On March 13, Bitcoin (BTC) reached a new all-time high of $73,777, only to experience sell-offs shortly after. In the last 24 hours, the price fell to $66,500, with significant losses across many altcoins. Were there early signs of this decline, and what should investors expect now?

Bitcoin (BTC)

Although Bitcoin‘s price lost the 50-day EMA, the situation isn’t as dire as feared. The price did drop below $65,000 yesterday but has since recovered to over $67,000. The critical support level that could trigger extreme sell-offs if lost is at $63,724. Buyers are strongly supporting the price increase and limiting losses.

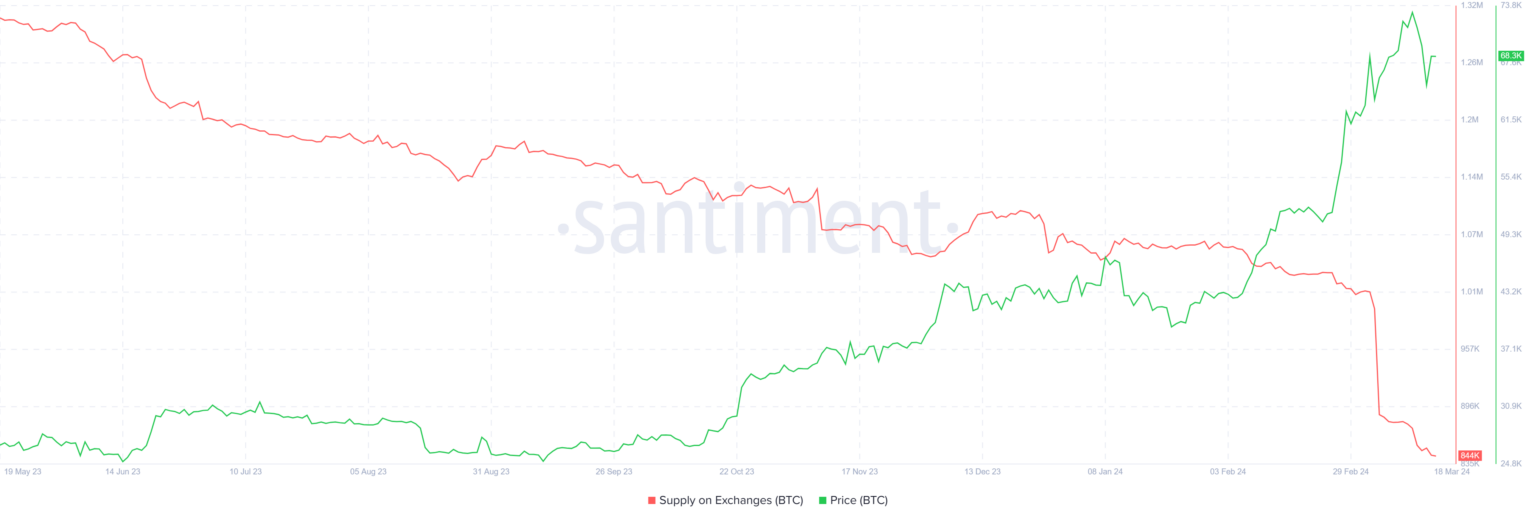

Just last week, approximately 36,640 BTC, valued at over $2.5 billion, were withdrawn from exchange wallets. Moreover, whales are not showing a significant accumulation trend, and buyers appear to be individual investors. Withdrawals from exchanges indicate that more investors are moving their assets to cold wallets for long-term goals.

BTC and Crypto Market Forecast

Bitcoin closing above $60,000 is keeping investor hope alive despite negative macroeconomic factors and the upcoming Federal Reserve decision on Wednesday. Although net inflows through ETFs have weakened, reserves continue to grow.

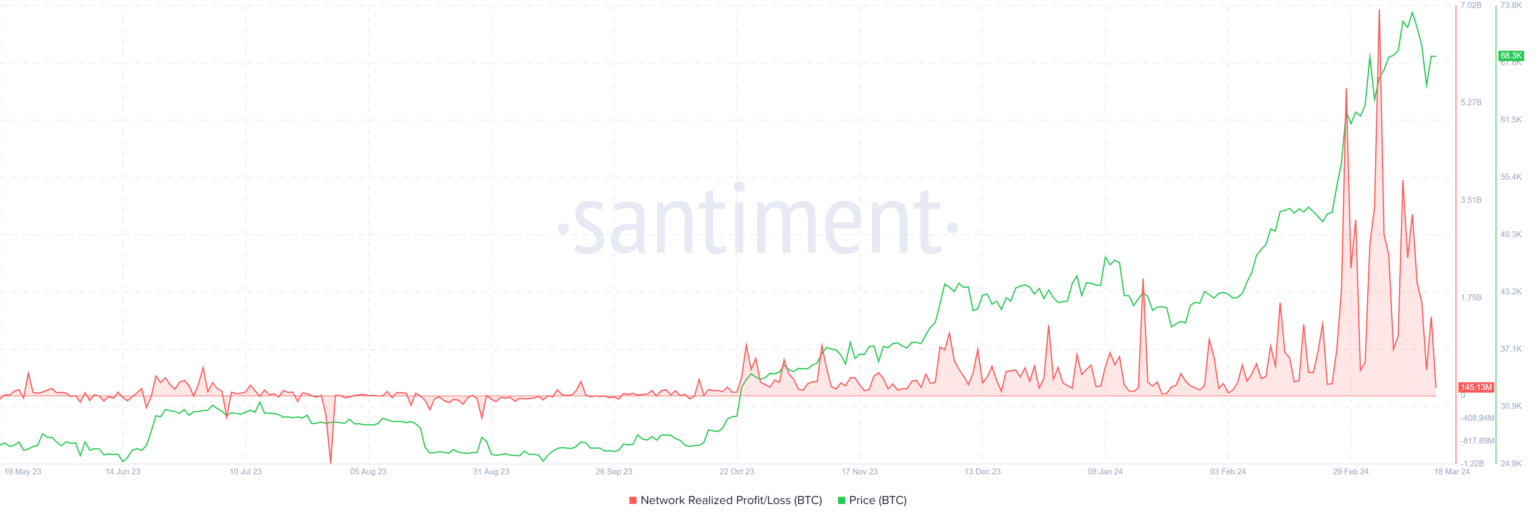

One of the biggest issues is the high profitability that increases investors’ inclination to sell. Profitability at a three-year high motivates investors seeking to reduce their current risk. Those who took risks at the right time capitalized on the lows and joined the uptrend early. But will they hold onto their assets until the true peak?

Many won’t because, as bull markets approach their peaks, old, profitable investors tend to sell to new and hyped traders. Especially in altcoins, investors who do not want to lose their gains due to excessive sell-offs might lean towards selling if BTC approaches the $63,724 scenario.

Furthermore, losing this key support could open the door to new lows below $60,000. For a potential comeback, Bitcoin needs convincing closes above $69,000.

Türkçe

Türkçe Español

Español