoin could reach a six-figure price target after the halving event.

On the other hand, reserves are growing. Today, BlackRock and Fidelity added 9,114 and 2,208 BTC to their reserves, respectively. Excluding GBTC, the reserve size reached 314,082, and the cumulative reserve rose to 758,120. Since the launch date, there has been a net inflow worth 136,330 BTC. This inflow is not far from the massive reserve accumulated by MicroStrategy to date. It roughly corresponds to about $8.3 billion at the current exchange rate.

In an environment where Bloomberg experts find the annual net inflow of $10 billion ambitious, this is astonishing and explains BTC’s parabolic rise.

Bitcoin Ascends

In the last few days, the Bitcoin price has reached all-time highs against the Japanese yen, Malaysian ringgit, Indian rupee, New Taiwan dollar, South Korean won, Chilean peso, Australian dollar, Chinese yuan, South African rand, Norwegian krone, and Turkish lira. Although the price surpassed $60,000 due to a strengthening dollar, the peak was seen early in most currencies.

Bitcoin price has historically increased by at least 270% after every halving. If we are to see a similar scenario and the price increases by at least 200%, it would need to rise to $138,000.

Türkçe

Türkçe Español

Español