Bitcoin (BTC) price suddenly surged and retested $28,000 after resilient US labor market data in September. According to the Bureau of Labor Statistics (BLS), payroll employment increased by 336,000 in September and the unemployment rate remained at 3.8%.

Impact of US Data on BTC

Positive employment data could lead to a hawkish stance by the FOMC at the next meeting in November. However, September Consumer Price Index (CPI) data, expected to be released on October 12, could provide clarity on the Fed’s interest rate decision in November.

In a recent analysis of BTC price movement, it accurately predicted an upward movement above $28,000 before a pullback towards $27,500 due to liquidity effects. BTC showed a tendency to retest price imbalances or liquidity areas. Buyers have used price volatility between $27,000 and $27,200 since October 2 to re-enter the market.

The recent rejection and the high level of $28,500 were the previous low level in early August. Above this level, there is another price volatility between $28,700 and $29,000, limiting the daily decline of the OB at $29,000 to $30,400.

Therefore, if Thursday’s CPI data favors the bulls, it is suggested that BTC may retest the specified resistance levels of $28,500, $29,000, or $29,500. Conversely, it is stated that bulls may defend price imbalances and the demand area between $27,000 and $27,200.

Any decline below the $27,000 level, especially if the September CPI favors sellers, could weaken BTC to $26,400 or the daily uptrend OB. In addition, the positive buying pressure, as indicated by the RSI, but the spot market demand has been volatile in the past few days, as indicated by the OBV.

On-Chain Metrics for BTC

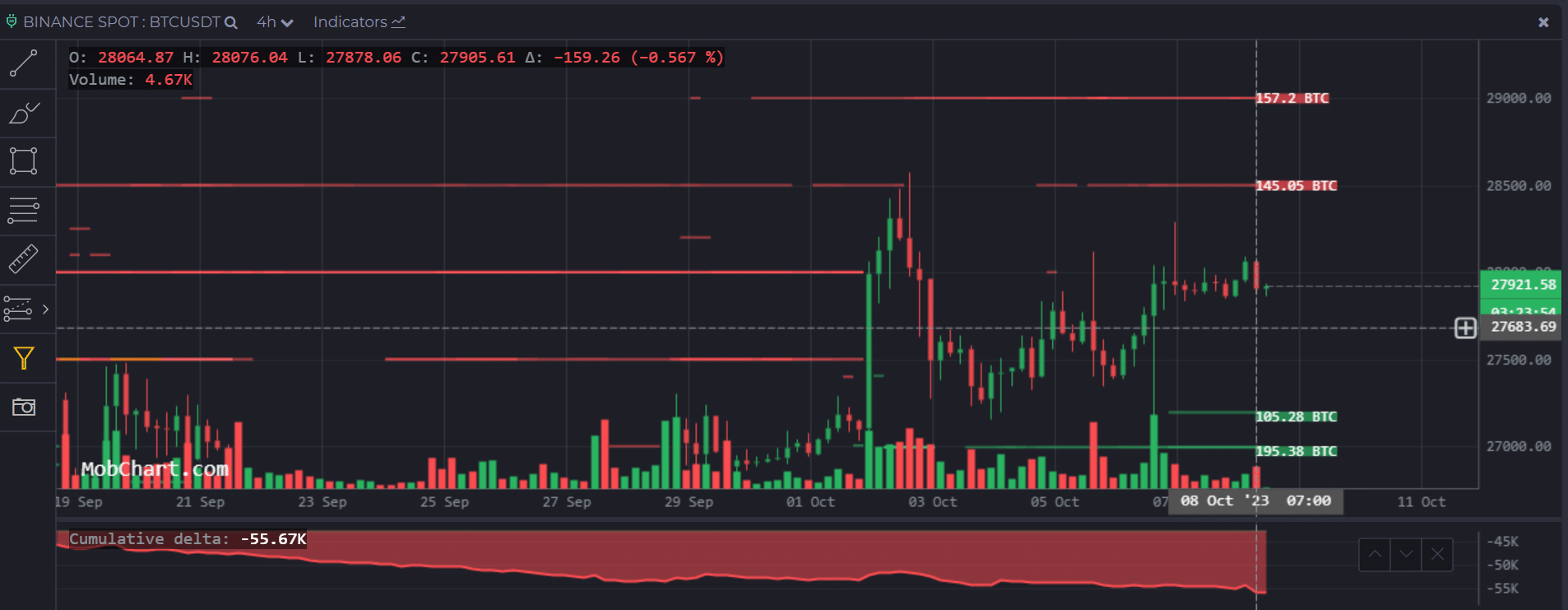

Furthermore, the CMF indicates that capital inflows into the BTC market have remained muted by staying below zero. According to order flow analysis obtained from MobChart data, BTC could see a price reaction at $28,500, $29,000, or $29,500. There were significant sell limit orders at the specified levels. On Binance Exchange alone, at the time of writing, 145 and 157 BTC were offered for sale at $28,500 and $29,000, respectively.

On the other hand, buy limit orders were at $27,200 and $27,000 levels. According to data from Coinglass’ Liquidation Map, the buy and sell limit order levels coincided with basic liquidity levels. Therefore, it is suggested that BTC price volatility could be between $27,000, $28,000, and $29,000 in the next few days.