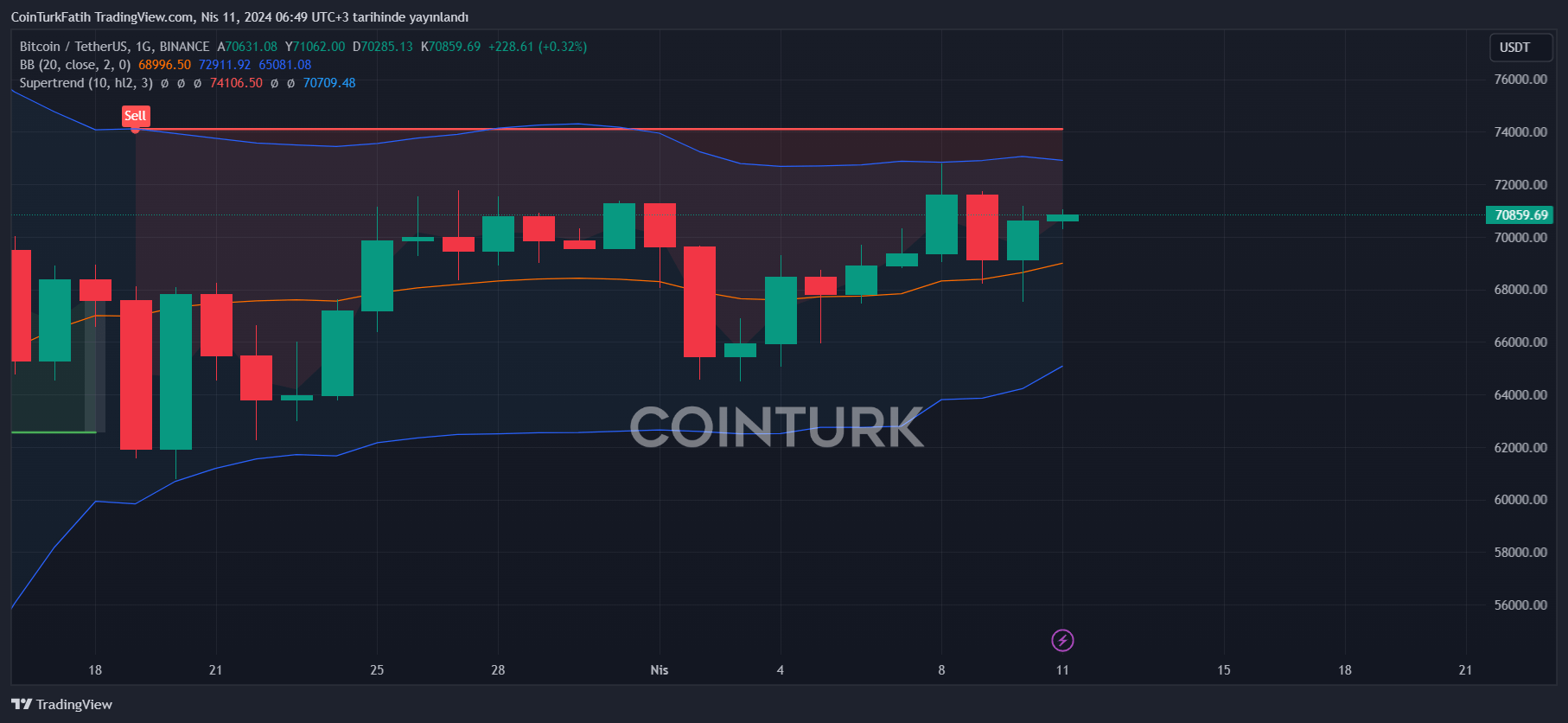

Bitcoin price at the time of preparation is once again above $70,000, finding buyers at $70,874. So, what’s the current situation? Yesterday, U.S. inflation data arrived, and as feared, it was again unfavorable. This led to a sharp drop towards $67,518. However, confident investors in the trend triggered a recovery in price from the dip.

Bitcoin (BTC)

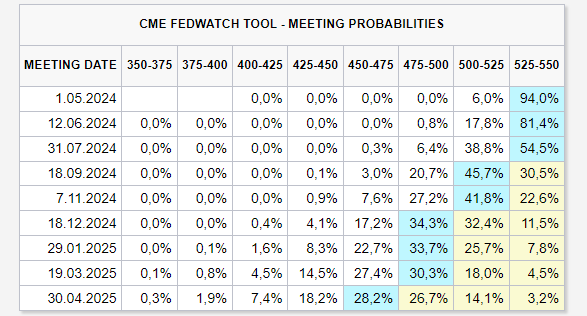

The Fed should now adopt a more hawkish stance, and if there is no significant drop in inflation, expectations for a rate cut in June should be scaled back. The excessive froth among investors expecting a 150bp rate cut in 2024 has been significantly reduced. Following the latest inflation data, according to FedWatch data, the earliest cut is now expected on September 18.

The annual rate cut expectation has now retreated to the 50-75 basis point range, yet Bitcoin‘s strong stance is interesting. This suggests we are moving towards a “new normal” where 2-year bonds, gold, inflation, and Bitcoin prices can rise together. As global economic confidence weakens, unusual things are happening in risk markets.

For Bitcoin, the key area is $71,700, and unless this region is solidified as support, it’s difficult to discuss a target of $80,000. For now, volatility is strong, and the rise continues with little time left until the halving.

Cryptocurrency Commentary

Halving will occur in 8-9 days, and we can say that this event keeps the markets lively. BNB continues the day with a 6% increase at $615. The popular altcoin, which tested $645 but turned back from the rally with the BTC drop, could this time push the ATH level above $700. Many cryptocurrencies maintain key support levels and target resistances.

Popular altcoins like SOL and AVAX are still below their breakout levels. This indicates that investors who see the risks brought by these highly volatile altcoins in case of a sentiment shift are cautious. Aside from halving optimism, the macroeconomic pressure mentioned in the first part is expected to increase, which could justify investors’ concerns.

Among the top 100 cryptocurrencies, NEO, JASMY, TON, and ORDI continue the day with a 10% increase. Their weekly gains are over 20%. NEO and TON have seen an increase of more than 50% in the last 7 days.

Türkçe

Türkçe Español

Español