In recent days, the fluctuations in Bitcoin prices during the Asian trading session have been closely linked to the flows of exchange-traded funds (ETFs) in the United States. According to Bloomberg, automated trading algorithms that operate based on US ETF flow data are causing significant fluctuations in Bitcoin prices during Asian trading hours.

Sharp Decline in Bitcoin Yesterday

The sharp decline observed in the Asian trading hours on Tuesday morning coincided with the release of US ETF flow data and pointed to the worst drop in Bitcoin in the last month. Shiliang Tang, President of Arbelos Markets, emphasized the impact of algorithmic trading behind these market movements.

According to Tang, from an algorithmic trading perspective, bots can essentially scrape this data automatically and trade based on it. It seems that this is fundamentally what is happening.

Since the launch of several Bitcoin ETFs in the US on January 11, a net investment of $12 billion has been withdrawn. These ETFs, especially in the first half of March, saw an increase in inflows and drove Bitcoin to a record level of $73,777. However, following these investments, Bitcoin faced volatile inflows and outflows in the sector, experiencing a drop of up to 17.6%.

Flow Model Affects Asian Market Returns

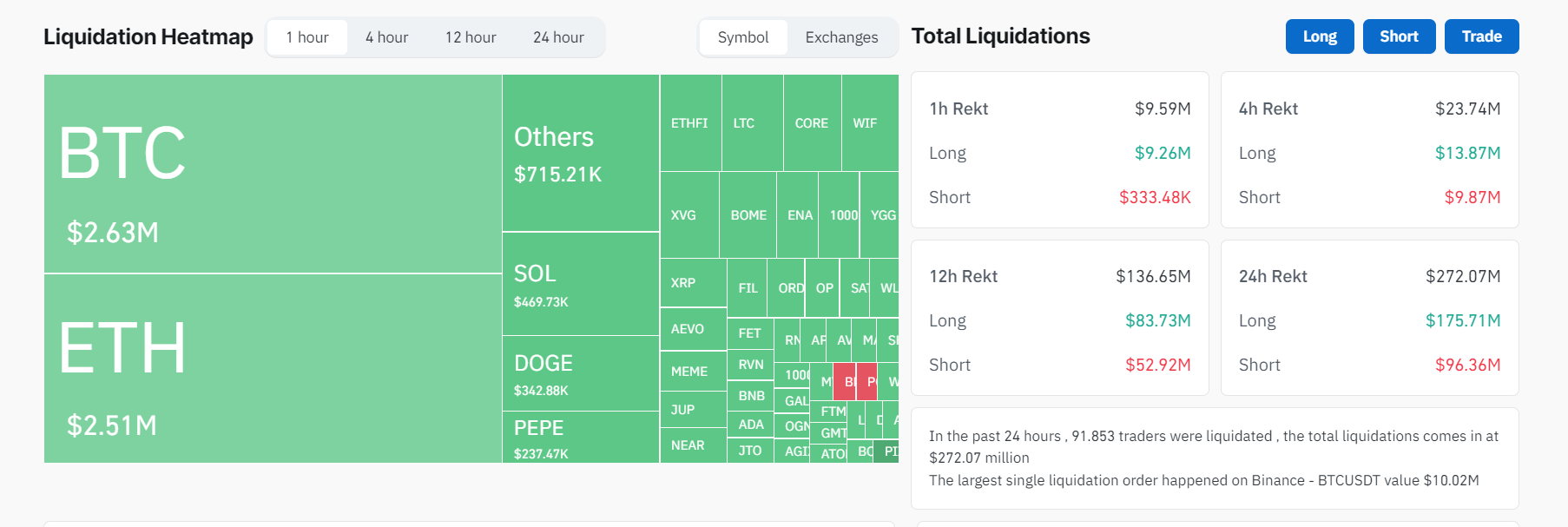

This flow model has significantly affected the returns of the Asian market. The market, which showed strong performance at the beginning of February and March, lost this performance in the following days. The influence of algorithmic protocols on the Bitcoin price affects not only the spot market but also the derivative markets, and according to Coinglass data, about $272 million in crypto positions were liquidated in the last 24 hours.

Charlie Morris, Chief Investment Officer at ByteTree Asset Management, pointed out the importance of ETF flows for Bitcoin compared to gold. According to Morris, with 5.5% of Bitcoin held in ETFs, compared to 1% for gold, this shows that ETF flows are becoming a more critical factor for Bitcoin’s market movements.

Market participants are emphasizing the market’s sensitivity to ETF flow data and suggest that the recent correction is a natural pause for the market to “catch its breath” amid widespread excitement. Names like Jakob Kronbichler, co-founder of Clearpool Finance, believe these fluctuations are part of a normal process and that the market will continue to progress healthily.

Unusual Performance of Spot ETFs

Yesterday, the crypto markets experienced unusual volatility. In particular, spot Bitcoin ETFs recorded a total inflow of $40.3 million, with contributions from major players like Blackrock amounting to $150.5 million. However, this momentum was not the same for some companies like ARK.

For example, ARK faced an outflow of $87.9 million despite an inflow of $200 million the previous week. Grayscale’s GBTC also encountered modest outflows of $81.9 million. Renowned market analysts like WhalePanda comment on the issue:

“Perhaps this is to close the first quarter profitably? However, this is still speculation. Mondays always seem to witness the most outflows, and I wonder if the end of the first quarter has anything to do with it. Additionally, the price drop following the US government’s transfer/sale of some of the Bitcoins obtained from Silk Road is noteworthy. Selling now seems more sensible than at levels of 100 or 200 thousand dollars. Let’s not forget, there are only 17 days left until the halving.”

Türkçe

Türkçe Español

Español