The largest cryptocurrency Bitcoin (BTC), reached an important level on February 28 by surpassing the $61,000 mark and briefly reaching $64,000, a price not seen in over two years. This extraordinary price surge indicated an impressive period of gains as Bitcoin‘s total market value exceeded $1.2 trillion last month.

Warning of a Potential 15% Correction

Various factors contributed to Bitcoin’s notable rise, including continuous inflows into spot ETFs launched in the US in January and expectations surrounding the fourth block reward halving expected in April. However, investors are approaching the current bullish sentiment with cautious optimism, preparing for a potential future correction.

Matrixport’s co-founder Daniel Yan called for caution amidst the surrounding bullish excitement for Bitcoin’s rise. Yan warned of a significant correction potential, advising investors to brace for a pullback of about 15% by the end of April. In his warning, he noted that Bitcoin’s price could drop to the range of $52,000 to $53,000 during this correction.

Yan emphasized that the timing of this potential correction could be triggered by macroeconomic data such as the Fed interest rate meeting and the gross domestic product figures announced by the Bureau of Economic Analysis.

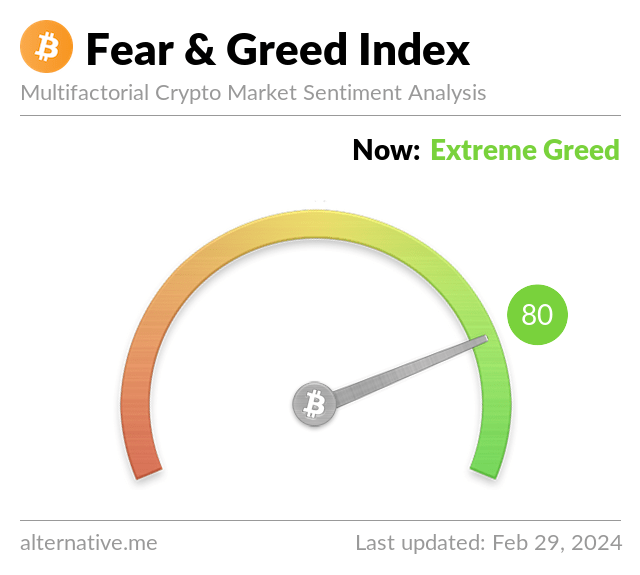

Crypto Fear and Greed Index Signals Caution for Bitcoin

With the planned March update for the altcoin king Ethereum (ETH) and the looming fourth Bitcoin block reward halving, March seems to be a significant month for Bitcoin.

Moreover, the current levels of the Crypto Fear and Greed Index reflect the market sentiment seen two years ago when Bitcoin reached a peak around $69,000. The index, currently at the level of 80, signals “extreme greed” and reflects the bullish sentiment among investors and traders, highlighting the need for caution amidst the market excitement.

Türkçe

Türkçe Español

Español