With the start of European trading hours today, Bitcoin (BTC) reached an all-time high of $72,218, marking a significant milestone. This increase was driven by a buying wave that boosted investor confidence, triggered by a combination of factors. Let’s take a closer look at the four main factors that initiated this extraordinary rally.

Acceptance of Bitcoin and Ethereum ETNs by the London Stock Exchange

As reported by Bloomberg, the London Stock Exchange (LSE) announced plans to accept applications for Bitcoin and Ethereum Exchange Traded Notes (ETNs) just before the price surge.

Although the exact launch date has not yet been confirmed, this move is seen as significant progress towards mainstream financial markets accepting cryptocurrencies. The inclusion of crypto ETNs in one of the world’s oldest exchanges, the LSE, indicates an increase in institutional interest in crypto assets. Accordingly, it is predicted that this development could attract a new wave of investors to the crypto market.

Impact of the Short Squeeze

Traditional finance portfolio manager Bitcoin Munger, (@bitcoinmunger) predicted on platform X that a short squeeze would push Bitcoin prices to new heights, which materialized.

This prediction was confirmed as Bitcoin rose to $72,218 while approximately $23.5 million in short positions were closed.

The Role of Tether in Capital Flow

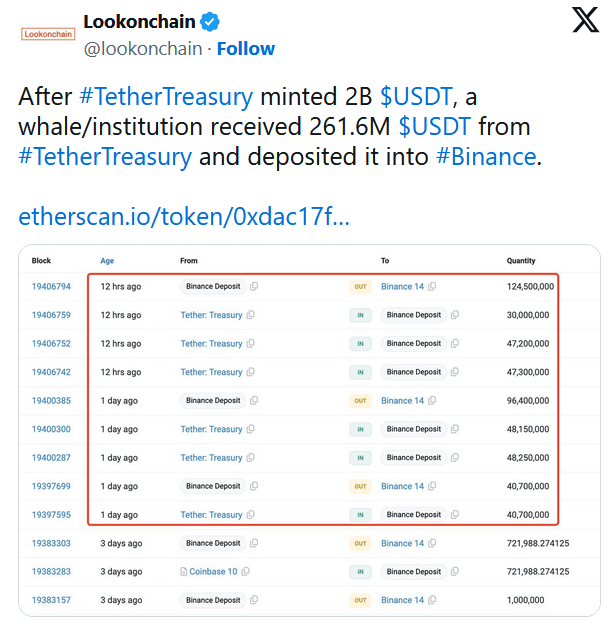

Over the past weekend and throughout this week, there has been a noticeable influx of new money into the market. According to Lookonchain, the leading stablecoin Tether (USDT) has been issuing new tokens. The company’s statement said, “Tether Treasury minted an additional 2 billion USDT yesterday! Moreover, a total of 5 billion USDT were minted on the Tron and Ethereum networks in just one week.”

A significant transaction was a whale or institution buying 261.6 million USDT from the Tether Treasury and depositing it into the Binance exchange. This indicated a major preparatory activity for large trading transactions.

Growing Demand for Bitcoin ETFs

In the United States, excitement about Bitcoin exchange-traded funds (ETFs) is extremely high. Matt Hougan, CIO of Bitwise, wrote in a note to investment experts, “Bitcoin ETFs have attracted more than $7.5 billion in net new assets since they were launched in the US on January 11, and many have become among the most successful ETF launches of all time.” He added:

“At Bitwise, our buyers currently include registered investment advisors (RIAs), family offices, and venture capital funds. In the future, we continue our discussions with large brokerage firms, institutional advisors, and major companies that represent trillions of dollars in assets.”

This view underscores a growing confidence in Bitcoin ETFs and expectations of significant capital inflows from such institutions starting from the second quarter of 2024. Hougan stated, “Based on current trends, I suspect we will see the first significant inflows from large brokerage firms, institutional advisors, and major companies in the second quarter of 2024.”