The process that occurred on November 21st resulted in a significant liquidation in the futures market. This development, which dragged down the cryptocurrency market, introduces new price targets for Bitcoin. As part of the regulatory sanction process by the United States Department of Justice, Binance received a substantial fine, leading to Changpeng Zhao stepping down from his position.

Why Did Bitcoin Drop?

This development was defined as a significant turning point in the cryptocurrency market and raised concerns among investors. The BTC/USD pair, according to TradingView data, dropped to its lowest levels since November 16th, reaching $35,600 before the price recovered, due to the closure of short positions.

Altcoins performed even worse during this period, and at the time of writing this article, many major tokens continued to trade 3-5% lower throughout the day. James Van Straten commented on the matter:

“Forget about a quiet week in the cryptocurrency market. The developments on Binance put an end to the boring market process.”

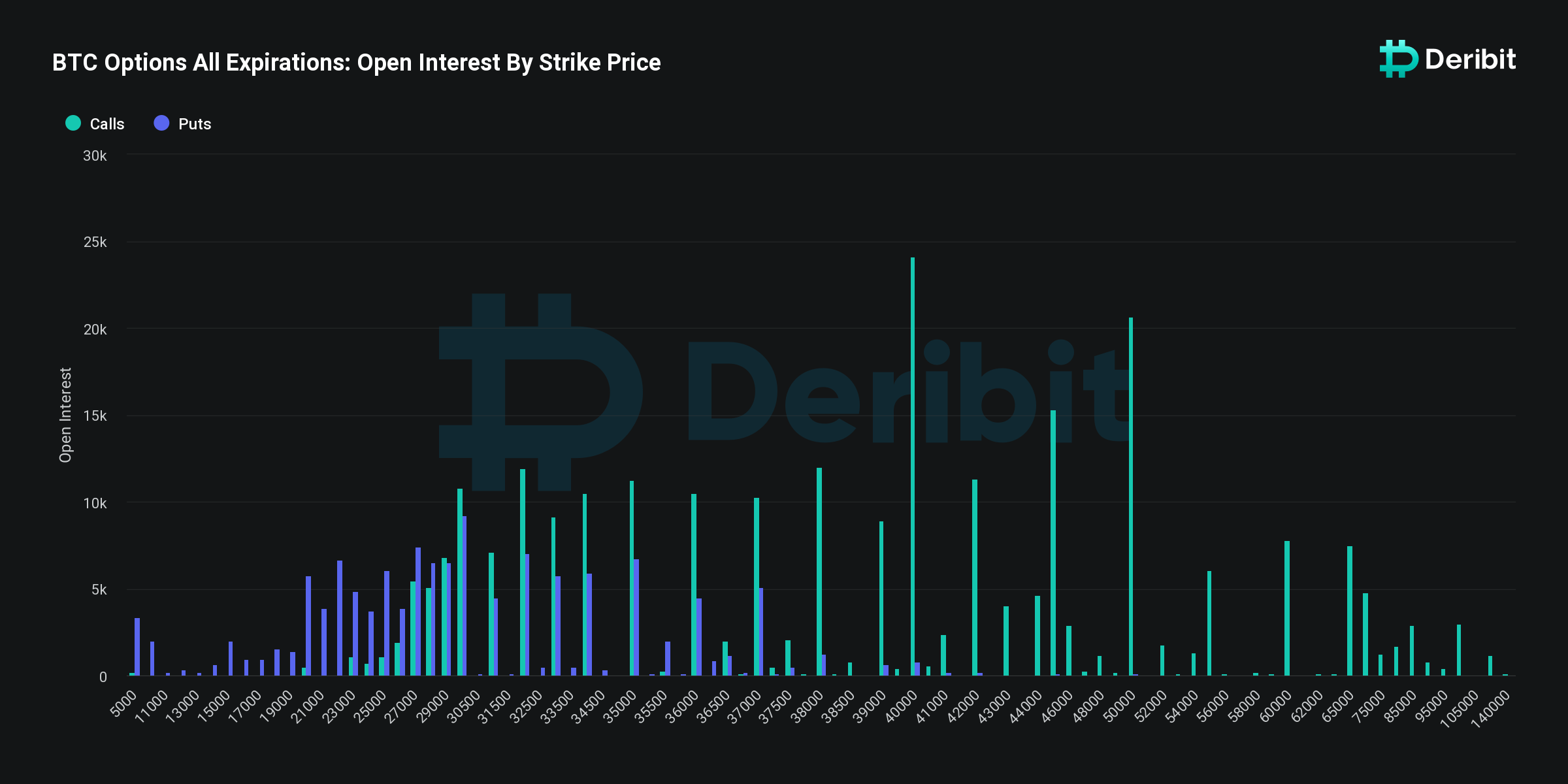

James Van Straten, a research and data analyst at crypto data analysis platform CryptoSlate, warns that volatility factors will continue to be involved in the process. This warning comes ahead of a massive $3.8 billion worth of 104,000 Bitcoin open interest expiration event that will potentially add new fuel to the already tense market environment on the day after the U.S. Thanksgiving holiday. Van Straten states that at the end of this process, the most likely scenario for Bitcoin’s price will be a drop to $32,000.

“The data, with a put/call ratio standing at 0.77, predominantly indicates a bullish trend, as evidenced by approximately 58,000 Bitcoin higher call open interest compared to the 45,000 Bitcoin put options.”

Alarming Prediction for Bitcoin

The fact that the maximum drop price in the options market is fixed at $32,000 is noteworthy. This figure is currently below the market price of Bitcoin. This indicates potential pressure on the price of Bitcoin as the expiration date approaches.

Van Straten suggests that the option figures imply an expectation that the price will remain at these levels, and if the $32,000 scenario becomes a reality, he adds that Bitcoin will still be in an upward trend during this process.

Türkçe

Türkçe Español

Español