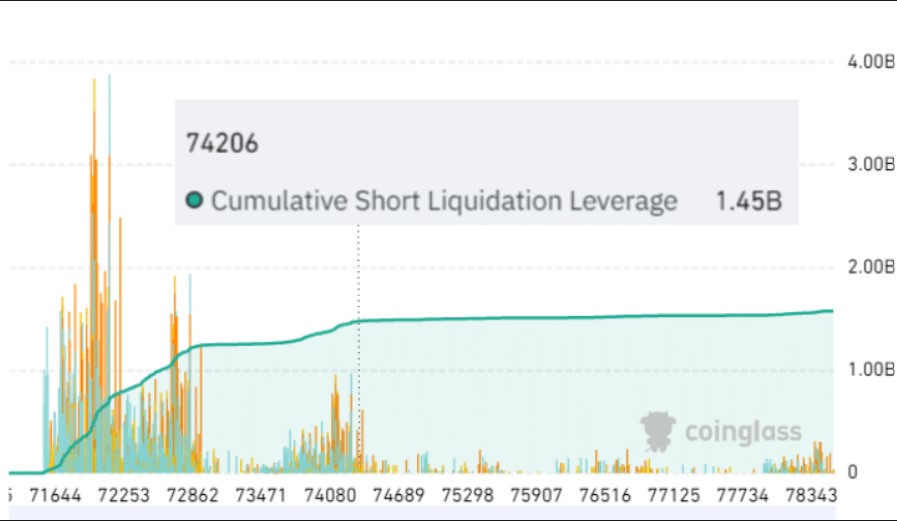

In recent weeks, the cryptocurrency market experienced a significant correction and witnessed a sudden increase in global crypto market capitalization. This upward movement coincided with data from the Bitcoin Liquidation Heatmap, indicating a substantial short-selling potential of $1.45 billion when BTC reached the critical threshold of $74,300.

Bitcoin’s Upward Momentum

Currently, Bitcoin’s (BTC) price stands at $70,931.32, with a 24-hour trading volume of $43.7 billion. Bitcoin increased by 5.89% in the last 24 hours. This sharp rise created market tension by predicting potential liquidations and price movements. Despite the $1.45 billion short-selling threat at the $74,300 level, BTC recently broke its range and grew in the last hours amid stable inflows exceeding $237 million. The sudden Bitcoin price increase resulted in significant liquidations of short positions, generating over $345 million in crypto derivatives transactions.

This significant turnover shows that Bitcoin bulls currently hold control and increase the likelihood of reaching an all-time high. The Relative Strength Index (RSI) surpassed the 50 threshold, reaching 68.90, potentially signaling a shift to upward momentum. Consequently, breaking the $70,000 level paved the way for a rise towards and potentially beyond the previous all-time high (ATH).

Current BTC Data

Following the last bearish candle on May 19, Bitcoin saw a massive daily candle rising 6% to $70,920.36, balancing the upward trend. Open positions on Bitcoin increased by 5.47% in the last 24 hours, reaching $18.7 billion. RSI continues its rise at 68.90.

The leading cryptocurrency Bitcoin’s market value stands at $1.3 trillion. Considering current market dynamics and bullish indicators, analysts predict that Bitcoin may continue its upward trend and face significant liquidations if it reaches the $74,300 level. This level is a critical threshold as it could trigger a substantial short squeeze, pushing the price even higher.

Türkçe

Türkçe Español

Español