Bitcoin (BTC)  $90,533 price reversed its earlier gains within hours yesterday, now exceeding $94,000 again. With just hours left in 2024, hopes for the new year remain high among traders. As of January 2, increased market volume and a potential recovery are anticipated with the end of the holiday season. What are the predictions from experts?

$90,533 price reversed its earlier gains within hours yesterday, now exceeding $94,000 again. With just hours left in 2024, hopes for the new year remain high among traders. As of January 2, increased market volume and a potential recovery are anticipated with the end of the holiday season. What are the predictions from experts?

Bitcoin (BTC) Year-End Analysis

BTC has been hovering around $94,000, while recent FUD regarding USDT has significantly shaken the markets. It seems that especially new investors have embraced this FUD. However, Tether’s reserves are exceptionally strong, and the decision to delist USDT for the EU is not likely to be a major concern for cryptocurrency traders. It is hoped that BTC’s rise correlates with the resolution of this FUD and can maintain its momentum.

Michael Poppe shared the following chart regarding the current situation:

“The thesis on Bitcoin remains the same. I expect a correction due to irrelevant USDT FUD. We might dive deeper, but considering the liquidity taken, the upward shift may have already begun.”

Comprehensive Cryptocurrency Analysis

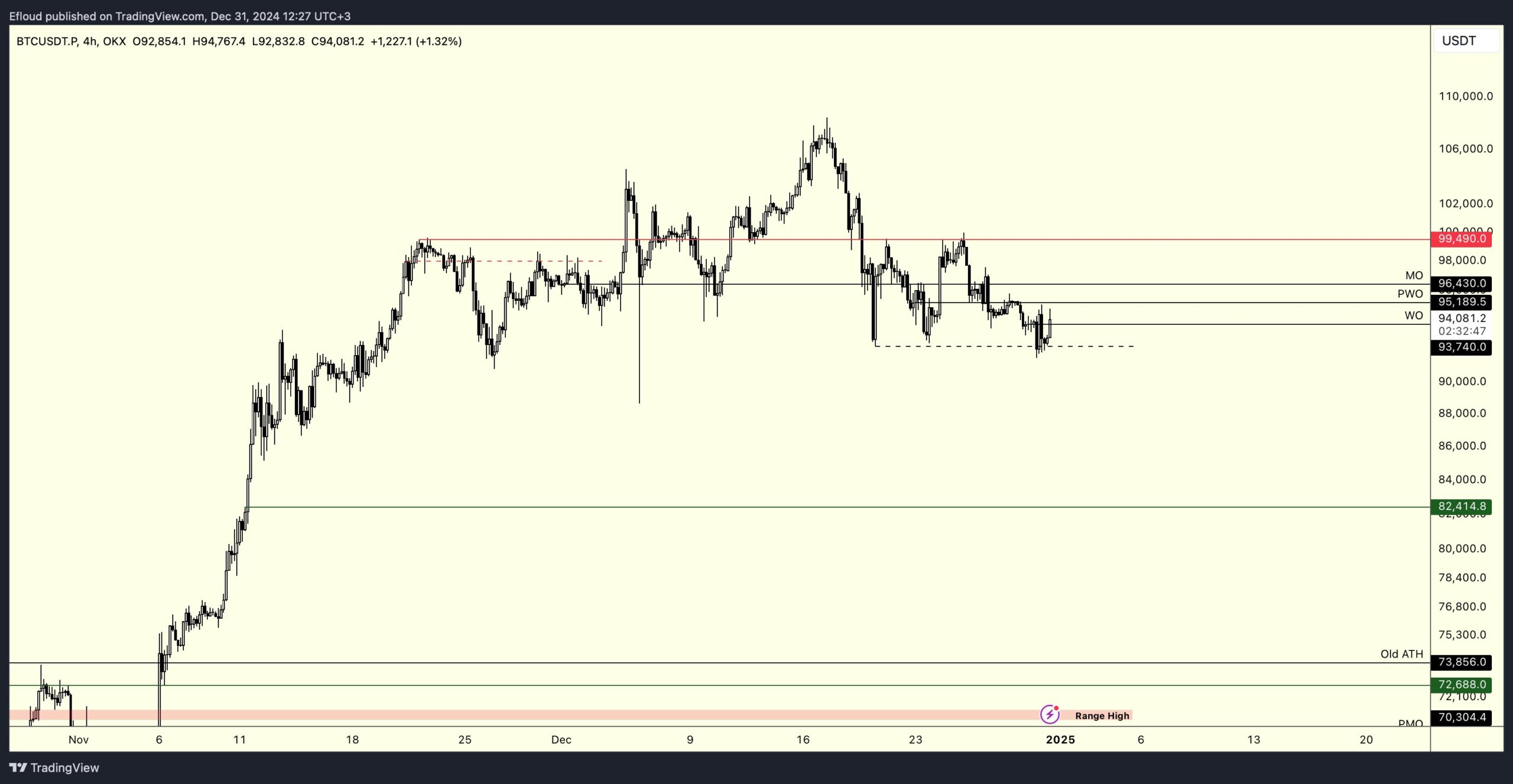

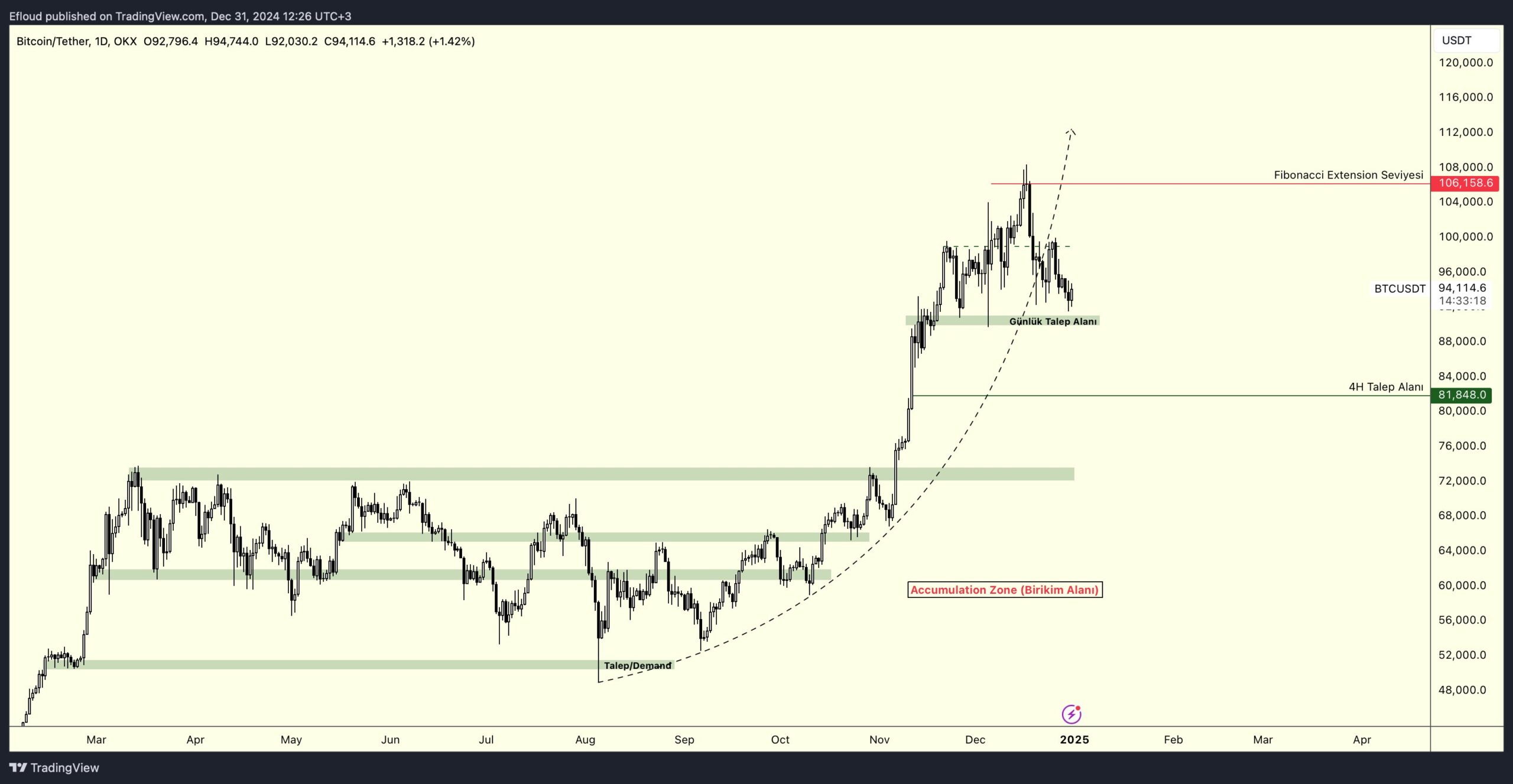

Popular Turkish cryptocurrency analyst Efloud has shared updates on both short-term and long-term outlooks. He provides essential insights for traders in his broad assessment at the year’s end.

“Higher Time Frame (HTF): The breakdown of the parabolic rise indicates signs of exhaustion, making profit realizations probable. The market continues to price this condition. Only by projecting new highs can profits be realized at peak levels.

The loss of the area labeled Daily Demand could lead to a realization of gains (deviation/manipulation), or I believe the market will strengthen again on the BTC side with bullish market structures in the 4H Demand zone.

Lower Time Frame (LTF): A short-term bounce occurs by clearing the equal lows at $92,000 outside HTF supports. However, this appearance alone does not convince me to purchase a product from here (excluding day trades), but the reaction from cleaning that liquidity area indicates that the price adheres to liquidity zones.

Thus, the idea of forming a short position for a brief hedge arises if the price gains and then loses the $99,500 level.”