Bitcoin investors enjoyed the rise on Valentine’s Day as Bitcoin reached its highest level in two years on February 14th. Data from TradingView followed a strong Bitcoin price recovery from the previous day’s lowest level of $48,400. During the Asian session, Bitcoin not only erased its 4% losses but also reached long-term high levels and was progressing towards $52,000 at the time of writing.

Why Is Bitcoin Rising?

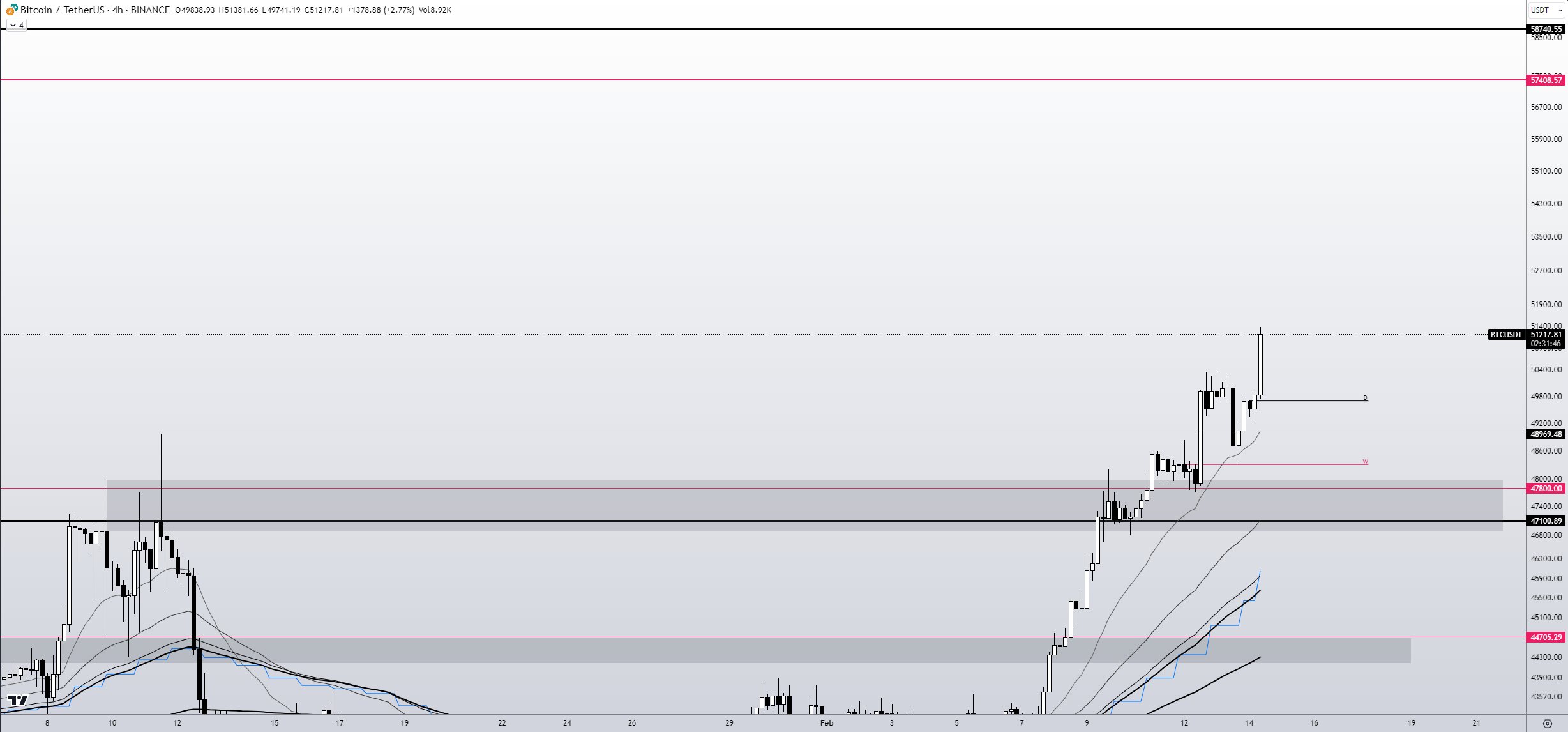

This characteristic surge saw the BTC/USD pair add $1,000 in a single hourly candle, while the overall crypto market value approached the $2 trillion mark as Bitcoin’s value surpassed $1 trillion. Analyzing the low time frame setup, popular trader Skew indicated an ongoing resistance/support flip on the 4-hour chart.

He mentioned that the main trend lines to watch were the exponential moving averages (EMAs) and the Relative Strength Index (RSI) score, and he shared the following on the subject through X:

“As long as the market maintains its current upward momentum, I think this trend is quite straightforward. On the 4-hour chart, EMAs will provide nice and concise trend confirmations along with RSI for momentum, and also when the current momentum is lost. Key closures in these trends are usually the daily open and the weekly open.”

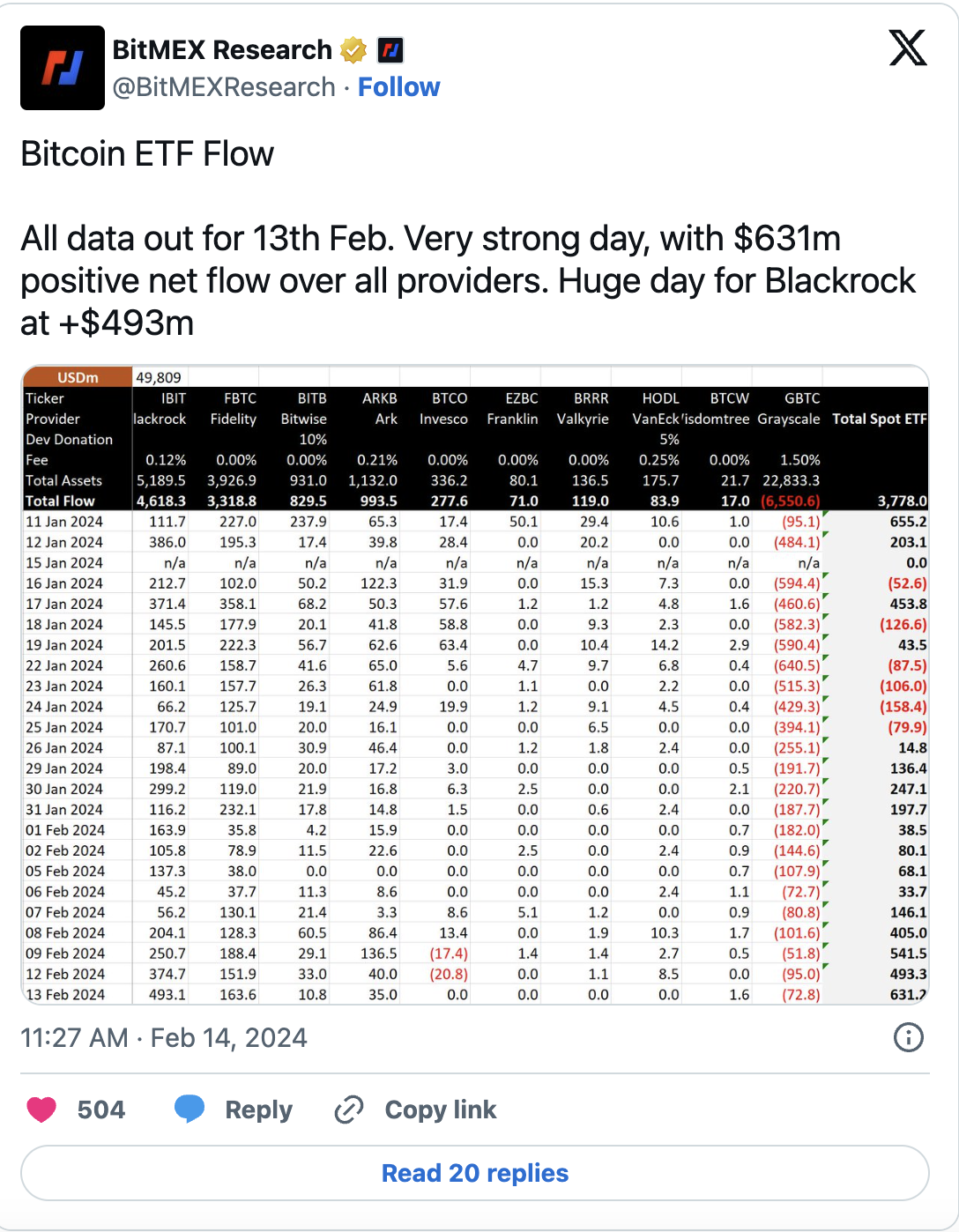

Binance Skew also highlighted the interest of spot buyers, emphasizing institutional entries through United States spot Bitcoin exchange-traded funds. This area continues to attract attention with more Bitcoin being purchased by nine ETF providers each day.

Eyes on the Halving Event

From a longer-term perspective, popular investor and analyst Rekt Capital suggested that everything is happening in accordance with classic bull markets for Bitcoin. He told his followers this week that the Bitcoin price recovery process towards all-time highs is happening just in time.

Making comparisons to the year 2020, Rekt Capital drew attention to the halving process, noting that the BTC/USD pair usually starts rallying two months before the event. The next halving event is set to take place in mid-April.

Türkçe

Türkçe Español

Español