The price of Bitcoin  $103,527 is moving downward after a rapid increase. As of the time of writing, the price had fallen to $67,670. Bitcoin is likely to continue weakening in the shadow of the upcoming election, having gradually lost key support levels. Profit-taking has reached significant levels, and altcoins are experiencing losses exceeding 5%.

$103,527 is moving downward after a rapid increase. As of the time of writing, the price had fallen to $67,670. Bitcoin is likely to continue weakening in the shadow of the upcoming election, having gradually lost key support levels. Profit-taking has reached significant levels, and altcoins are experiencing losses exceeding 5%.

Bitcoin Dips

With the announcement of a new U.S. President expected on Tuesday, traders are starting to reduce risk across cryptocurrencies. Bitcoin, which had surged above $73,000, witnessed over $2 billion in short-term investor sales on Thursday. This reflects expectations that larger peaks may not be achieved. As Trump’s winning odds on crypto prediction platforms decline, Bitcoin’s downtrend continues.

ETF inflows likely triggered fluctuations concerning Trump’s potential victory. The issue here is that, as the election date approaches, the likelihood of him winning also appears to diminish.

Moustache noted in a recent assessment that testing between $64,000 and $66,000 for Bitcoin could be reasonable. He believes the next few days will be decisive.

U.S. Government Spending and Bitcoin

Rising debt could lead cryptocurrencies to regain prominence. However, Buffet has created a historic cash reserve and is preparing for a recession. He believes that cash will be more beneficial in the economy going forward, which is not favorable for cryptocurrencies.

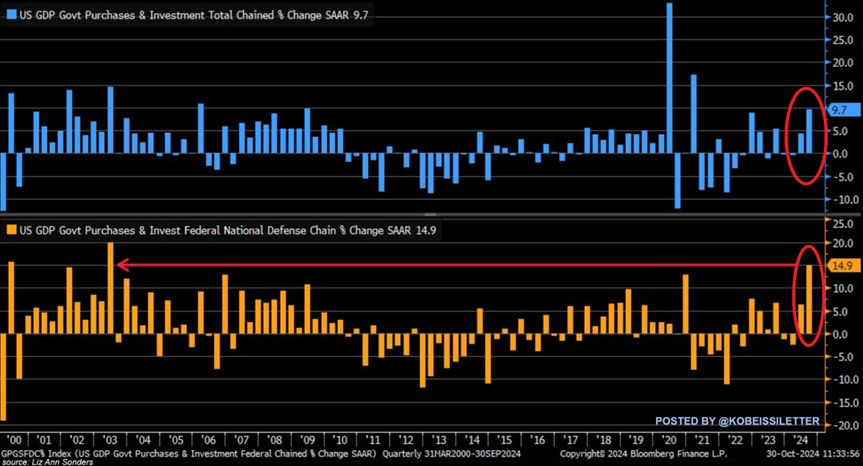

The Kobeissi Letter today emphasized public spending, using the term “crisis.” Federal government spending increased by 9.7% in the third quarter of 2024 compared to the previous quarter, marking the largest jump since the first quarter of 2021.

Türkçe

Türkçe Español

Español