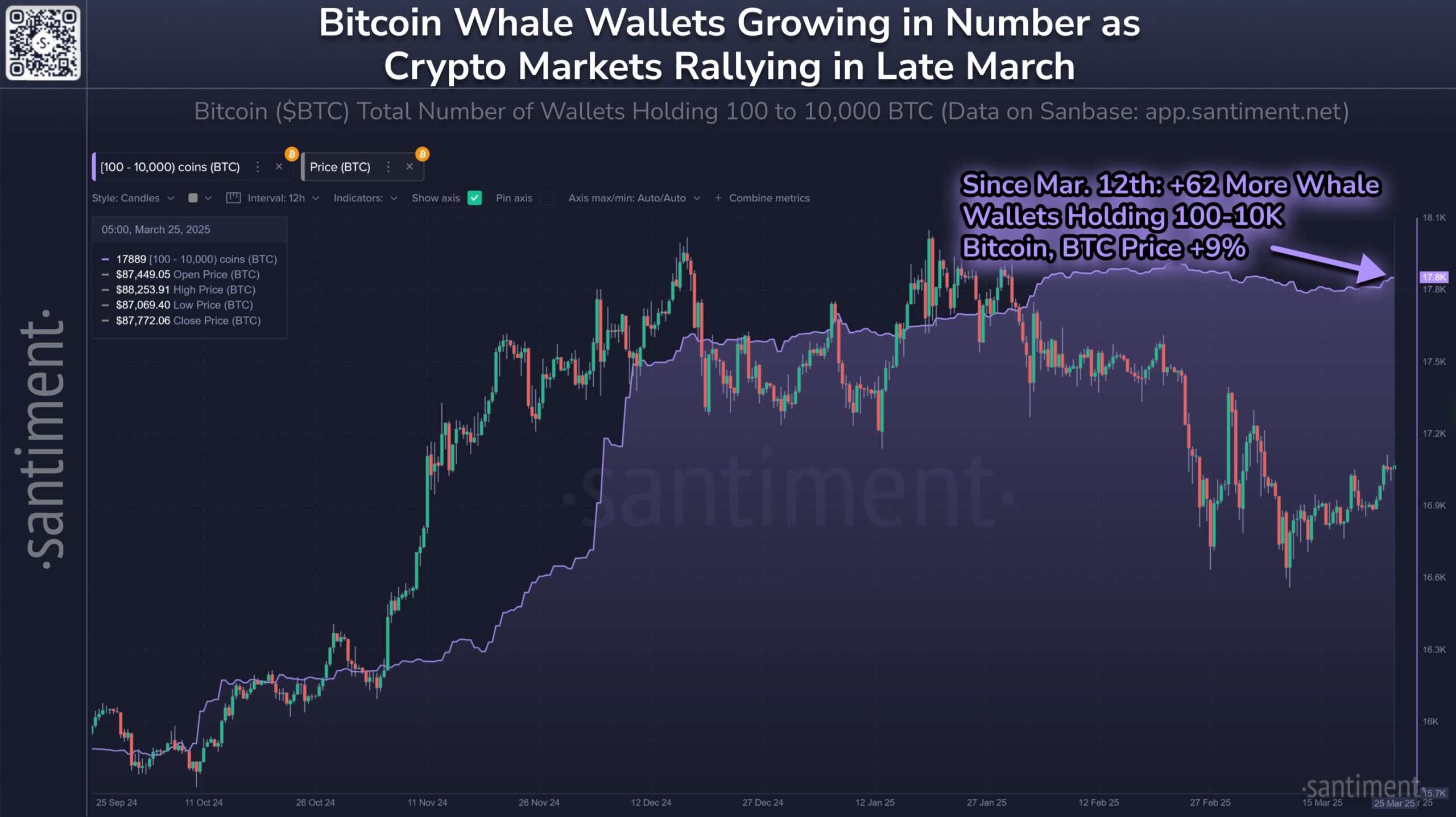

In the past two weeks, the price of Bitcoin  $96,782 has surged nearly 14%, climbing from $77,500 to $88,500. This significant increase has been accompanied by a remarkable rise in the number of addresses holding large amounts of BTC. According to data shared by the crypto analysis firm Santiment, the number of major addresses holding between 100 and 10,000 BTC has notably increased. On March 12, there were 16,600 such addresses, which rose to 17,889 by March 25. Experts consider that the increased Bitcoin acquisitions by these large addresses represent a positive signal for the market.

$96,782 has surged nearly 14%, climbing from $77,500 to $88,500. This significant increase has been accompanied by a remarkable rise in the number of addresses holding large amounts of BTC. According to data shared by the crypto analysis firm Santiment, the number of major addresses holding between 100 and 10,000 BTC has notably increased. On March 12, there were 16,600 such addresses, which rose to 17,889 by March 25. Experts consider that the increased Bitcoin acquisitions by these large addresses represent a positive signal for the market.

Large Addresses Accumulate BTC, Boosting Market Confidence

In the cryptocurrency market, movements by large addresses are seen as significant indicators by traders. Often referred to as “whales,” these large addresses can influence the market by holding substantial amounts of BTC. The recent increase indicates that major investors are starting to accumulate Bitcoin again.

Experts believe this accumulation is strengthening the positive atmosphere in the market. The renewed accumulation of BTC by whales may prompt other investors to take action, potentially supporting a broader rise in the market.

Data from Santiment clearly reveals the accumulation of Bitcoin by large addresses over the past two weeks. In fact, the concentrated purchases by whales are cited as a key factor supporting the rise in Bitcoin prices. Analysts suggest that the renewed activity among major investors might help stabilize Bitcoin prices amidst market fluctuations.

Will the Bitcoin Price Surge Continue?

After two weeks of positive price movements, investors are questioning whether the Bitcoin increase will persist. Some analysts believe that continued purchases by large addresses could sustain the price rise. Additionally, as market optimism grows, small and medium-sized investors may also increase their Bitcoin investments, leading to a stronger and more stable upward market trend.

However, some market analysts caution that Bitcoin prices might experience short-term corrections. Particularly after recent gains, profit-taking may create selling pressure, potentially causing temporary pullbacks. Nevertheless, the continued buying momentum from large addresses suggests that such pullbacks could be limited and short-lived.

Türkçe

Türkçe Español

Español