The price of Bitcoin (BTC)  $107,342 has climbed back above $70,000 after regaining the $67,000 mark. This increase has allowed many altcoins to achieve significant gains. The leading cryptocurrency had been stagnant below $70,000 for nearly 100 days. What happens next? What do evaluations suggest?

$107,342 has climbed back above $70,000 after regaining the $67,000 mark. This increase has allowed many altcoins to achieve significant gains. The leading cryptocurrency had been stagnant below $70,000 for nearly 100 days. What happens next? What do evaluations suggest?

Warnings for Cryptocurrency Traders

Kyledoops has issued a warning to investors following the recent surge. With strong demand in the ETF channel, optimism for the final quarter, and the upcoming US elections, the BTC price reached as high as $71,587. The resistance here lies at $71,500, and even higher consolidation levels favor the altcoins.

Kyle shared a graph depicting the market cap to open positions ratio, noting the following:

“The Marketcap/Open Interest (OI) ratio warns of increased risk influenced by turbulence from events like the FTX collapse (August 2023) and market maneuvers by Binance since August 2024. As platforms like Coinbase increase ETF risk, the likelihood of rising open positions on centralized exchanges intensifies. In this volatile environment, sharp risk management is crucial.”

Will Cryptocurrencies Rise?

Crypto Columbus highlights the dominance of stablecoins. Increased capital in stablecoins indicates a low risk appetite among investors. The ratio of stablecoins to total market cap is one of the key details to observe. A significant development occurs here as Bitcoin breaks its trend line while the USDT (Tether‘s market dominance) shows a declining trend.

If USDT.D is dropping, we should expect a rise among other cryptocurrencies. Analysts hope for success in this latest attempt for that reason.

Moustache commented:

“The moment you realize it’s just a game of patience, future rewards will come.”

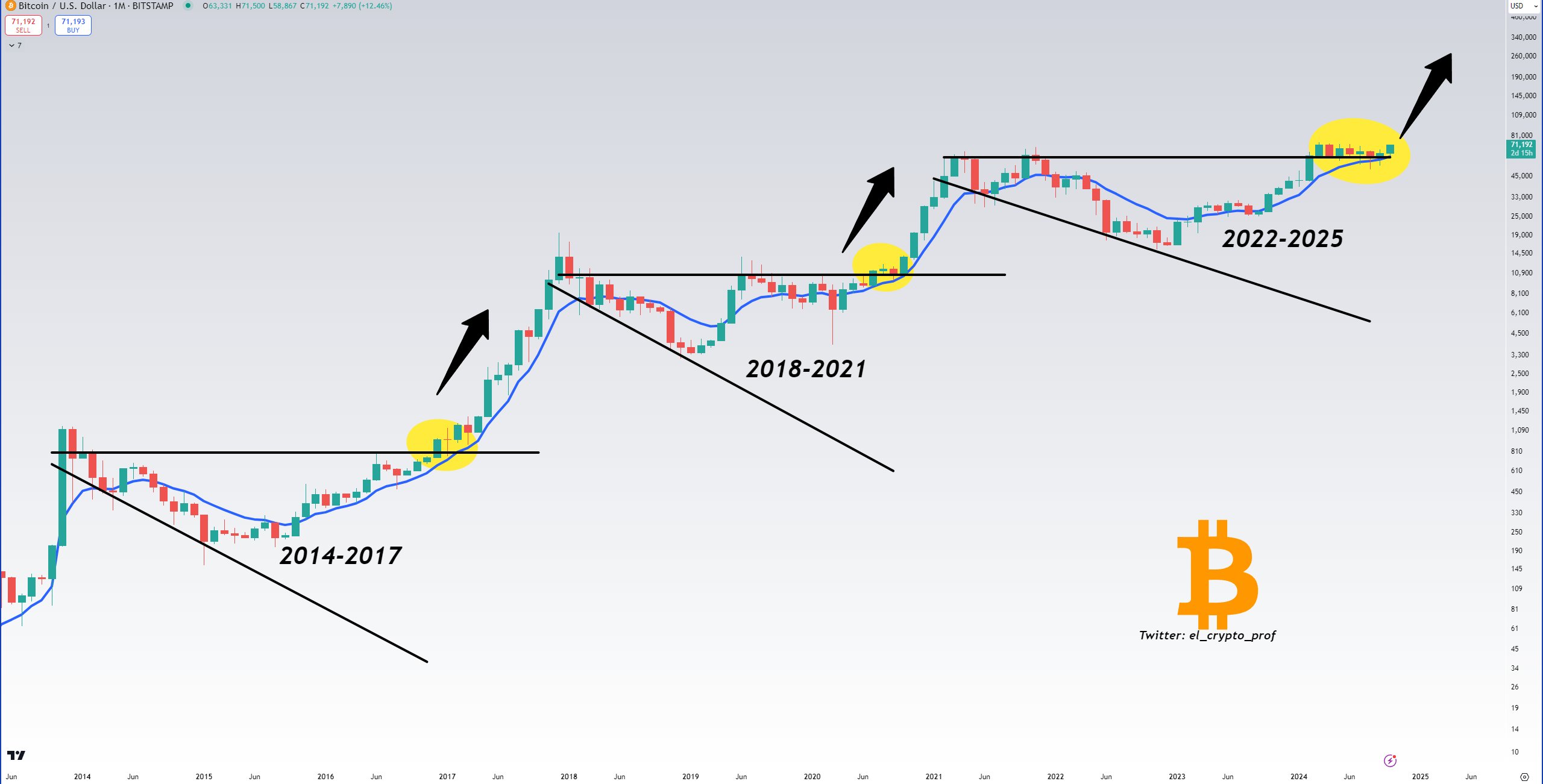

“I’ve shared this chart since BTC hit its low in 2022. It’s progressing similarly to previous cycles. The next and best phase of this cycle is beginning.”

Michael Poppe pointed out the low in the ETHBTC pair. As BTC rises, ETH has lagged, leading to new lows in BTC pairings.

“Ethereum  $2,447 reached 0.035 BTC. We fell during last week’s unemployment data. This is the most critical period of the year, and I believe it marks the lowest point. As interest rates fall, ETH rises. Altcoins are waking up.”

$2,447 reached 0.035 BTC. We fell during last week’s unemployment data. This is the most critical period of the year, and I believe it marks the lowest point. As interest rates fall, ETH rises. Altcoins are waking up.”

Türkçe

Türkçe Español

Español