Bitcoin starts the new week with a significant comeback, reaching all-time highs. After a 12% weekly increase, Bitcoin’s price shows minimal signs of slowing down as it approaches ultimate resistance. Beyond that, there is a return to price discovery, but can the bulls finally achieve their wishes after four months of consolidation?

Hopes Rise for Bitcoin

Last week, following what an analyst called an extremely explosive move, Bitcoin enjoyed an ideal weekly close above $68,000. This came thanks to the news that U.S. President Joe Biden will not run for re-election in November.

Despite volatility in both directions, data from TradingView shows that the BTC/USD pair reached $68,486, its highest level since June 12, and just 7.75% away from all-time highs. Popular trader Skew mentioned in the latest market update on X:

“So far, the bulls look very good.”

Skew, describing the weekly close as very important, said that if the bulls want to maintain control, at least $65,000 should remain as support in higher time frames:

“Otherwise, if the bid is clearly followed at the beginning of the week, $70,000 – $80,000 liquidity becomes the target.”

The analysis also touched on the relative strength index (RSI) signals, which provide a clear early warning of the upcoming rise. Fellow trader Daan Crypto Trades, who follows Fibonacci extension levels, made similar predictions about possible Bitcoin price targets:

“We are still in a big range, but if we start going higher, the green boxes will be the areas to watch for me.”

What’s Happening on the US Front?

Following Biden’s announcement, markets strengthened their predictions of a Republican election victory, giving Bitcoin bulls fresh fuel to reach higher levels. The party’s presidential candidate, Donald Trump, added a pro-Bitcoin stance to his election platform. Now, with the release of the US core inflation data, attention has once again turned to economic issues.

This could come in the form of the Personal Consumption Expenditures (PCE) Index, known as the Federal Reserve’s preferred inflation measure. The PCE release, scheduled for July 26, comes a day after the second-quarter gross domestic product and rolling unemployment figures, potentially leading to a volatile end of the week for risk assets and crypto.

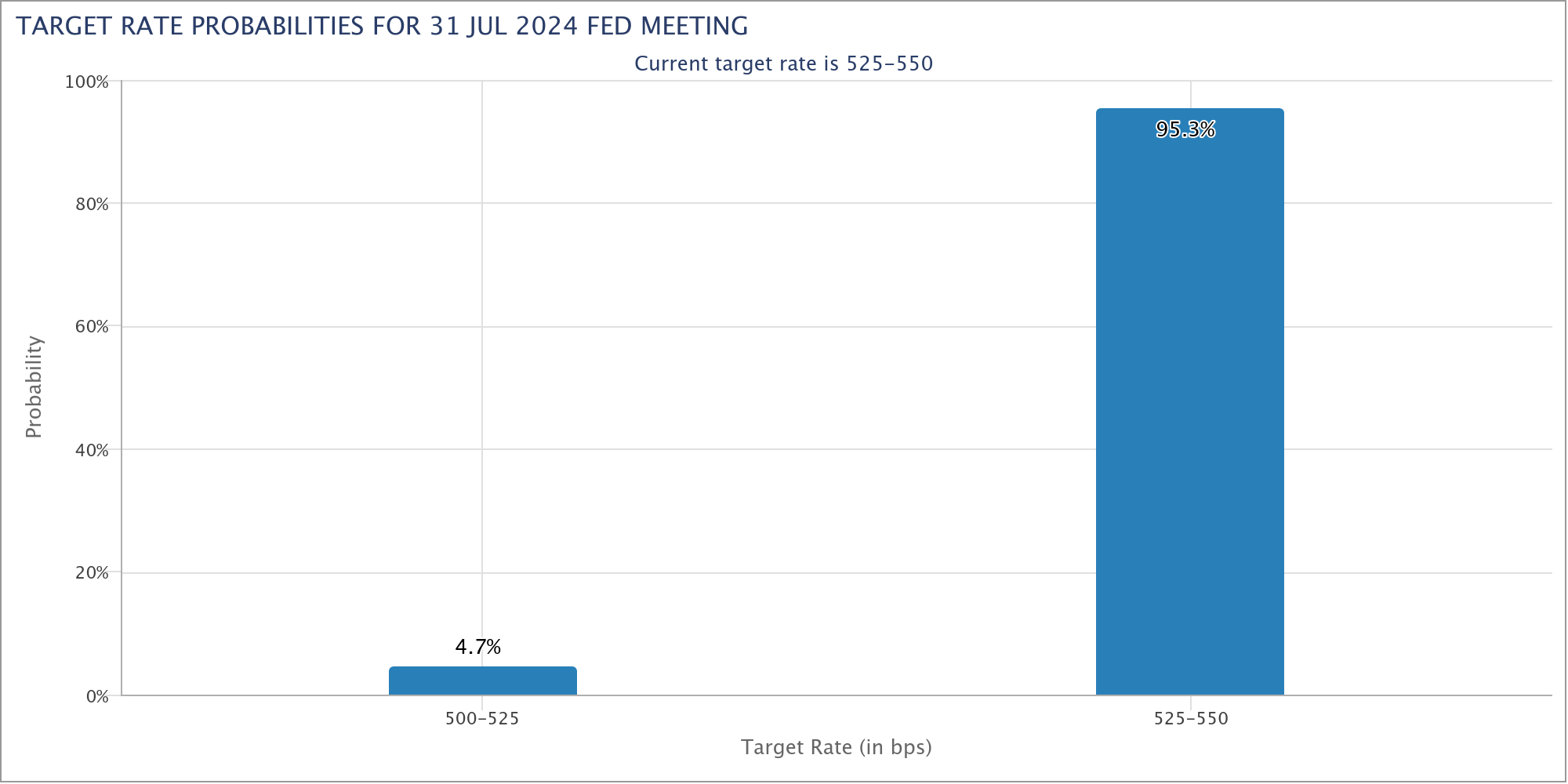

The latest forecasts from CME Group’s FedWatch reflect market expectations that there will be no rate changes until the next FOMC meeting in September.

Türkçe

Türkçe Español

Español