Analysts suggest that the dangerous period after the halving could end, and Bitcoin could rise further as Bitcoin’s price climbed above $65,000 on May 6. Bitcoin entered a three-week period after the halving, historically marked by downward volatility occurring below the accumulation range.

Prominent Figures Comment on Bitcoin

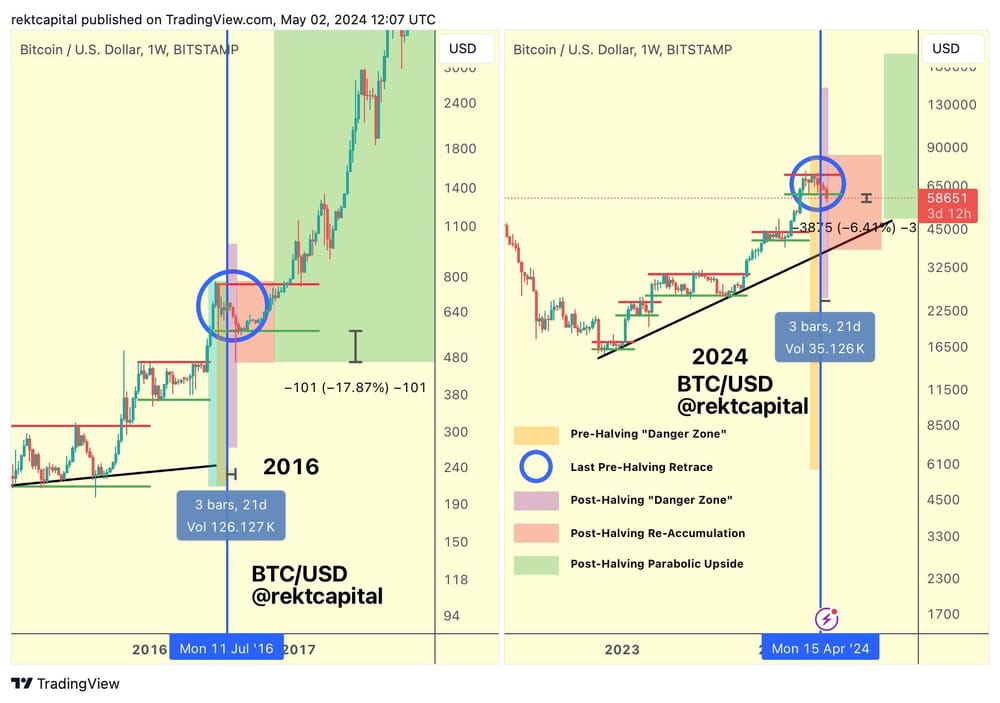

According to popular crypto analyst Rekt Capital, the end of the post-halving danger zone might have occurred as Bitcoin rose above the current re-accumulation range of about $60,000. The famous analyst wrote in a post dated May 6:

“In terms of time, the post-halving danger zone will continue for the rest of this week and will see its third final week post-halving, but the expected price impact has already occurred.”

Rekt Capital, in a post dated May 6, explained that during the 2016 bull cycle, Bitcoin produced an 11% downward wick 21 days after the halving event, marking the beginning of this price return:

“History repeated itself because in this cycle, Bitcoin produced a 6% downward wick below the relevant low range within 15 days after the halving event. Bitcoin has since risen strongly.”

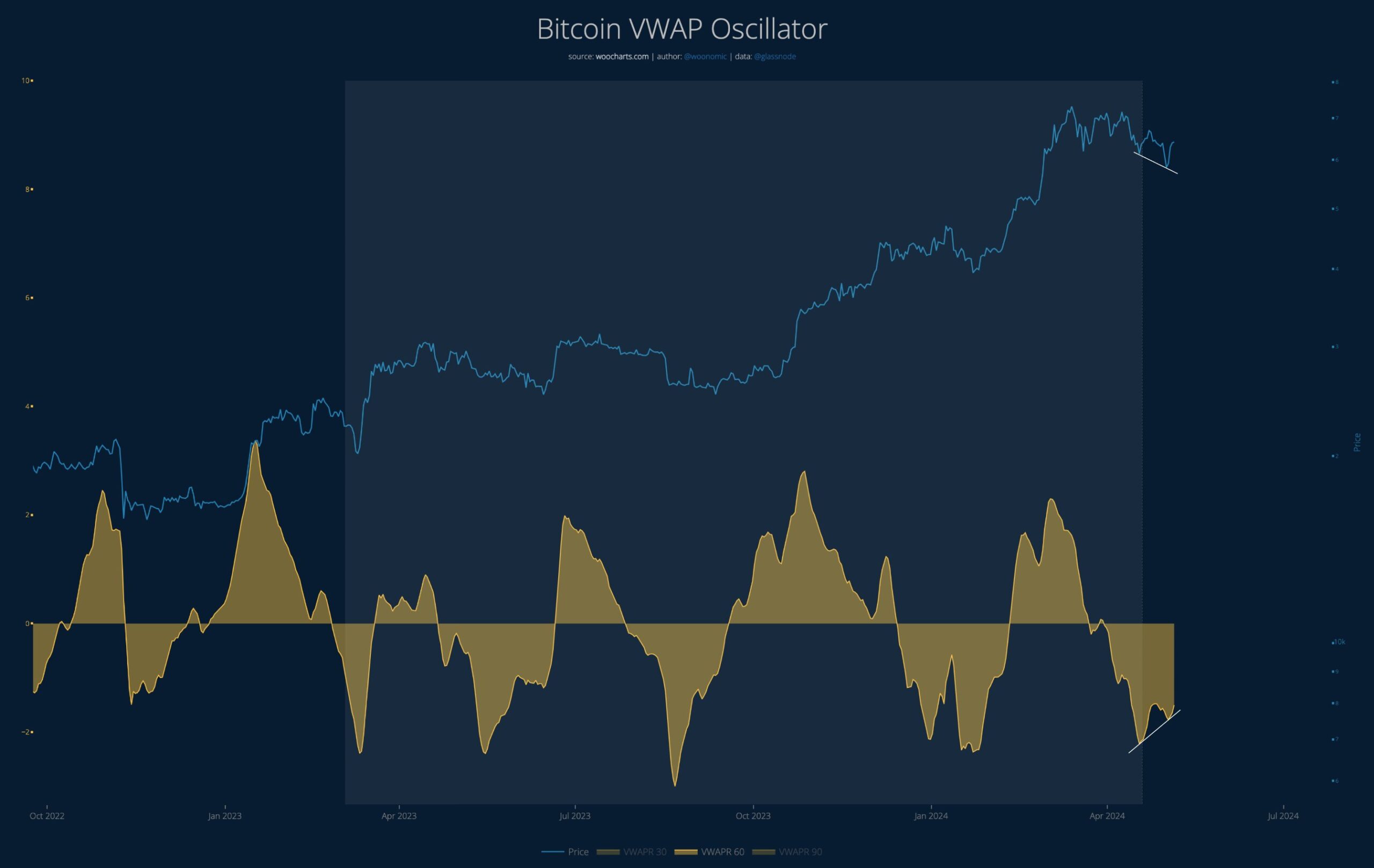

Meanwhile, Bitcoin analyst Willy Woo expects higher Bitcoin prices based on the Volume Weighted Average Price (VWAP), a popular oscillator used by investors to determine the average asset price based on price movement and volume. Woo wrote in a post shared on May 6:

“It looks like a good setup for Bitcoin to reach escape velocity. Plenty of room to run for the bull divergence.”

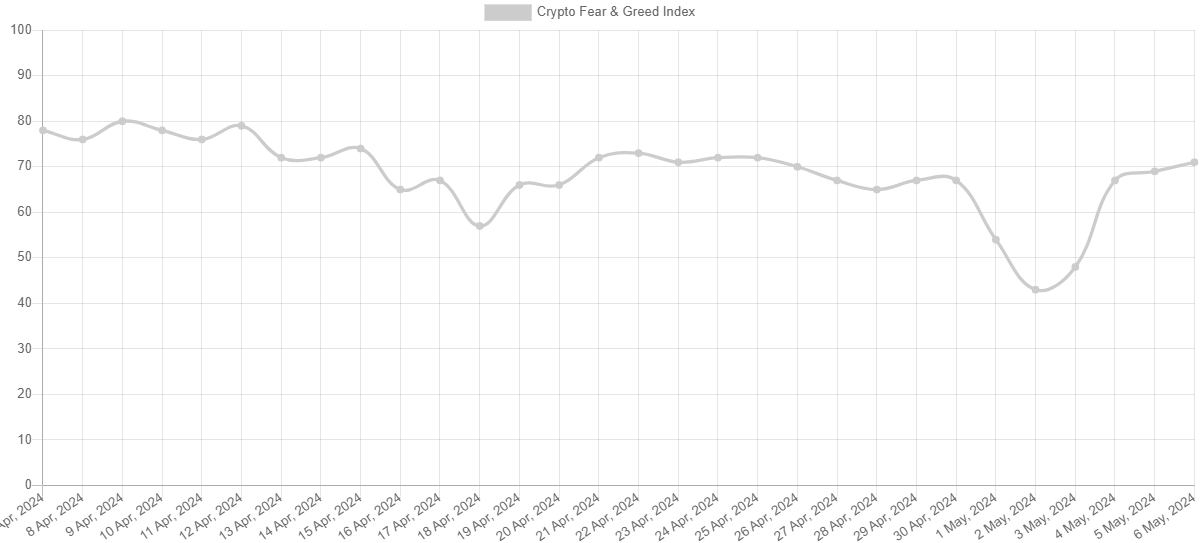

The Crypto Fear and Greed Index, further highlighting the change in investor sentiment, rose from 43/100 to 71/100 on May 2, indicating greed or fear.

Notable Data on the Bitcoin Front

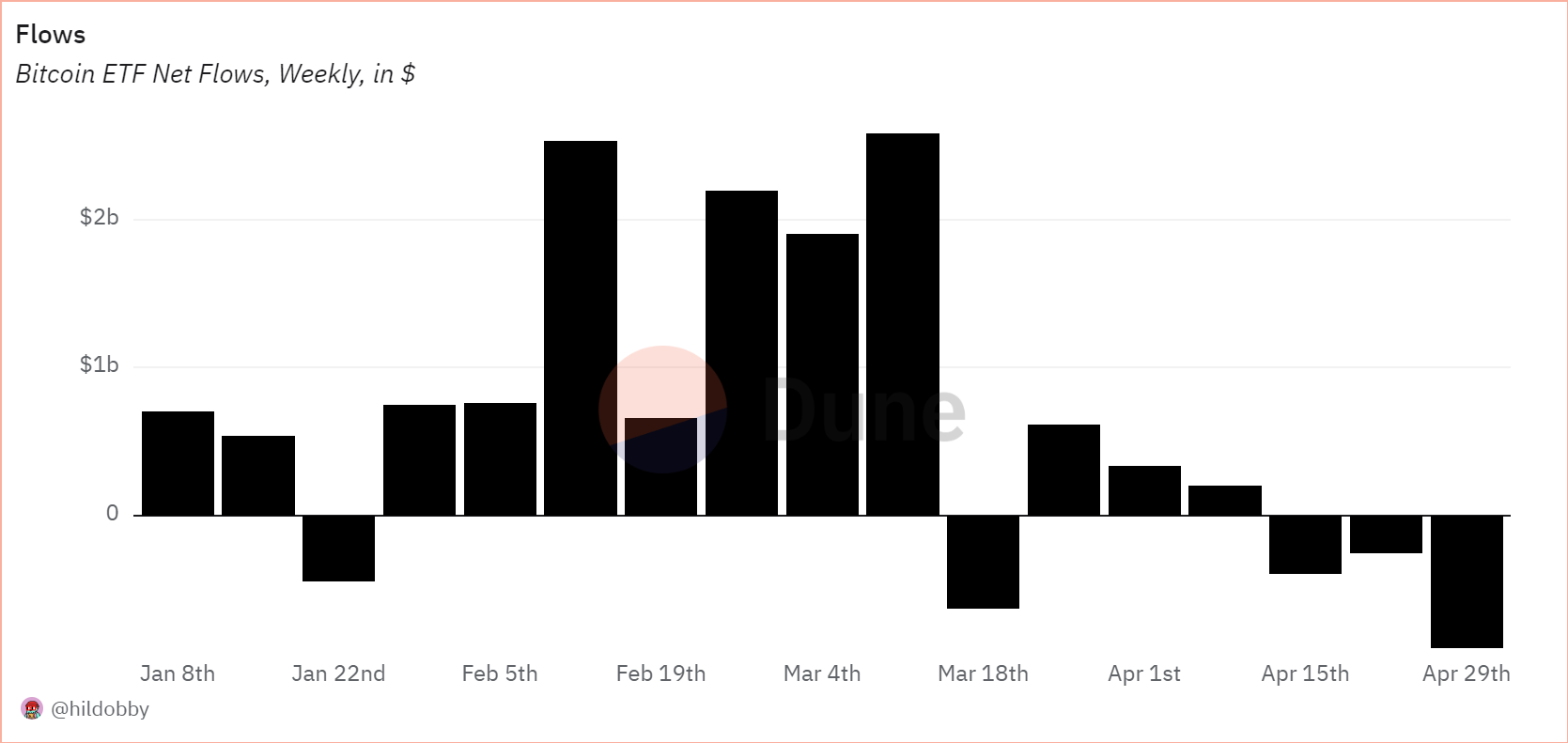

Exits from 11 spot Bitcoin exchange-traded funds in the US contributed to Bitcoin’s correction. According to Dune data, US ETF funds recorded the highest weekly exit since launch last week, with approximately $900 million in net cumulative exits.

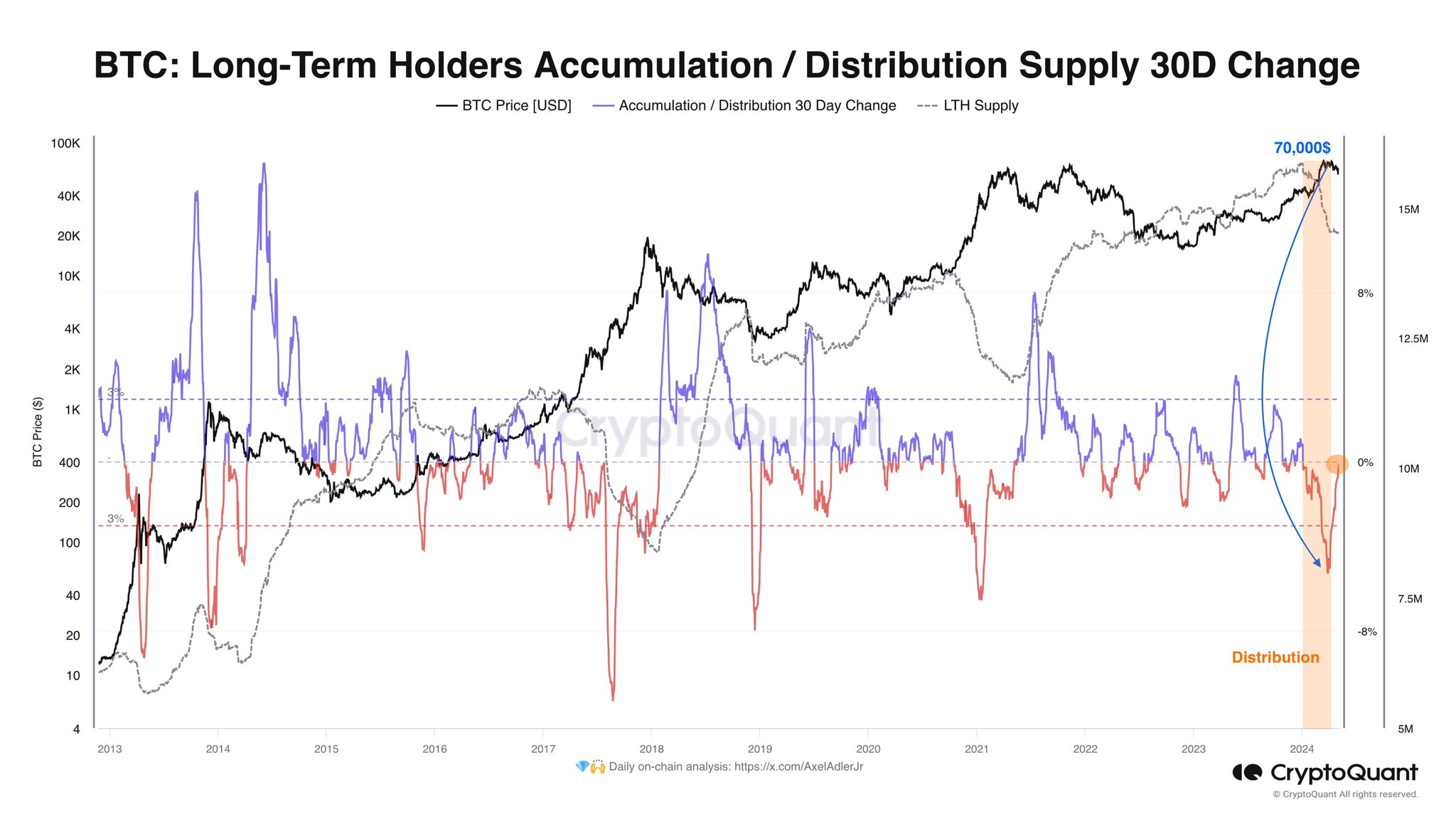

Interestingly, data shows that long-term holders (LTH) at $70,000 finished selling to new investors, possibly signaling the start of a new active accumulation phase, according to CryptoQuant author Axel Adler Jr’s post on May 6.