Bitcoin price continues to linger at frustrating levels while altcoins have retreated to significant support levels. Since the second half of March, things in the crypto market have not been going well. BTC, now finding buyers at $61,000, has diverted altcoins aiming for new all-time highs. What are the popular analyst’s predictions for Bitcoin?

Bitcoin (BTC)

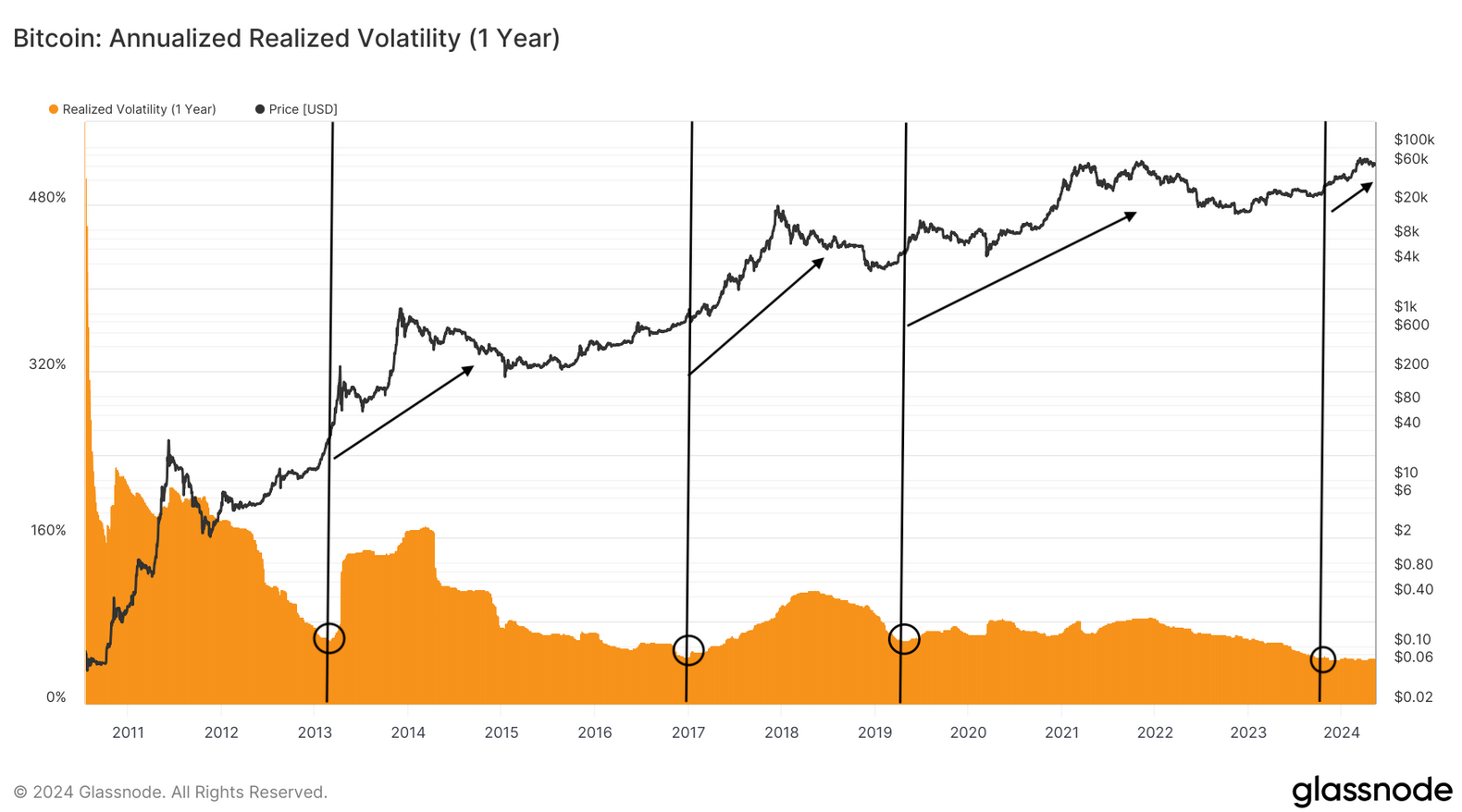

Bitcoin price has started a new period of low volatility. We have experienced similar frustrating periods before. The shallow, boring movements seen before major rises again bring to mind the possibility of a similar turnaround. Bitcoin’s 1-year volatility was around 43% in December 2023. Since then, spot Bitcoin ETFs have been approved in the United States.

After an influx of $12.6 billion, ETFs attracted entries around the $13 billion mark, but now have retreated to $11.68 billion. Robert Mitchnick, head of digital assets at BlackRock, which manages over $10 trillion in assets, is not worried about the current situation.

He even believes that significant inflows will be seen in the coming period through government sovereign funds, pension funds, and foundations. So far, BlackRock’s predictions have proven correct, and the world’s largest asset manager making such a prediction is significant. If we see more major players entering the game as expected, we might long for these days.

Scott and Bitcoin (BTC) Price Prediction

Institutional investors need to see at least six months of performance before showing more interest in spot Bitcoin ETFs. We have been sharing warnings and evaluations even on the busiest days for months. Liquidity, price deviation, demand, and other details turning into bi-quarterly reports will help investment firms make decisions about these ETFs. The period of June and July is important in this regard.

The conditions to fully realize the potential demand for ETFs in the USA and other countries have not yet formed. Many investment firms and advisors have not been able to categorize BTC ETFs as investable, risky, or not investable due to not seeing their six-month performance.

On the other hand, crypto market analyst Scott Melker says;

“It’s very important to remember that this takes time; these companies are just starting to assess the situation. A great institutional money flood will elevate Bitcoin to all-time high levels.”

The analyst targets a Bitcoin price reaching between $100,000 and $150,000 with ETF entries.

Türkçe

Türkçe Español

Español