As interest from investors rises, Bitcoin’s price is experiencing a renewed upward trend. In the last 24 hours, Bitcoin’s price has increased from $69,000 to $71,000, with market analysts indicating that this rise may be sustainable. Key factors driving this increase include improvements in technical indicators, a growing demand for spot Bitcoin  $91,967 ETFs, and macroeconomic influences, notably one week before the US elections. Analysts from Bitfinex noted expectations that Trump could emerge victorious, combined with historically positive market performance in the fourth quarter, suggesting that a strong upward phase for Bitcoin is imminent.

$91,967 ETFs, and macroeconomic influences, notably one week before the US elections. Analysts from Bitfinex noted expectations that Trump could emerge victorious, combined with historically positive market performance in the fourth quarter, suggesting that a strong upward phase for Bitcoin is imminent.

Bitcoin Options Market Sees $80,000 Expectations Rise

The positive outlook for Bitcoin is also evident in the options market. Investors are positioning for Bitcoin’s price to surpass $80,000 by the end of the year. According to Bitfinex analysts, particularly popular are the $80,000 call options expiring on December 27. However, as the election date approaches, implied volatility is increasing, indicating potential short-term fluctuations in price.

Bitfinex highlighted an increase in option premiums expiring during the US election week, anticipating that implied volatility could peak after November 5.

QCP Capital has also noted the rising volatility linked to the election week, with expected volatility rates surpassing 60%. The firm mentioned that while call demand has decreased as Bitcoin remains above $70,000, the open interest in perpetual contracts has reached its highest annual level, supporting the bullish outlook.

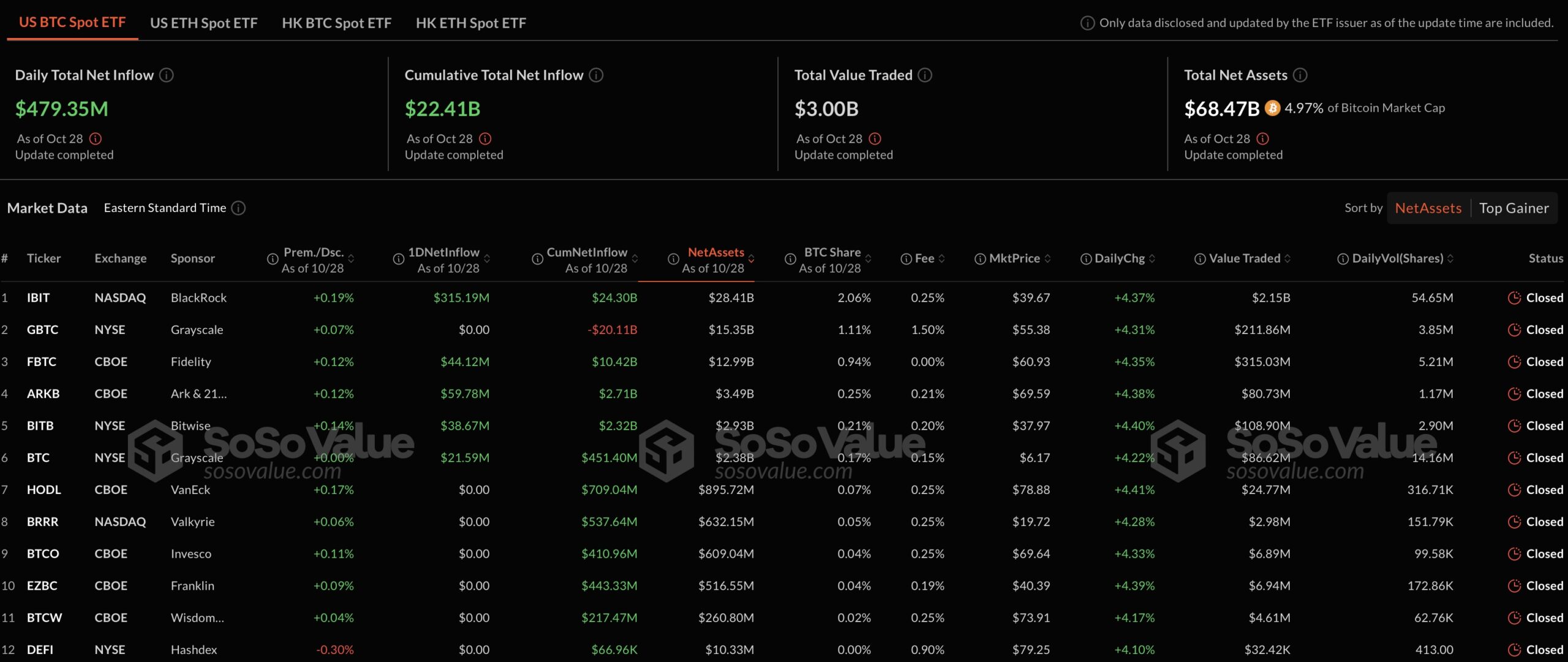

Record Net Inflows into Spot Bitcoin ETFs

Demand for spot Bitcoin ETFs continues to increase. On Monday, net inflows of $479 million were recorded in spot Bitcoin ETFs, marking the highest daily inflow in the past two weeks. A significant portion of this influx, amounting to $315 million, came from BlackRock’s IBIT ETF. Data indicates that this ETF has maintained an 11-day positive flow streak. Other substantial inflows included Ark and 21Shares’ ARKB and Fidelity’s FBTC, bringing the total trading volume to $3 billion.

Additionally, fundamental indicators for the Bitcoin network show a bullish trend. Mining difficulty has increased by 4%, and the next difficulty level is expected to rise by another 6%. Blockware Intelligence stated that this increase enhances network security, positively contributing to Bitcoin’s overall market health.