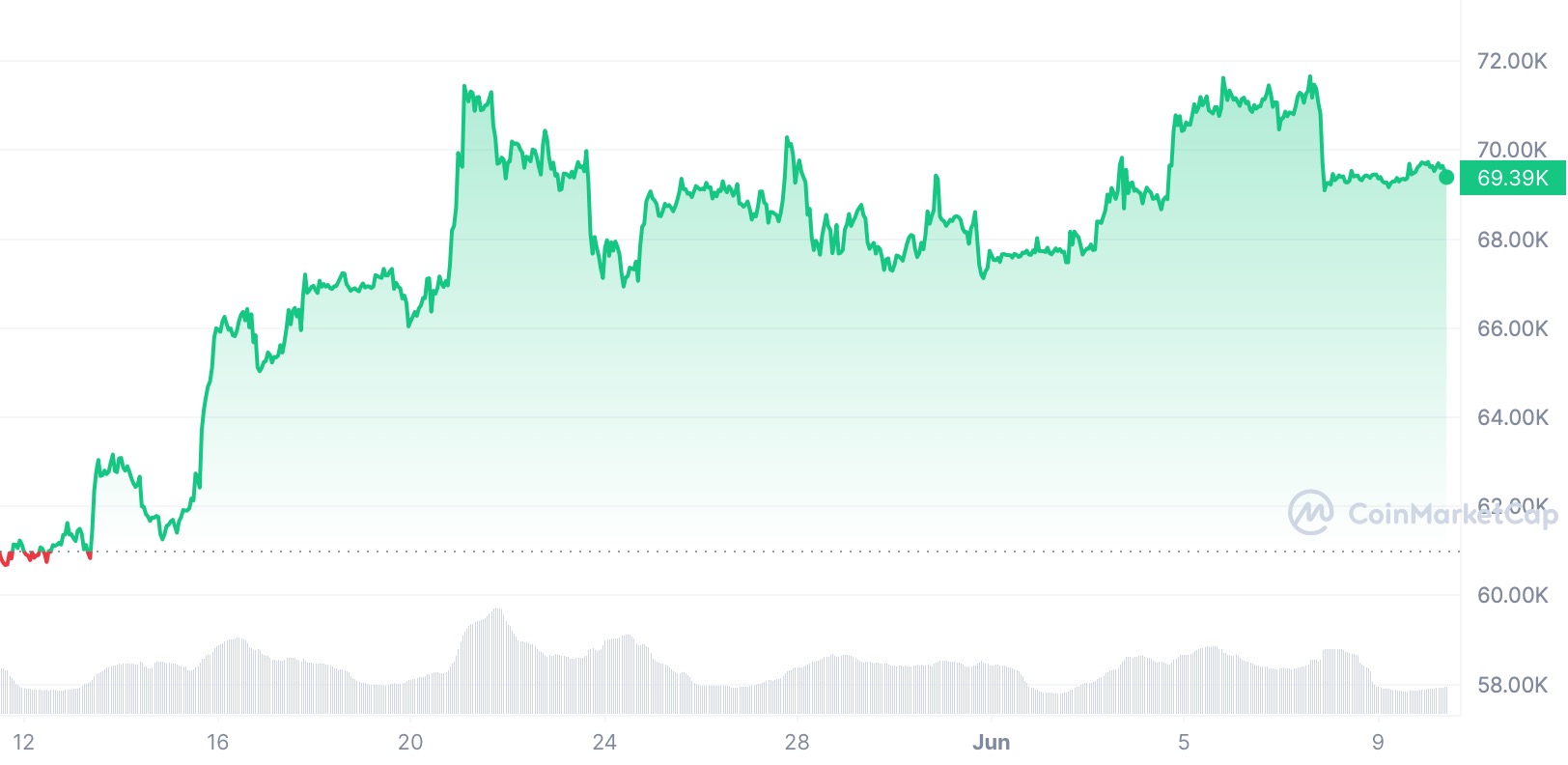

The world’s largest cryptocurrency by market value, Bitcoin (BTC), achieved its second-highest weekly close ever, driven by strong inflows into spot ETFs in the US, which acted as a significant catalyst for its rise. The crypto king demonstrated its resilience and continued investor interest by closing last week’s candle at $69,640 after a highly volatile week.

US Employment Data Impacted Bitcoin

Bitcoin’s price reached $71,949 on June 7, marking its highest level since May 21. Despite this rise, it failed to break the resistance level at $72,000. This resistance was partly due to stronger-than-expected US employment data reported in May, which had implications for future Fed interest rate decisions.

A strong labor market suggests that the Fed may not lower interest rates soon, and risk assets like cryptocurrencies typically benefit from looser monetary policies. Consequently, this created a macroeconomic headwind that temporarily halted Bitcoin’s upward momentum.

Despite this obstacle, Bitcoin bulls showed strength in surpassing the $70,000 level. Currently, Bitcoin is trading at $69,540, indicating strong investor confidence. The significant inflows into spot-based Bitcoin ETFs last week were a major bullish factor, showing increased institutional interest and investment in the largest cryptocurrency.

Surpassing $73,000 Could Lead to $100,000

Bitcoin’s price remains range-bound for now. According to Galaxy Digital CEO Mike Novogratz, Bitcoin needs to break the resistance level at $73,000 to enter a new trading range and potentially move towards $100,000. This indicates that despite the strong current momentum, significant resistance levels still need to be overcome.

Historically, Bitcoin’s highest weekly close was recorded on March 11 at $73,794, following its all-time high, and then at $71,285 in March. After reaching this peak, Bitcoin experienced a sharp correction, with its price dropping to $56,500 on May 1 due to slowing ETF flows and stagflation concerns highlighted by prominent financial figures like JPMorgan CEO Jamie Dimon.

Although Bitcoin has recovered from these low levels, it has yet to firmly establish itself above the $70,000 threshold. One contributing factor was long-term Bitcoin investors distributing their BTC to new ETF investors. This redistribution of Bitcoin likely prevented the bulls from fully taking control of the market.

Türkçe

Türkçe Español

Español