With the news of a drop in US inflation rates, Bitcoin (BTC) price made a significant leap. Following the announcement of the Consumer Price Index (CPI) data, Bitcoin rose from $62,000 to over $66,000 in just a few hours. The momentum of BTC’s price remains stable as it is currently trading at $65,949.63, a 7% increase from yesterday.

Impact of Bitcoin ETFs on the Rise

The Bitcoin Spot ETF played a significant role in the mentioned rise. The popularity of Bitcoin ETFs remains in the market, and this situation may continue as long as the approval of the Ethereum ETF is heading towards rejection. A crypto analyst noted that among these ETF options, Blackrock IBIT emerged as the most preferred by investors, with 414 owners reporting in the first 13F season of the fund. This figure surpasses all previous Bitcoin ETFs such as Bitwise’s BITB, Fidelity’s FBTC, etc.

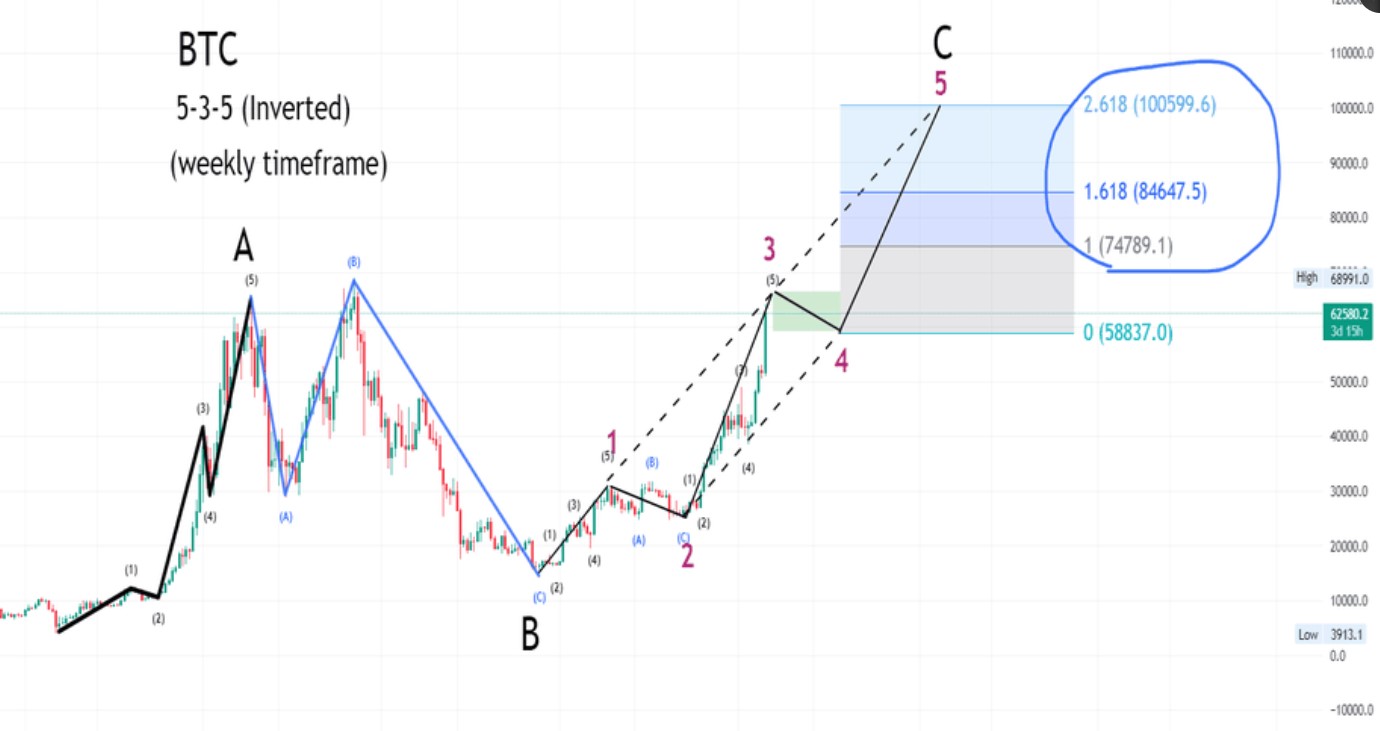

Singapore-based QCP Capital predicted that the Bitcoin price increase would continue until it targets $72,000 and above. This prediction came after analyzing the current technical factors supporting US inflation rates and Bitcoin’s rise. According to technical indicators, Bitcoin is in a strong buying zone, as MACD and moving averages fully show the buying pressure on cryptocurrency. Crypto analysts also emphasized the same situation, with Dr. Crypto Ninja highlighting the possibility of Bitcoin reaching $74,000, $84,000, and $100,000. Additionally, the ongoing support of the Bitcoin Support ETF aids Bitcoin’s rise.

Current Status of BTC ETFs

Recently, the State of Wisconsin invested $99 million in the BlackRock ETF, making it the most popular Bitcoin ETF at that time. Additionally, Hedge Fund Millennium Management disclosed assets worth $1.94 billion in five renowned Bitcoin ETF products. QCP Capital also highlighted the participation of asset managers like Millennium and Schonfeld, each allocating 3% and 2% of their tokens under AUM to the Bitcoin Spot ETF. Over time, this participation may increase further and support Bitcoin’s price in a rise.

Moreover, despite the launch of new tokens, Bitcoin’s popularity does not wane. Additionally, El Salvador Holding has also surged in the current market. The country currently holds 5,751 BTC worth more than $379 million. With such a support system backing Bitcoin, it may succeed in rising to $72,000 in the coming days. The current Bitcoin price rise has driven the cryptocurrency market from a neutral zone to greed. With today’s development and the increasing demand for Bitcoin spot ETFs in the market, Bitcoin now targets $72,000 by the end of the month.