Despite there being 35 days left until the halving, the Bitcoin price has surpassed $73,000 and is normalizing at this level. Just weeks ago, $60,000 was a challenging target and an exciting threshold, but now it has become the focus of price correction concerns. In the future, we will likely see headlines declaring “Bitcoin is dying” when its price drops to $70,000, which reflects the normalization of its price.

Bitcoin Halving and Miners

Bitcoin network security is maintained by miners, and the upcoming halving will reduce their rewards to 3.125 BTC per block. They are the ones who will be most directly affected by this event. Daniel Gray from Fidelity recently wrote in his assessment on this matter:

“Each mining hardware has its own profitability price point. Every operation will enter this event assuming they have enough reserves to withstand the halving’s negative pressure.”

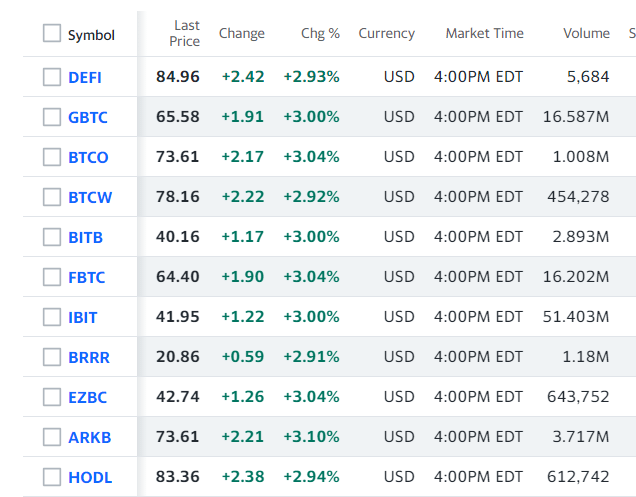

Last month, mining companies placed orders worth $1 billion, driving their BTC reserves to a three-year low, precisely for this reason. The most significant event that made this halving easier for miners was the rise in Bitcoin price supported by ETFs. They found an opportunity to sell at very profitable prices at the right time, filling their coffers with cash for operational expenses.

Moreover, with the rise in stock and crypto markets, the share prices of mining companies also experienced a massive increase. We can say that this also made their job easier.

Halving vs Spot Bitcoin ETF

Which is more important? If a comparison were made between the launch of spot Bitcoin ETFs in January and the halving of Bitcoin block rewards in April, which would be deemed more significant?

Nardini from B Riley Securities firmly believes that the approval of ETFs should come first. In terms of adoption, short-term price movement, and long-term potential, Spot Bitcoin ETFs have opened the door to an unprecedented process. The legitimization of Bitcoin by the US is an added bonus.

Moreover, when we combine the halving, supply scarcity, and Web3 narratives with ETFs, we see that the FOMO in this cycle is not limited to crypto exchanges. The rapid rise we are experiencing these days is fundamentally due to the first-time encounter with ETF-driven FOMO, and investors familiar with traditional finance are showing tendencies similar to gamblers (!) in the crypto markets. Furthermore, the potential of cash entering through ETF channels is much greater than that of crypto exchanges.

Türkçe

Türkçe Español

Español