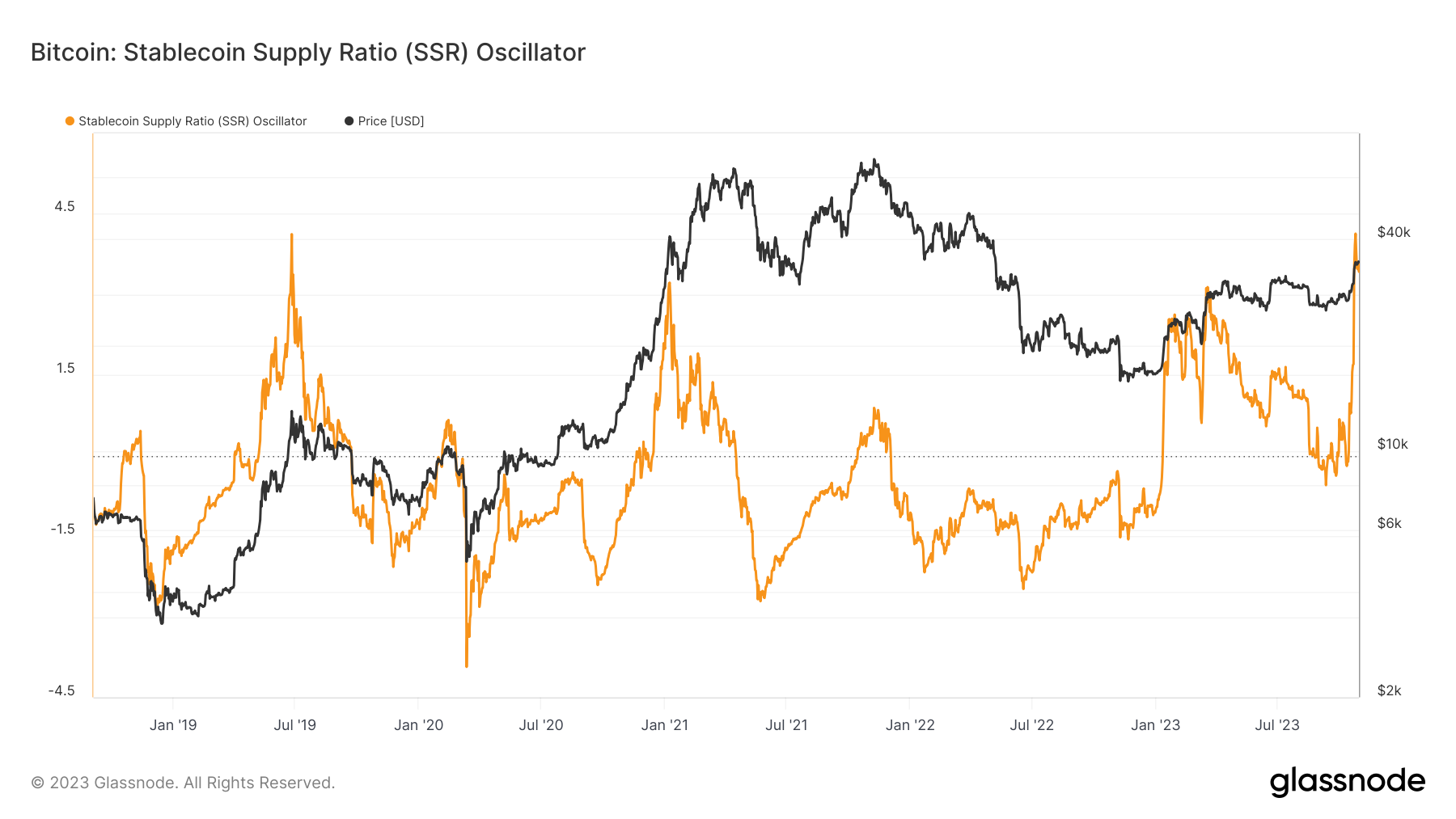

<a href="https://en.coin-turk.com/crypto-market-tumbles-bitcoin-btc-records-over-2-loss-major-metrics-to-consider/”>Bitcoin has reached its highest level in 17 months with recent developments. The approval of a spot Bitcoin exchange-traded fund (ETF) in the coming months and the countdown of just 164 days until the next Bitcoin halving event are generating anticipation. Despite the new bull cycle indicated by the Stablecoin Supply Ratio (SSRO) data, which shows a 106.38% gain since the beginning of the year, it is worth noting the increase in stablecoin dominance.

New Record in the Bitcoin Arena

According to data from the blockchain data analytics platform Glassnode, the Stablecoin Supply Ratio (SSRO), which is an important measure of stablecoins’ dominance over Bitcoin, reached an all-time high of 4.13 on October 25th. Such an increase indicates significant appetite for Bitcoin accumulation.

However, this situation also shows that the purchasing power of stablecoins is at an all-time low. Historically, this deviation in the SSRO, which reached 4.12 on June 26th, 320 days before the May 2020 halving event, is the highest since 2019. Therefore, the appearance of the same upper signal in the SSRO this week may indicate a period of retreat before the next halving event, which will take place in April 2024. Despite the current weak buying power, the alignment of high SSRO levels with the beginning of larger bull market cycles is remarkable.

Eyes on Possible Spot ETF Approval

The potential approval of a spot Bitcoin ETF has encouraged market participants and raised the possibility of the current Bitcoin rally being different from the one in 2019. One metric, the Reserve Risk (RR) indicator, measures market sensitivity and the risk-reward incentives concerning the “HODL bank” and the spot Bitcoin price. Glassnode explains this indicator as follows:

“When confidence is high and the price is low, there is an attractive risk/reward for investment (Low Reserve Risk). When confidence is low and the price is high, then the risk/reward is not attractive (High Reserve Risk).”

When the SSRO reached similar high levels in June 2019, the RR data followed this metric and rose above the green band as shown in the graph above.